What happened

Precious metals stocks shone brightly on Thursday, with several gold and silver stocks jumping by double-digit percentages by midday. Here's how much the top-performing stocks from the sector had rallied at their highest point in trading today as of 2 p.m. ET:

- Fortuna Silver Mines (FSM -2.27%): up 13%.

- Coeur Mining (CDE -0.77%): up 11.6%.

- Iamgold (IAG 1.21%): up 11.1%.

- Endeavour Silver (EXK -2.26%): up 10%.

Thank the latest economic data for today's surge in these stocks.

So what

As is typically the case with commodity stocks, prices of the underlying commodities are the biggest factor that drives shares higher or lower.

Gold and silver prices rebounded on Thursday and were posting solid gains by midday -- gold was up around 1.4%, while silver was trading roughly 2.3% higher.

Those gains may look insignificant at first blush, but not so once you put them in context of what's driving prices higher.

For example, gold earlier this week plunged to levels not seen since February. It's been worse for silver: Prices slumped to near two-year lows on May 13.

Today's rebound in gold and silver prices is, therefore, meaningful, which is also why stocks across the sector soared today.

Image source: Getty Images.

Housing starts fell in April, and mortgage rates are inching higher alongside the Federal Reserve's interest rate increases in the wake of sky-high inflation. Meanwhile, jobless claims in the U.S. last week rose to their highest level since January.

These disappointing economic data coming in today were the biggest drivers of gold and silver prices as they raise concerns about the economy's growth trajectory. The stock markets are already bearing the brunt of those fears, what with major companies also reporting dismal quarterly numbers amid inflationary pressures.

When stocks fall and concerns about the economy's health loom large, investors flee to safe haven assets like gold and silver, which helps drive prices of the precious metals higher. Precious metals are considered a hedge against inflation and economic uncertainty. The latest housing and jobs data, combined with rising inflation and weak corporate earnings, are all coming together to create a perfectly conducive environment for precious metals like gold. And as prices of gold and silver rise, so do prices of shares of companies that deal in gold and silver.

While Canada-based Iamgold is a pure-play gold company and Endeavour Silver a pure-play silver company, Coeur Mining and Fortuna Silver own both silver and gold mines.

Now what

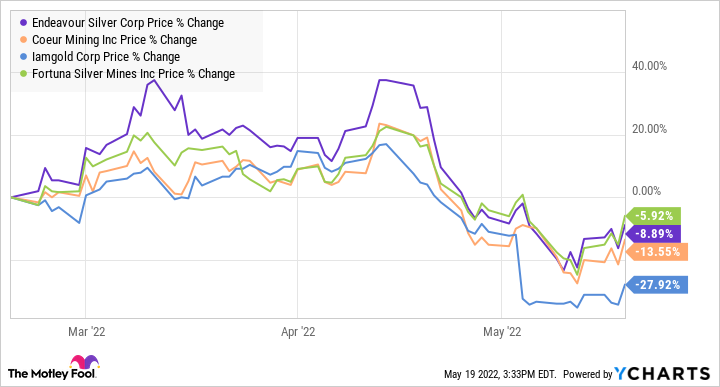

The correlation between gold and silver and the prices of these stocks is unmistakable, as the chart below proves. You can see how each of these stocks tanked after mid-April as gold and silver prices cooled down. It's therefore not surprising to see these stocks rally today on firmer precious metals prices.

In fact, after today's rally, shares of Endeavour Silver, Coeur Mining, Fortuna Silver, and Iamgold are each up double digits so far this week. It is evident the market is driving these stocks higher in anticipation of a rebound in gold and silver prices, but you may want to be cautious and pick your stocks carefully after weighing in on fundamentals.

To give you an example from among the stocks listed in this article, Iamgold may have beaten first-quarter revenue and earnings estimates earlier this month, but the miner also expects significantly higher capital expenditure on its Côté gold project in Ontario because of inflation. In management's own words, that poses "significant near-and-mid term challenges" for the company.

Endeavour Silver, on the other hand, didn't just surprise the market with strong Q1 numbers last week but also provided insight into its growth plans for the second quarter. The silver stock popped more than 20% after earnings.

The point I'm trying to drive home is that you may see days like today more often now given the uncertain macroeconomic environment, but while rising prices of precious metals can lure investors to buy gold and silver stocks, it shouldn't be the only, or even the primary, reason behind your investment.