With the recent sell-off in technology stocks, some investors may be looking at the large-cap tech giants for their portfolio. However, these tech giants have been the big outperformers over the past decade. Can they continue to outperform?

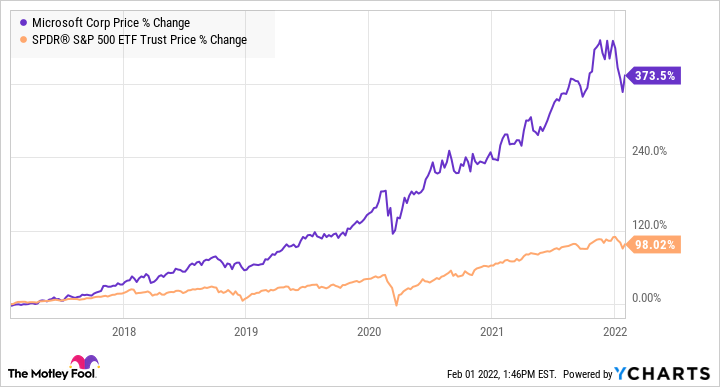

One of the biggest winners has been Microsoft (MSFT 1.58%), up 374% over the past five years, nearly quadrupling the return of the S&P 500.

Microsoft has proved itself a safe and durable grower, and perhaps the best tech stock to own for older investors and those near retirement. However, is it too late to get in on Microsoft's red-hot performance?

Image source: Getty Images.

Why Microsoft has been a market-beater

It wasn't that long ago that Microsoft was thought of as a relic of the 1980s. Sure, the company had dominant positions in computer operating systems with Windows and some nice productivity software in its Office Suite. These were dominant, high cash flow businesses, but there was some question as to how much they could grow in the mobile era. So the stock actually traded at a relatively low multiple. In 2013-2014, Microsoft's P/E ratio even went into the low teens.

MSFT PE Ratio data by YCharts

Of course, Microsoft's fortunes changed when Satya Nadella became CEO in early 2014. Nadella had been the head of Microsoft's young but growing cloud computing business, which would usher in a new "cloud first, mobile first" era. Microsoft's Azure cloud computing platform grew by leaps and bounds in short order, and its Office and Dynamics software suite also benefited from the more efficient cloud deployment.

Nadella then gave Microsoft's prospects a new twist with its "intelligent cloud" strategy, named in 2017, in which artificial intelligence would be infused into all Microsoft's offerings. Integrating AI and machine learning into its cloud and enterprise software, Microsoft made its tools even more automated, productive, and beneficial to customers.

During his tenure, Nadella also became aggressive on the acquisition front, expanding Microsoft's reach with business social media company LinkedIn, code repository GitHub, and various video game companies, solidifying its content for its Xbox platform.

As you can see, since Nadella became CEO and Microsoft's cloud business gained traction, earnings have reaccelerated to the upside.

MSFT EPS Diluted (TTM) data by YCharts

Where things stand now

As earnings have taken off, Microsoft's multiple has expanded to around 33 times this year's earnings estimates (for the year ending in June 2022) and around 28.7 times next year's estimates.

While those multiples are much higher than where Microsoft used to trade, they don't appear to be that high compared with Microsoft's current growth rates and profitability. Last quarter, Microsoft grew revenue 20%, which is amazing for a company this large. Even better in this era of concern over profitability, Microsoft's operating margins expanded, with operating profits surging an even higher 24%.

It appears that level of growth can be sustained. Microsoft is now a conglomerate with a number of high-growth products and services, which it broadly groups into three segments: productivity and business processes, intelligent cloud, and more personal computing. Here's how the categories shook out last quarter:

|

Microsoft Segment |

Q2 Revenue |

Growth Rate |

|---|---|---|

|

Productivity and business processes |

$15,936 |

19% |

|

Intelligent cloud |

$18,327 |

26% |

|

More personal computing |

$17,465 |

15% |

|

Total |

$51,728 |

20% |

Data source: Microsoft Q2 2022 press release. Chart by author. All dollar figures in millions.

As you can see, the intelligent cloud platform, which consists of Azure, GitHub, server products, and other cloud-based services such as databases, is growing faster than overall revenue, and it just became the largest segment in Microsoft's empire. Since Microsoft's largest segment is growing the fastest, overall growth rates should remain steady as intelligent cloud makes up a greater part of the business -- even if the segment decelerates somewhat.

Moreover, there are a number of products and services that are growing at higher-than-company rates underneath the various segments. The Azure cloud infrastructure platform grew 46% last quarter. Dynamics enterprise resource planning tools, under the business and productivity segment, grew at a fast 29% clip. And Microsoft's advertising-sensitive LinkedIn and Bing search engine segments were up 37% and 32%, respectively.

Since Microsoft has a number of high-growth products and is currently pursuing even more value-add acquisitions, I think it can sustain 20% or so revenue growth for the next few years at least. And since the company's profit margins are expanding as it grows, earnings should grow even faster.

That would bring Microsoft's PEG ratio, or the P/E ratio divided by its growth rate, to a little bit over one. That's not an expensive price at all, provided Microsoft achieves that level of earnings growth. Since cloud computing, AI, and gaming show no signs of slowing anytime soon, I'm confident Microsoft can succeed at beating the current analyst estimates.

In other words, while the gains may not be as great in the next five years as they were in the past five years, Microsoft still seems like a good bet to outperform the market going forward.