What happened

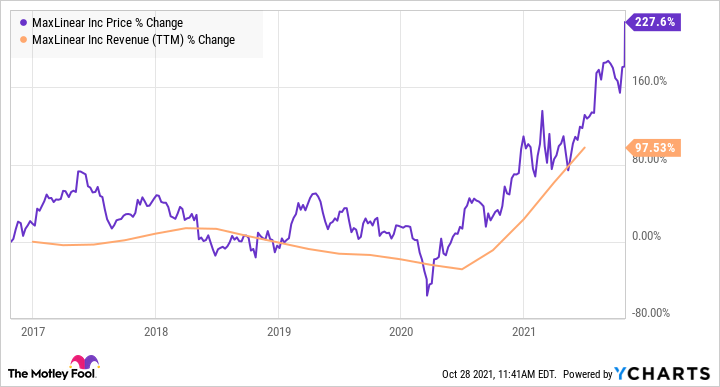

Shares of MaxLinear (MXL -1.26%) were up 17.5% as of 10:59 a.m. EDT on Thursday after strong earnings results in the third quarter. Revenue increased 47% year over year to $229 million, while adjusted earnings per share (EPS) more than doubled to $0.75 over the year-ago quarter.

So what

The company credited growth in broadband, connectivity, and industrial markets for the surging demand for its high-performance analog chip products. Broadband was the largest driver, contributing 55% of total sales for the quarter.

Connectivity revenue increased 21% sequentially over Q2 to $38 million. "We see sustained momentum for our Wi-Fi products as operators address strong consumer demand for robust broadband access and connectivity services," CEO Kishore Seendripu said during the Q3 earnings call.

Image source: Getty Images.

Now what

Since broadband is MaxLinear's largest business, it was encouraging to see Seendripu express optimism about near-term demand trends. "As service providers and operators ramp their capital expenses to address new bandwidth-intensive consumer application services, we will benefit from this organic mix shift to more technology-intensive consumer premise equipment in the near and long term," Seendripu said.

The supply problems affecting the semiconductor industry remain an obstacle, which makes the company's Q4 guidance look very strong. It expects revenue to be approximately $240 million to $250 million, representing year-over-year growth of 25% at the midpoint of the guidance range. Analysts currently expect adjusted EPS to increase 76% year over year to $0.69.

MaxLinear serves a growing communication solutions market that it expects to double from 2018 levels to $8 billion by 2022. It's not a surprise the stock is jumping to new highs after a strong earnings report. The stock trades at a modest price-to-earnings ratio of 25 based on 2021 earnings estimates, which could leave room for more upside.