Several days ago, Ocugen (OCGN 0.81%) was an early-stage biotech company focusing on gene therapy to cure eye diseases. And then everything changed. All of a sudden, investors began piling into the shares, and the company joined the center stage of the stock market with the likes of Pfizer (PFE 0.23%) and Moderna (MRNA 3.28%).

That's because Ocugen finalized a deal to co-develop and commercialize Indian company Bharat Biotech's late-stage investigational coronavirus vaccine in the U.S. The biggest gain didn't follow the announcement, though. It came after Ocugen raised $23 million at a considerable premium to fund the project. As a result, the stock soared more than 200% in one trading session. Now the question is whether the Ocugen/Bharat vaccine candidate's efficacy can beat that of today's vaccines -- those of Pfizer and Moderna. Let's take a closer look.

Image source: Getty Images.

A smart financial move

Ocugen's move probably came as a surprise to many, given that it isn't a player in the infectious disease field. But from an earnings standpoint, it's smart. That's because the deal will bring in near-term product revenue -- if the U.S. Food and Drug Administration (FDA) grants the vaccine candidate Emergency Use Authorization (EUA). Ocugen will take 45% of U.S. profits, and the remaining 55% will go to Bharat, according to the terms of the agreement.

Without such an operation, Ocugen would have to wait years for product revenue. Ocugen's candidates are all in the preclinical stage. The company plans to begin phase 1 studies for one candidate this year -- for mutation-associated retinal degeneration.

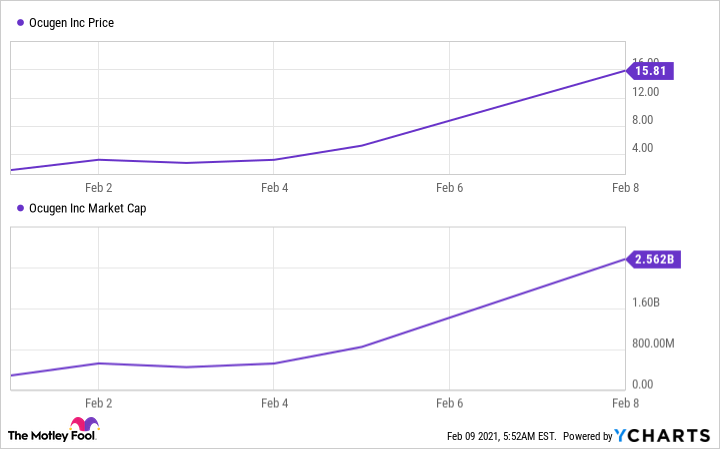

Financial conditions are also positive. In Ocugen's recent offering of common stock to institutional investors, it sold the shares at a 46% premium to the previous day's closing price. This shows investors' confidence in Ocugen's future. The company's share price and market value have surged in a matter of days.

Expertise and logistics look good, too. Ocugen assembled a vaccine scientific advisory board including six industry and research experts to help it successfully travel along the clinical and regulatory path. If the FDA authorizes the vaccine, Bharat will supply initial doses. But Ocugen is discussing the possible production of vaccine with U.S. manufacturers after the launch.

Ocugen hasn't said when it will apply for an EUA. But it has started talks with the FDA "to develop a regulatory path to EUA."

Covaxin versus rivals

So now let's focus on the most important point of all: Covaxin, the Ocugen/Bharat candidate, versus the vaccines of Pfizer and Moderna. While the Indian government has granted Covaxin emergency authorization, Bharat hasn't yet completed phase 3 trials or generated interim data. Bharat's chairman expects to release data by March.

Pfizer's and Moderna's vaccines focus on the coronavirus spike protein. The problem there is that if spike protein mutations multiply, these vaccines may not offer protection. So far, both companies say their vaccines can handle the emerging U.K. and South African strains of coronavirus. But White House medical advisor Dr. Anthony Fauci has said these vaccines are likely less effective against the mutated strains than they are against the original coronavirus -- and potential new strains in the future represent a threat.

Covaxin induces immune responses to several coronavirus proteins, not just the spike protein. So it may be more effective than more advanced rivals in protecting against today's strains and future variants. That's a big plus. Another advantage is that it can be stored at refrigerator temperatures. So can Moderna's -- but Pfizer's vaccine requires ultralow temperatures that make it a challenge to transport and store.

Considering these two elements, Covaxin may be a stronger vaccine than those of Pfizer and Moderna. But only phase 3 data can confirm that. If efficacy is low or adverse events are high, the whole picture may change. So right now, it's best to be cautiously optimistic about Covaxin.

And that's why I would be cautiously optimistic about Ocugen, too -- but with a big emphasis on the "cautious." If Covaxin's phase 3 data are strong, Ocugen's share price may move higher. But if trial results aren't compelling, shares of this biotech company could crash -- especially considering the recent surge. For most investors, it's best to watch this story from the sidelines for now.

This article represents the opinion of the writer, who may disagree with the "official" recommendation position of a Motley Fool premium advisory service. We're motley! Questioning an investing thesis -- even one of our own -- helps us all think critically about investing and make decisions that help us become smarter, happier, and richer.