Despite volatility picking up during the fourth quarter, it was another fantastic year for the major indexes and the cryptocurrency space. The benchmark S&P 500 ended 27% higher last year, with the kingpin of all digital currencies, Bitcoin (BTC 1.14%), more than doubling up the S&P 500's gain.

But take a few steps back and adjust your focus for a completely different view. Whereas the S&P 500 has doubled over the trailing five years, Bitcoin has catapulted higher by more than 5,000%.

Image source: Getty Images.

Although I'm not personally a fan of Bitcoin as an investment, for reasons I've extensively laid out in recent weeks, it's treated buy-and-hold investors incredibly well for more than a decade. Bitcoin's 21 million token cap, along with its first-mover advantage and highly secure transaction model, has made it the blue chip of cryptocurrencies.

Investors who want exposure to Bitcoin have a number of ways to get it. The most obvious and direct way would be to purchase Bitcoin on a cryptocurrency exchange. Directly owning Bitcoin allows investors to precisely mirror its movements.

Another really smart way to gain Bitcoin exposure for those with less of an appetite for risk and volatility would be to buy a company like Block, which was formerly known as Square. Though Block is known best for its seller ecosystem, the company's rapidly growing Cash App service allows investors to trade Bitcoin. Block also holds a small of percentage of its assets in Bitcoin.

Avoid these dangerous Bitcoin stocks

On the flipside, there are some truly undesirable ways to gain exposure to the world's largest cryptocurrency. Below are four of the most dangerous Bitcoin stocks, along with explanations of why they should be avoided in 2022 (and beyond).

Image source: Getty Images.

MicroStrategy

If there's one Bitcoin stock I'd strongly suggest investors shy away from, it's enterprise analytics software company MicroStrategy (MSTR 3.00%). At this point, it's almost not worth considering the company's analytics software operations given that founder and CEO Michael Saylor has turned his company into a leveraged bet on Bitcoin.

At the end of December, MicroStrategy acquired 1,914 Bitcoins for an average price of $49,229. This increased its aggregate ownership to 124,391 Bitcoin at an average price of $30,159. In total, we're talking about an investment of $3.75 billion that, as of Jan. 14, had appreciated to $5.3 billion.

Though Saylor has been correct in his leveraged bet, thus far, there are some glaring red flags with the company. Namely, MicroStrategy went from having over $560 million in cash, cash equivalents, and short-term investments and no debt at the end of 2019 to just $57 million in cash and $2.15 billion in various forms of debt by the third quarter of 2021. Saylor has rolled the dice on his company's balance sheet and may have to issue a mountain of shares to repay its obligations if Bitcoin doesn't head higher in the coming years.

Additionally, Saylor has seemingly ignored his company's analytics software operations. Though product license and subscription service sales are modestly higher through the first nine months of 2021, they've been in a six-year downtrend leading up to 2021. With Saylor spending most of his time pumping Bitcoin in interviews or on social media, the company's tangible products and services have languished.

Image source: Getty Images.

Marathon Digital Holdings & Riot Blockchain

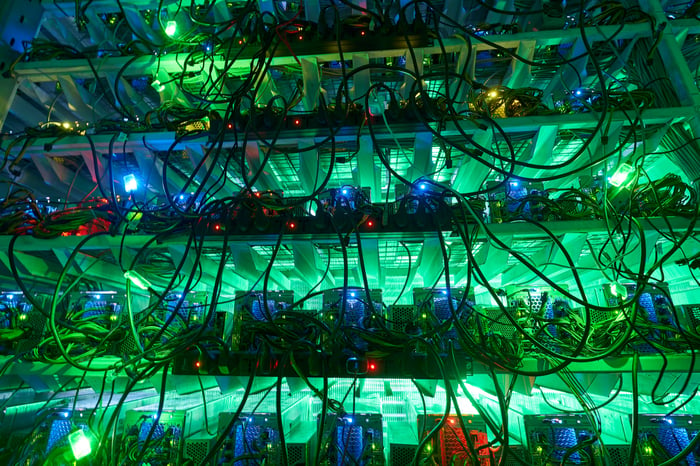

The second and third dangerous Bitcoin stocks that should be avoided by investors are cryptocurrency miners Marathon Digital Holdings (MARA 0.60%) and Riot Blockchain (RIOT -1.23%). I'm lumping these two together because of their extremely similar operating models.

Cryptocurrency miners are people or businesses using high-powered computers to solve complex mathematical equations that validate groups of transactions (known as a block) on blockchain. In the case of Marathon and Riot, they're both mining Bitcoin. For being the first to solve a block and validate transactions as true, a block reward of 6.25 Bitcoin is paid. That's worth about $267,000.

On one hand, bigger is certainly better when it comes to Bitcoin mining. Marathon and Riot will eventually have full mining operations containing around 199,000 and 120,000 mining units, respectively. On the other hand, the mining space has virtually no barrier to entry, and new competitors are targeting Bitcoin on a regular basis.

To make matters worse, Bitcoin's block reward halves every four years -- the next halving should take place in 2024. This means a larger number of companies is fighting over what will eventually be a shrinking pie. Marathon and Riot will need Bitcoin to double in price simply to break even on a revenue basis once block rewards halve.

But the biggest issue of all is Marathon Digital and Riot Blockchain are completely reliant on external factors (i.e., the price of Bitcoin) and not on innovation. With so much competition and risk involved, it makes no sense for Bitcoin bulls to put their money to work in crypto mining stocks.

Image source: Getty Images.

Grayscale Bitcoin Trust

The fourth dangerous Bitcoin "stock" I'd suggest avoiding in 2022 is the Grayscale Bitcoin Trust (GBTC 4.19%). If you're wondering why "stock" is in quotations, it's because, as its name implies, this security is a trust and acts more like a closed-end fund than an actual stock.

The premise here is simple: Grayscale Bitcoin Trust acquires Bitcoin to hold for the trust, and those assets should, in theory, increase or decrease in value on par with the price of Bitcoin. It's an alternative investment option for those who don't feel comfortable directly buying Bitcoin through a cryptocurrency exchange.

However, history has shown that the Grayscale Bitcoin Trust has a poor track record of accurately mirroring the price moves of its underlying security. A few years ago, its share premium could be up to 100% above its net asset value (NAV). Nowadays, it's valued at more than a 20% discount to its NAV.

In November, Bobby Blue of Morningstar laid out Grayscale's dilemma for the world to better understand. Because it's a trust, the only entity able to create and remove shares from the market is Grayscale; and Grayscale only does this through a serious of private placements and redemptions to accredited investors at sporadic times throughout the year. Instead of the number of shares outstanding matching demand, the restrictions placed on this trust lead to wild disparities between its share price and its NAV. Unless Grayscale Bitcoin Trust can convert to an exchange-traded fund (ETF), these inefficiencies will persist.

As one final note, paying a 2% management fee seems excessive for a trust that's merely handling private placements and redemptions a few dozen times a year.