Much has been written about the life sciences industry in the wake of COVID-19. The bottom line is that the bar for speed of innovation, regulation, and collaboration has been forever raised.

With a renewed interest in science, the companies behind the research and development process should experience a golden age over the next few years and beyond. Repligen (RGEN -6.48%) -- a provider of bioprocessing systems -- is trying to step front and center.

The company has used many small acquisitions over the past few years to piece together impressive growth. But could the risks be growing? Here are two good reasons to buy the stock and one possible reason to sell.

Image source: Getty Images.

The life sciences industry is consolidating

Bioprocessing is a broad term that doesn't quite paint the picture of what Repligen provides its customers. The company's products include everything from filtration and separation to fluid management, analytics, and lab software. It has been an innovator in providing single-use products that reduce the amount of maintenance and cleaning.

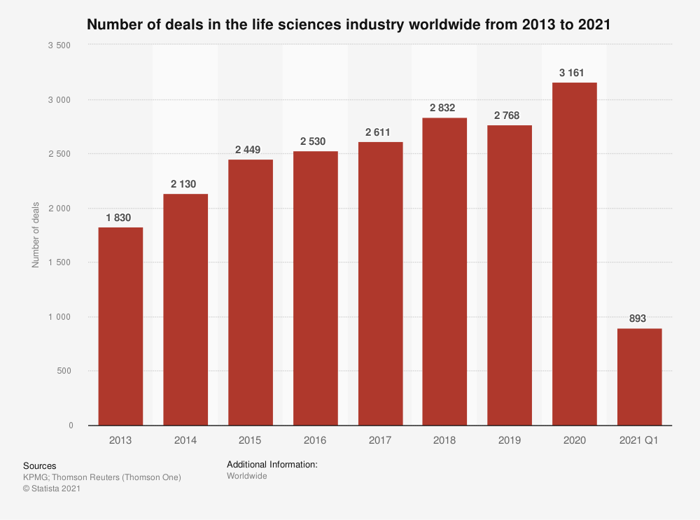

Historically, life sciences has been a fragmented market. And the past few years have seen thousands of deals as the big fish try to scale up by acquiring the small frys. There's plenty of opportunity -- it's a $45 billion industry.

Repligen has been no exception. Although it's been an acquirer, I wouldn't be surprised if it became the target of an industry giant.

Management has done well with this strategy

The company lists at least 16 acquisitions in its filings with the Securities and Exchange Commission over the past few years. The deals have filled out product offerings, offered customers increased speed and efficiency, and let it move further into gene therapy. It has also been the engine of growth.

Comparing Repligen's overall growth to organic growth -- which excludes the contribution from businesses purchased in the past 12 months -- illustrates its success. It's also easy to see the impact COVID had on the business.

Data source: Repligen. Chart by author.

Debt and goodwill are climbing

When a company borrows to buy other businesses, it can accumulate debt. Although Repligen's obligations have grown, it's still in a comfortable position.

Its earnings before interest and taxes, or EBIT, is 13 times the amount of interest it's paying annually. If debt climbs or growth slows, it could become more of an issue. For now, it's easily manageable.

The next issue is slightly more concerning. Goodwill is a somewhat strange accounting item. It's the portion of the purchase price above the fair value of the assets and liabilities of the acquired business. It can be attributed to a brand name, a roster of customers, or proprietary technology.

Goodwill must be tested by the company each year to ensure it's accurate. Repligen's has been climbing quickly.

Data source: Repligen. Chart by author.

That isn't a red flag by itself, but it warrants caution as consistently making acquisitions at a premium runs the risk of having to write down the value if reality doesn't live up to rosy projections. For example, publicly traded U.S. companies wrote down $143 billion of goodwill in 2020, due to the pandemic, according to valuation firm Duff & Phelps.

For Repligen, the pandemic helped the business. But goodwill on its balance sheet as a percentage of total assets rose to 36% in 2021. It was zero in 2014.

Back to reality

As the pandemic winds down, management is expecting the business to return to normal. It's calling for revenue growth in 2022 between 19% and 24%, and that's impressive. But it would represent the slowest pace of expansion since 2014. The midpoint of guidance suggests organic growth of 20%.

Repligen has been on an acquisition spree since 2014 that has fueled growth in a largely competitive industry. The question for shareholders is whether the company has been careful enough with its money to generate an adequate return going forward as the world gets back to normal.