What happened

Shares of Digital World Acquisition (DWAC) gained 26% in February, according to data from S&P Global Market Intelligence. The special purpose acquisition company's (SPAC) stock gained ground leading up to and following the release of the Truth Social app from Trump Media & Technology Group (TMTG), which is led by CEO Devin Nunes and Chairman Donald Trump.

Digital World Acquisition is set to take Trump Media & Technology Group public through a merger, and a relatively strong debut for the latter company's social media platform helped push the SPAC's share price higher. Truth Social, which is positioned as a competitor to Twitter and other platforms, launched on Feb. 21 and helped power a continued bullish run for the stock.

So what

Following its release last month, Truth Social quickly shot to the top of the free-application download charts on Apple's App Store. Despite facing bugs and outages upon its debut, the social media platform appears to have gotten off to a solid start in terms of user engagement, and Digital World Acquisition's stock is now up roughly 90% across 2022's trading.

Image source: Getty Images.

Now what

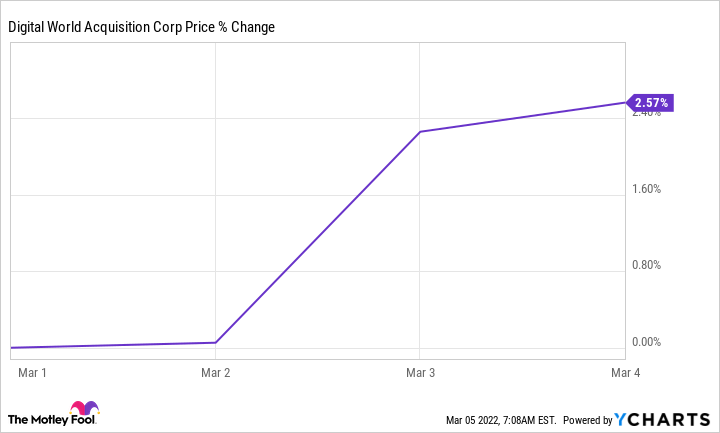

Digital World Acquisition stock has continued to gain ground early in March's trading despite sell-offs for many other growth-dependent software stocks. The company's share price is up roughly 2.6% in the month so far.

Even with the recent launch of Truth Social, investors still have relatively little visibility into the business operations and financial fundamentals of TMTG. Many SPAC stocks have also seen turbulent trading following the completion of their mergers. These dynamics set up the potential for Digital World Acquisition to see volatile swings in the coming months, but it's also possible that the stock will continue to see strong gains if Truth Social and other services continue to attract users and post strong engagement metrics.

In addition to Truth Social, Trump Media & Technology Group has said that it plans to launch a subscription video service, dubbed "TMTG+." According to a filing with the Securities and Exchange Commission, the upcoming streaming service will feature "'non-woke' entertainment programming, news, podcasts, and more."

With multiple fledgling services, it's possible that TMTG is still in the early stages of a much bigger growth story. However, the lack of visibility into the young social media business and potential for post-merger volatility due to substantial new share offerings and other factors means that Digital World Acquisition remains a risky investment even if it could post more big gains.