Investors in PepsiCo (PEP 1.15%) just received their biggest update of the year from the snack and beverage giant. The fourth-quarter report detailed how Pepsi was able to grow through the pandemic in 2020 to win market share in food and soda niches. The update also showed why the company has abruptly ended stock buyback spending for the time being as it aims to end a two-year slide in profitability.

Let's take a closer look at three questions the company answered for investors.

Image source: Getty Images.

1. When will costs start coming back down?

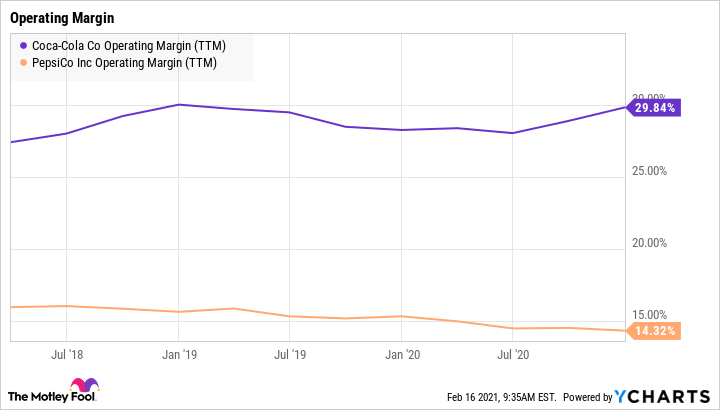

Pepsi's 2020 marked a second straight fiscal year of falling profitability. That result stood out from rival Coca-Cola (KO -0.14%), which boosted margins even though its sales declined. Pepsi's earnings were also pinched by extra investing into the business in areas like manufacturing, supply, and IT.

Management said this cost pressure isn't going to disappear anytime soon because it's a consequence of Pepsi's new strategy that involves attacking more markets and consumer demographics. "As we've pivoted to more of growth strategy," CFO Hugh Johnston told investors, "we're [boosting] capacity."

KO Operating Margin (TTM) data by YCharts. TTM = trailing 12 months.

2. Why is stock buyback spending diving?

Pepsi spent $2 billion on stock repurchases last year compared to $3 billion in 2019. Management is planning a more dramatic slowdown this year, with buybacks falling to near zero.

The company said the shift doesn't represent a change to its capital allocation plans but is just aimed at shoring up finances after a volatile selling year. Debt jumped in 2020 as consumer spending slumped in early March, and Pepsi joined all of its peers in taking advantage of low interest rates to boost cash holdings. The buyback pause reflects its aim to keep boosting the dividend without pushing debt leverage too high. "We're trying to balance our debt rating versus our cash return to shareholders," Johnston said.

3. What are the plans for plant-based meat products?

Pepsi provided more details about the new partnership with Beyond Meat (BYND 2.45%) that will give it a significant presence in the plant-based snacking niche. That's a promising growth area, and while management isn't expecting any immediate payoff from the deal, it's clear that it's looking at it as a potentially long-term partnership.

"We did a lot of due diligence," CEO Ramon Laguarta said, "and we have high expectations for that [deal]." Pepsi says it should have some co-branded products on the market by late 2021, with the niche likely growing more significant next year.

It's all about balance

Ultimately, Pepsi is trying to strike a balance between investing in core franchises like Doritos and Pepsi zero sugar while pushing into attractive growth areas like energy drinks and plant-based protein snacks. That's the approach management sees as the best long-term generator of positive investor returns.

After having made some big acquisitions like SodaStream and Rockstar energy drinks in recent years, 2021 won't include game-changing brand purchases, Pepsi said. Instead, investors should see another year of solid sales growth while profit margins hold steady and cash returns fall. These moves should set the company up for stronger earnings gains in 2022 and beyond, all supported by Pepsi's new market share momentum.