Mortgage REITs, or mREITs, provide real estate financing by originating or purchasing mortgages or mortgage-backed securities (MBS). They are an essential part of the residential mortgage market, helping to finance about 1 million homes in the United States each year. They also support the commercial real estate sector by providing loans to develop, acquire, reposition, and own income-producing properties.

Here's a closer look at the overall mortgage REIT market and the sector's unique risks. Plus, we'll discuss a couple of interesting mREITs you might want to consider.

Understanding mortgage REITs

Mortgage REITs are a subcategory of the real estate investment trust (REIT) segment that focuses on real estate financing. There are several important aspects of mREITs that investors need to understand, including:

- Business models: These entities purchase or originate mortgages and MBS, earning interest income from their investments. Some mREITs also earn loan origination and servicing fees. These factors make mREITs similar to financial stocks.

- Use of leverage: Mortgage REITs make money differently than other real estate investments. They earn a profit on their net interest margin, which is the spread between the interest income generated by their mortgage assets and their funding costs. Mortgage REITs use various funding sources to originate and purchase mortgages and related securities. This can include common and preferred equity, repurchase agreements, structured financing, convertible and long-term debt, and credit facilities. Their use of financial leverage increases returns and risks.

- Investments: Some mortgage REITs will originate real estate-backed loans that they hold on their balance sheet. Other mREITs will purchase mortgages and MBS originated by banks and other lenders. Additionally, some mREITs will make direct property investments.

Here's an example of how mREITs work. Let's say an mREIT raises $100 million of equity from investors to buy mortgages. It secures another $400 million in capital from other sources, at an average funding cost of 2%, allowing it to purchase $500 million of MBS.

If the loans had an average weighted yield of 3%, they would generate $15 million of interest income annually. Meanwhile, at a 2% cost of funding, it would have $8 million of annual funding costs, allowing the mREIT to generate $7 million of net interest margin each year.

IRS guidelines for mREITs require them to distribute 90% of net income to shareholders via dividend payments, which explains the high dividend yields for most mREITs.

Mortgage-Backed Securities (MBS)

How do mortgage REITs make money?

Mortgage REITs make money in several different ways depending on their business model. Here are some of the different income streams earned by mortgage REITs:

- Loan origination fees: Some mREITs originate real estate-backed loans and earn a loan origination fee.

- Mortgage servicing rights: Some mortgage REITs will service mortgages owned by third parties, earning a fee for serving these loans.

- Interest income: Most mortgage REITs hold mortgages, MBS, and other real estate-backed loans that generate interest income.

- Rental income: Some mREITs will also make direct equity investments in real estate, entitling them to the rental income generated by these properties.

- Asset sales: Mortgage REITs often earn a gain (or book a loss) on the sale of assets, such as mortgages they originated and sell to a third party or MBS they no longer want to hold.

Types of mortgage REITs

There are three main types of mortgage REITs:

- Home financing: These REITs focus on investing in mortgages secured by residential real estate such as single-family homes, multifamily properties, and builder lots.

- Commercial financing: These REITs concentrate on providing financing to the commercial real estate sector. They'll originate real estate-backed loans to fund the acquisition, development, or redevelopment of commercial real estate such as office buildings or warehouses.

- Hybrid: These REITs invest in real estate-backed loans and make direct equity investments in real estate.

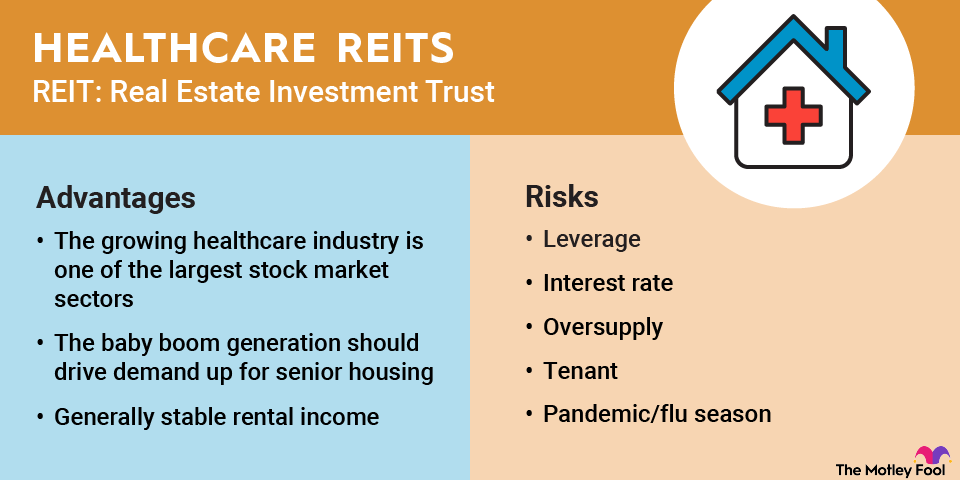

Risks of investing in mortgage REITs

Mortgage REITs are riskier than many other investments, including other REITs, because they face certain specific risks, including:

- Interest rate risk: While changes in interest rates affect REITs overall, they have an even greater effect on mREITs because changes in short- and long-term interest rates can affect net interest margins by increasing the costs of funding and reducing interest income. Interest rate changes can also affect the value of an mREIT's mortgage assets, affecting its net asset value and share price.

- Prepayment risk: Mortgage borrowers can refinance their loans or sell the underlying real estate. When that happens, it forces the mREIT to reinvest the repaid loan proceeds in the current interest rate market, which might be lower than the rate on the existing mortgage.

- Credit risk: Mortgage REITs focused on commercial mortgages can face credit risks if borrowers default. Mortgage REITs that focus on residential loans backed by government agencies don't have to worry about this nearly as much.

- Rollover risk: Residential mortgage REITs tend to own long-term mortgages and mortgage-backed securities. However, they often fund these purchases with shorter-duration borrowing since short-term interest rates are generally lower than long-term rates. This funding strategy creates rollover risk. The mREIT must obtain funding at attractive rates to roll over loans as they mature.

Two mortgage REITs to consider in 2026

There are several dozen mREITs, and many have underperformed the S&P 500 in recent years due to fluctuating interest rates. However, a couple of mREITs stand out as compelling candidates in this volatile sector and could be worth a look for patient investors who want high income streams.

| Name and ticker | Market cap | Dividend yield | Sector |

|---|---|---|---|

| Starwood Property Trust (NYSE:STWD) | $6.7 billion | 13.33% | Financials |

| AGNC Investment Corp. (NASDAQ:AGNC) | $11.5 billion | 14.55% | Financials |

Here's a closer look at these two leading mortgage REITs.

1. Starwood Property Trust

NYSE: STWD

Key Data Points

Starwood Property Trust is the largest mortgage REIT focused on commercial financing. The company has built a diversified portfolio with $27.5 billion of assets in late 2025, 56% of which comprised commercial loans. Starwood Property also has residential and infrastructure lending platforms, as well as direct property investments.

In mid-2025, Starwood expanded its direct property investments by acquiring Fundamental Income Properties from Brookfield Asset Management (BAM -0.59%) for $2.2 billion. The deal increased the company's diversification by adding a large-scale global net lease platform to its portfolio.

Starwood's diversification beyond the commercial lending sector has enabled it to generate steadier earnings and provided additional growth opportunities. That has supported the company's ability to maintain its high-yielding dividend for more than a decade. That dividend security has been hard to find in the mREIT sector, where payouts have generally declined over the years due to interest rate volatility and other factors.

2. AGNC Investment

NASDAQ: AGNC

Key Data Points

AGNC Investment is an mREIT focused on investing in mortgage-backed securities protected against credit losses by government agencies like Fannie Mae, Freddie Mac, and Ginnie Mae. The REIT only invests in MBS, which it does on a leveraged basis, primarily using repurchase agreements. It also uses a dynamic risk management strategy to protect the value of its portfolio from interest rate and other risks.

The REIT's simple strategy has enabled it to pay a stable monthly dividend for the last several years. That dividend stability has made it stand out in a sector where many of its rivals have reduced their dividend payments as interest rates rose.

Related investing topics

Mortgage REITs offer higher dividends along with higher risk

Mortgage REITs can generate a significant net interest margin when there's a wide spread between short-term interest rates (where they borrow) and long-term interest rates (where they lend). Unfortunately, the spread doesn't usually stay wide for long, which is why mREITs tend to be very volatile.

Because of that risk, mREITs aren't always the best option for income-seeking investors since their high yields fluctuate wildly. However, a couple of interesting mREITs are worth considering since their differentiated business models help insulate them from the sector's overall volatility.