NovoCure (NVCR -0.89%) was one of the better-performing stocks of early 2021, but the big gains came to an end in June. Since peaking this summer, shares have lost more than 58% of their value.

Is the recent plunge an opportunity to buy a great medical device stock on sale, or is it the beginning of a longer slide? Here's what you should know before attempting to catch this falling knife.

Image source: NovoCure.

Reasons to buy NovoCure now

NovoCure's flagship product, Optune, is a weird-looking, battery-powered hat that generates electric fields in order to disrupt cancer cell division. It's used to treat glioblastoma multiforme (GBM), a form of brain cancer that usually doesn't respond to available drugs.

In a large clinical trial, adding treatment with NovoCure's device to standard chemotherapy lowered GBM patients' risk of death by 37% compared to chemotherapy on its own. That's the sort of improvement that gets oncologists' attention.

Highly effective new cancer therapies usually come with dangerous side effects. The decision to prescribe Optune, though, is a relatively easy one. Beyond the mild embarrassment and skin irritation that comes from wearing a goofy-looking device on the head, there doesn't seem to be any extra danger for oncologists to weigh against Optune's potential benefit.

Despite revenue that has soared 342% over the past five years, NovoCure's stock price has been hammered over the past few months. At the recent price of around 18.1 times trailing sales, patient investors who buy the stock now will come out way ahead if Optune sales continue growing at the same pace over the next five years.

Reasons to be cautious

There are only around 12,000 new cases of GBM diagnosed in the U.S. annually, so saturation is eventually going to limit growth. The stock has been getting hammered this year because it looks like device sales may have already plateaued.

In 2020, Novocure received millions in Medicare back payments that it hasn't received in recent quarters. The big, non-recurring payments received in 2020 are making the company's top-line performance in 2021 look lousy, so it's a little hard to tell.

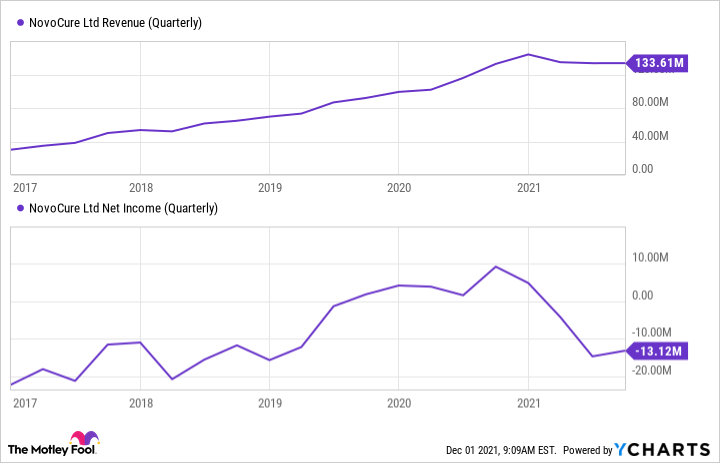

NVCR Revenue (Quarterly) data by YCharts

Flatlining sales could be really bad news for NovoCure right now. The company generated a modest profit for the first time in 2020. Unfortunately, growing research and development expenses and flatlining sales have led to significant losses on the bottom line all over again.

Novocure finished September with $934 million in cash after losing $32 million during the first nine months of 2021. Research and development expenses in the first nine months of 2021 ballooned 64% year over year to 144 million.

A buy now?

Research and development expenses are going through the roof, but so are the company's opportunities to expand. The number of active patients on NovoCure devices at the end of September was only 3,502 and that includes GBM patients on Optune plus the more recently launched Optune Lua device for patients with mesothelioma.

In 2024, NovoCure expects results from a pivotal trial with pancreatic cancer patients. In 2023, the company could have data from a pivotal ovarian cancer trial, and a pilot study with stomach cancer patients will read out results next year.

Lots of clinical trial activity will raise operating expenses further, but I think sales will perk up again once the pandemic subsides. With lots to look forward to, patient investors who buy the stock at recent prices can reasonably expect market-beating gains over the long run.