Unity Software (U -0.21%) is one of the most popular metaverse stocks in which to invest. With its 3D-animation tools, the company is a logical choice for content creators. Additionally, Unity's augmented-reality (AR) and virtual-reality (VR) solutions give the company exposure to multiple other industries.

In five years, the effect the metaverse will have on the world and Unity may still be up in the air. Regardless, Unity's solutions make it independent of the metaverse's success.

Image source: Getty Images.

Many possible futures

Unity Software operates two main segments within its business -- create and operate. The create segment does exactly as it sounds -- creates content. While this segment only makes up 26% of revenue, the opportunity garners the most attention.

One product from Unity's create software can transform building plans into a VR space so customers can experience the premises before it's built. Game developers can also utilize Unity's tools to make a video game across multiple platforms and have incredible graphics with built-in options.

Unity's animation software is finding use within metaverse applications, as its users can create 3D content to fill the world. Whether it's buildings or models of people, Unity has the software to do it all.

The operating segment focuses on maintaining existing games. It provides developers with several tools to maximize game popularity and profitability.

Unity's analytics tools can also help creators understand the audience and how long they play. Even though this is the largest component of Unity's business, several features are in the beta-testing stage, which will drive future revenue growth once the tools are released and adopted by customers.

In five years, the metaverse could be thriving, still on the horizon, or may have faded into the distance as a good idea that never happened. Even though Unity would benefit from massive amounts of metaverse content being created, its video game development and maintenance tools, as well as its expansion into ancillary markets like architecture and engineering, make it a resilient company.

Future financials

CFO Luis Visoso claimed the company can sustain 30% revenue growth over the long term. While some investors may be accustomed to seeing 40%, 50%, or higher growth rates, the effect of continuous 30% growth is astounding.

| 30% Revenue Growth Projection | |||

|---|---|---|---|

| Metric | 2021 Revenue | 2024 Projected | 2026 Projected |

| Revenue | $1.1 Billion | $2.42 Billion | $4.08 Billion |

| Growth from Q3 2021 | N/A | 120% | 271% |

Source: Unity Software. TTM = trailing 12 months.

The longer the stock is held, the more impressive 30% annual revenue growth becomes. To calculate the potential market cap and a stock price for Unity, a valuation must be applied. While these numbers are educated guesses, knowing how the market will be valuing companies five years into the future is impossible.

| Market Cap in 5 Years at Future Valuation | |||

|---|---|---|---|

| P/S of 10 | P/S of 23 (Lowest Ever Valuation) | P/S of 27 (Current) | P/S of 40 |

| $40.8 Billion | $93.8 Billion | $110.2 Billion | $163.2 Billion |

Source: Y-charts. Lowest valuation reached on May 5 2021. Current valuation as of Jan. 25 2022. P/S = price to sales ratio.

Unity Software has about a $31 billion market cap right now, but if it can deliver on its 30% revenue-growth promise, it will be an incredible stock market winner. Even at its lowest valuation as a public company, the stock would return 203%, or 25% annually.

To achieve this, however, two things must occur. First, investors must hold the stock through good times and bad. Second, the share count must stay the same, something Unity hasn't realized over its public-company life.

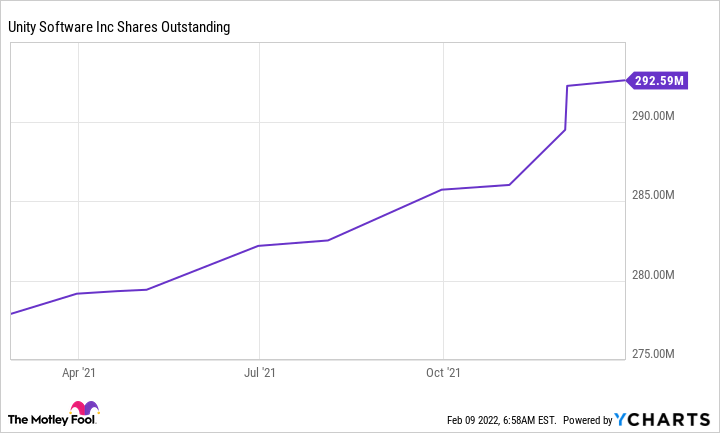

U Shares Outstanding data by YCharts

During Q4, Unity's stock-based compensation bill rang up to $98 million, or about 31% of revenue. Its share count rose 1.2% quarter over quarter, which would equate to a nearly 5% increase annually. Much like inflation, shareholder dilution decreases the claim one share has on a business. If Unity continues shelling out stock at the rate it is, one share today will be worth 0.79 five years in the future.

Unity is also posting significant quarterly losses. From a generally accepted accounting principle standpoint (GAAP) perspective, its net margin was a horrific negative 54%. Even when Unity adjusts for stock-based compensation, this number still sits at negative 1%.

Over the next five years, Unity must show some operating-efficiency improvement or will dilute its shareholders through stock-based compensation or capital raises. Plus, the market tends to beat down unprofitable companies during random intervals. If one of these periods happens to occur five years from now, business gains may be overshadowed by the company's unprofitability.

Unity Software has multiple strong-use cases and a bullish management team. While it has some spending problems, this should get ironed out after it's in the public markets for a while, as employees may want to be compensated with cash instead of stock -- especially if the stock price remains depressed.

The metaverse may or may not come, but AR and VR use are only increasing, and Unity's solutions solve real-world problems. Because Unity looks like a candidate for a great stock five years in the future, investors should consider taking advantage of it now, since the stock is down 50% from its all-time high.