Procter & Gamble (PG 1.17%) stock has been one of the worst performers in the S&P 500 so far in 2021. It briefly dropped by more than 10% in early March and is still lower on the year. The bigger-picture trend looks worse. P&G has risen only 6% in the past year compared to a 35% surge in the wider market.

That performance gap doesn't reflect the consumer staples giant's dominant operating performance, or its ability to shower investors with cash over the next few years. So let's look at some of the main reasons to buy P&G today.

Image source: Getty Images.

1. Winning in a growing market

Every consumer staples retailer did well during the pandemic, but P&G took growth to a different level. It notched an 8% organic sales boost in the most recent quarter, marking another surprisingly strong showing after achieving record growth in fiscal 2020. Those gains were faster than at peer Kimberly-Clark (KMB 2.09%), and they were more balanced, with a healthy mix of volume and pricing growth.

In other words, P&G is winning market share in a growing industry that's likely to figure prominently in consumers' monthly spending long after the COVID-19 threat subsides. "There may be a continued increased focus on ... time at home," executives said in a recent conference call. "We will serve what will likely become a forever-altered cleaning, health, and hygiene focus."

2. Gushing cash flows

The short-term industry outlook is weak, which is no surprise after a year of unprecedented sales gains. Kimberly-Clark warned investors in late January that growth will slow to a crawl in 2021 and profit margins might dip in comparison to the pandemic spike.

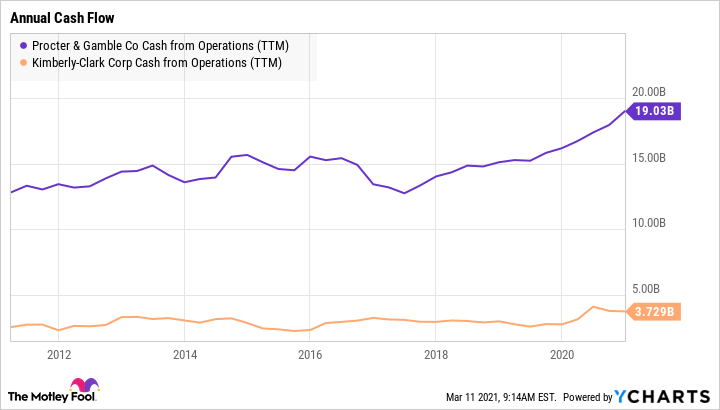

Data by YCharts.

P&G isn't immune to those challenges, but investors don't have to worry about its finances. Costs have been falling for years, and the company enjoys some of the highest profit margins and cash flow rates in the industry. These factors helped convince management to raise its cash return target to $18 billion this year alone. Some of that cash will come from the dividend, but most will arrive in the form of stock buyback spending.

3. The 64th dividend increase

We're likely just a few weeks away from P&G announcing a significant boost to its dividend. The company has been paying a steady dividend for 129 straight years. It has raised that payout in each of the past 63 years.

Management usually announces the annual increase just before its fiscal third-quarter results, which will come out on April 20. But there could be an unusually large boost on the wings.

After all, earnings and cash flow have surged over the past year. CEO David Taylor and his team raised their growth and profit outlooks last quarter, too. Yes, the expected volatility around demand might convince executives to avoid bold growth predictions for fiscal 2022. But P&G is flush with cash that could fund a more generous dividend hike than last year's 4% increase.

Even if P&G takes the cautious route on its new payout commitment, investors have every reason to expect more operating and financial wins ahead. The company had strong movement before the pandemic, won market share during the upheaval, and is set to consolidate those gains over the next year or so.