To be successful in the stock market, you'll need a long-term strategy. Investing isn't a "get rich quick" scheme, so the best approach involves buying good stocks and holding them for as long as you can.

It can sometimes be challenging, however, to determine which stocks make for good long-term investments. Nobody knows what the future holds, and even the healthiest companies aren't guaranteed to succeed over the long run.

Image source: Getty Images.

Investing in exchange-traded funds (ETFs) is a smart way to limit your risk, because each ETF can contain hundreds or sometimes thousands of stocks. This instantly diversifies your portfolio and keeps your money safer.

While there are plenty of great ETFs to choose from, one Vanguard fund, in particular, has a very good chance of growing your money over time.

An ETF you'll want to hold forever

One of the best funds out there is the Vanguard S&P 500 ETF (VOO 0.84%). This ETF tracks the S&P 500, so it includes stocks from 500 of the largest companies in the U.S. It also has a low expense ratio of 0.03%, which means that for every $10,000 you invest, you'll pay just $3 per year in fees.

S&P 500 ETFs are a wise choice for long-term investors, because they're likely to see positive returns over time.

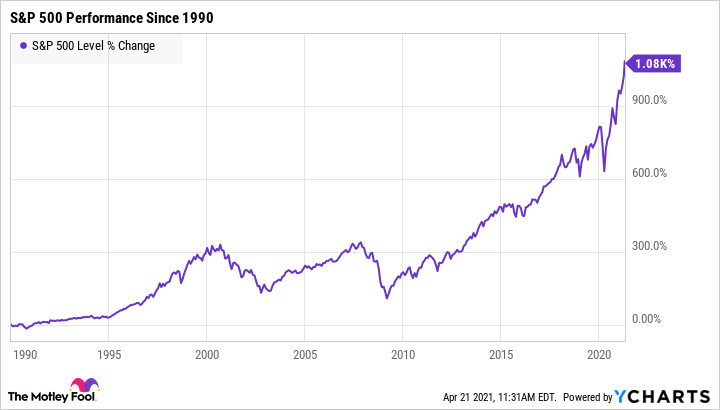

The S&P 500 was established in 1957, and since then, it has experienced a slew of market crashes, corrections, and downturns. Despite everything, though, it has continued to climb over the long run.

Keep in mind that the market will always be subject to short-term volatility. Market downturns are normal and inevitable, so you'll see your returns fluctuate from year to year. That also means you'll experiences losses some years, and that's OK.

The most important thing to remember is that investing is playing the long game. It doesn't necessarily matter how your investments perform in the short term, because what's most important is how they perform over the next several decades.

Nobody knows how the market will perform over time, so there's no guarantee that your investments will see positive returns. But based on the S&P 500's history, there's a very good chance your ETF will recover from even the worst crashes.

Getting rich with the right investment

The Vanguard S&P 500 ETF has earned an average rate of return of 15% per year since its inception in 2010. That's a staggeringly high return for this type of fund, and it's mostly due to the fantastic bull market we've experienced over the last decade.

Since the S&P 500's inception, the index itself has earned an average rate of return of around 10% per year. Keep in mind that that's an average over time. So while some years you may experience 15% or even 20% returns, other years you may experience losses. Over the course of a few decades, though, you're likely to experience an overall average return of around 10% per year.

Say you're just starting your investing journey and can afford to invest $300 per month in this ETF. Let's also say you're earning a 10% average annual return over time. Depending on how many years you have left to save, here's approximately how much you could accumulate in savings:

| Number of Years | Total Savings |

|---|---|

| 5 | $22,000 |

| 10 | $57,000 |

| 20 | $206,000 |

| 30 | $592,000 |

| 40 | $1,600,000 |

Source: Author's calculations.

With some patience, it's possible to become a millionaire by investing in this ETF. Also, the more you invest, the more you can potentially earn. As long as your bills are paid and you have a healthy emergency fund, it's wise to invest as much as you can to maximize your earnings.

Investing in ETFs is a great way to build a diversified portfolio, and the Vanguard S&P 500 ETF is a fantastic addition to your investments. By investing consistently and holding this fund for as long as possible, you can potentially make a lot of money.