Zoom Video Communications (ZM 1.35%) stock is having a rough start to the year in 2022. The stock is down 40% as the markets fall out of love with growth stocks. Rising inflation has forced the Federal Reserve to increase interest rates, which work to decrease the present value of future cash flows.

That's not the only headwind for Zoom; economic reopening has meant workers are returning to offices, and organizations' need for video communication software is decreasing. Still, it's not all doom and gloom for Zoom. Let's look closer at its prospects and consider its valuation to determine if long-term investors should buy Zoom stock.

Zoom's explosive growth is slowing down

It's essential to realize the company was growing revenue rapidly even before the pandemic. From 2017 to 2019, revenue increased from $61 million to $331 million. This is vital to remember because some investors assume that Zoom was not a fast-growing company before the outbreak, and the only reason it gained prominence was the rise of remote working. That theory is far from the truth, as evidenced by Zoom's more than 100% revenue growth in the two years preceding the rise of COVID-19.

Of course, the pandemic boosted the business, and revenue exploded from $331 million in fiscal 2019 to $4.1 billion in fiscal 2022. Note Zoom's fiscal year ends in January, and its most recently completed year was fiscal 2022. Zoom's video communication software seamlessly connects individuals or teams, who can then share their screens with each other and record the meetings for later viewing. When my university sent students home for remote learning, I used Zoom to deliver multiple lectures, recorded the lessons, and uploaded them for students to view whenever they wanted. Students appreciated the convenience of learning from home and the availability of recorded lectures to view anytime.

Now that economies are reopening and folks are returning to offices and campuses for working and learning, the use cases for Zoom could decrease. That said, these few years during the pandemic highlighted the effectiveness of remote meetings. Even if meeting remotely is not 100% as effective as meeting in person, the cost savings are so abundant that it doesn't have to be. As the world emerges out of the pandemic, it will be apparent that some habits adopted will be long-lasting. Remote work may not exist as much as it did during lockdowns, but certainly more than before the outbreak. Not all meetings will be over Zoom, but probably more than before 2020.

Indeed, for fiscal 2023, management does not expect revenue to decrease. However, it does see a significant deceleration of revenue growth to 11% for the year. In conjunction with the market falling out of love with growth stocks, the slowdown can explain why Zoom stock is down 40% on the year and 80% off its highs.

Image source: Getty Images.

Zoom stock is cheaper than it's ever been

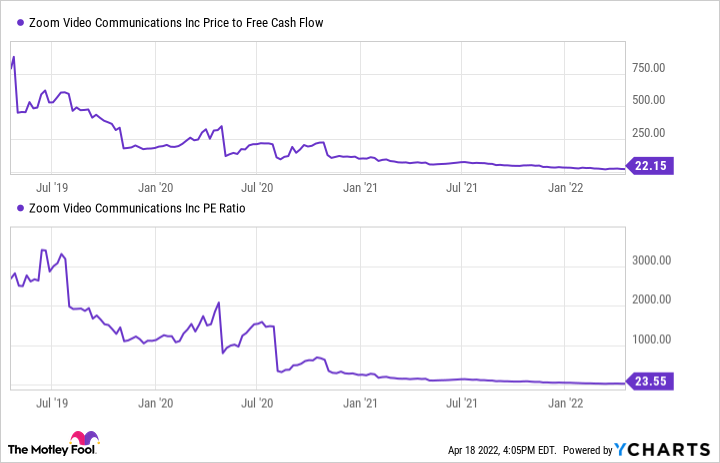

ZM Price to Free Cash Flow data by YCharts

Due to that sell-off, Zoom stock is cheaper than ever. Zoom is trading at price-to-free cash flow and price-to-earnings ratios of 22 and 24, respectively. According to those metrics, Zoom is significantly discounted. To put its valuation in context, it's trading at a similar P/E and P/FCF as McDonald's -- a respectable business to be sure, but one that is not expected to grow like Zoom is over the next decade.

So, to answer the question posed in the headline, yes, Zoom stock looks like a buy right now.