3D Systems (DDD 3.33%) is slated to report its first-quarter 2021 results after the market close on Monday, May 10. Its conference call with analysts is scheduled for 8:30 a.m. EDT the following day.

Many investors will probably be approaching the 3D printing company's report with cautious optimism. The company's performance last year was a mixed bag relative to Wall Street's quarterly revenue and earnings estimates. Its performance improved notably in the second half of last year, which helped to drive up the stock price.

In 2020, 3D Systems faced challenges stemming from the COVID-19 pandemic, as did most companies that have large customer bases in the industrial sector. Pandemic-related tailwinds in the company's industrial segment will likely continue into 2021.

Investors should be prepared for volatility. 3D Systems stock often makes big moves up or down following the company's release of quarterly results. As to the stock, in 2021, it's up 119% through April 13. The S&P 500 has returned 10.7% over this period.

Here's what to watch in 3D Systems' Q1 report.

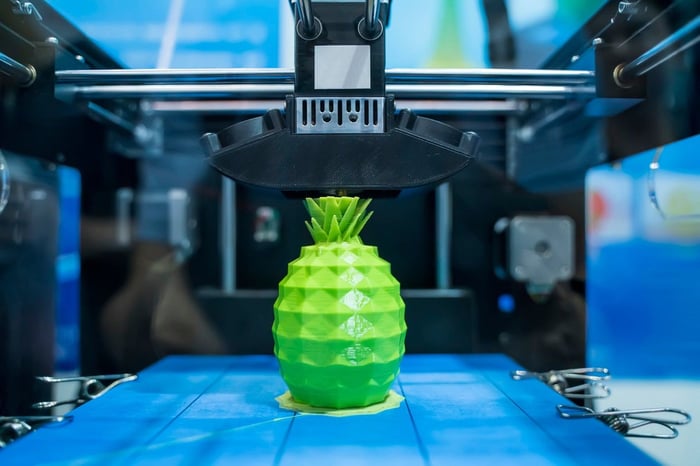

Image source: Getty Images.

3D Systems' key numbers

Below are the company's results from Q1 2020 and Wall Street's consensus estimates to use as benchmarks.

| Metric |

Q1 2020 Result |

Wall Street's Q1 2021 Consensus Estimate | Wall Street's Projected Change |

|---|---|---|---|

|

GAAP revenue |

$134.7 million |

$136.4 million |

1.3% |

|

Adjusted earnings per share (EPS) |

($0.04) |

$0.01 |

N/A. Result expected to flip to positive from negative. |

Data sources: 3D Systems and Yahoo! Finance. GAAP = generally accepted accounting principles.

Management didn't provide guidance, citing continued uncertainty surrounding the pandemic.

For context, in the fourth quarter of 2020, 3D Systems' revenue edged up 2.6% year over year (but rose 27% sequentially) to $172.7 million. Growth was driven by the healthcare segment, whose revenue soared 48% year over year. That strong performance slightly overcompensated for the 22% drop in revenue in the industrial segment. Both segments, however, posted double-digit sequential revenue growth.

Last quarter, adjusted for one-time items, net income was $10.6 million, or $0.09 per share, an 80% improvement from the year-ago period.

Cash flows

As always, investors will also want to focus on cash flows -- cash generated from operations and free cash flow.

3D Systems had some liquidity-related challenges in the first half of last year, which it addressed by implementing a restructuring plan that notably reduced operating expenses and by divesting of non-core software businesses.

Second-quarter 2021 guidance

If management issues Q2 guidance, this data will probably be the biggest factor in any post-earnings stock movement. That's because the stock market looks ahead.

For Q2, analysts are modeling for revenue to increase 24% year over year to $138.6 million. The quarter's year-over-year performance will benefit from an easy comparable. In the second quarter of last year, revenue plunged 29% year over year due to the fallout from the pandemic.

On the bottom line, analysts expect adjusted EPS of $0.02, compared to an adjusted loss of $0.13 per share in the year-ago period.