Electric-vehicle (EV) leader Tesla (TSLA 2.40%) defied conventional carmaking techniques to launch better products. Likewise, its stock has so far defied conventional valuation metrics. The key question is, can it continue to do so?

Tesla's valuation

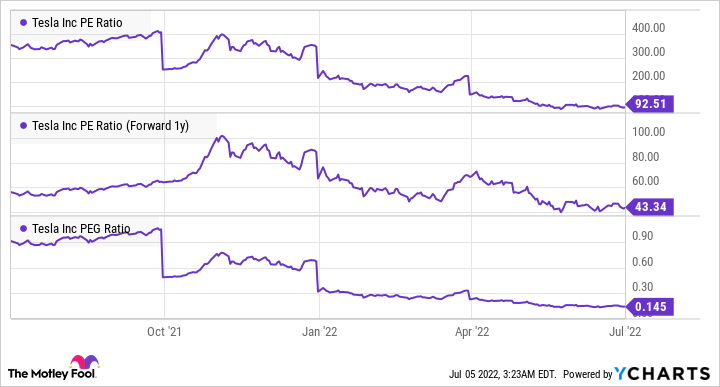

As of this writing, Tesla stock is trading less than 10% above its 52-week low price. The stock's valuation metrics, such as its price-to-earnings (P/E) and price-earnings-to-growth (PEG) ratios, have fallen to extremely attractive levels, compared to their historical levels.

TSLA PE Ratio data by YCharts.

Based on its estimated earnings for the next fiscal year, the stock's forward P/E ratio has fallen close to 43. Indeed, the valuation gap between Tesla stock and that of traditional automakers is still gigantic. Yet Tesla stock's steep fall this year doesn't look as bad as the fall of the other automakers.

A key reason for Tesla stock's comparatively smaller fall this year is the company's growth. While all major automakers are reporting low or negative revenue growth, Tesla's revenue continues to grow impressively.

TSLA Revenue (Quarterly YoY Growth) data by YCharts.

While investors are usually worried about a greater correction in growth stocks in bear markets, Tesla's fundamental strength has protected the stock from falling drastically. I think it will also uplift the stock when markets recover.

Tesla has several potential growth avenues

There are many reasons why Tesla commands a premium valuation. It generates higher margins than traditional automakers. In terms of potential avenues for expansion, there are big expectations from the full self-driving features of Tesla cars. Then there are its various projects in development, like robotaxis, auto insurance for Tesla owners, the Optimus robot, and so on.

Clearly, there's a risk that Tesla will fail to achieve what it's hoping for, hurting its stock price. As an example, investors see recent layoffs by Tesla as a warning sign. Similarly, rising competition from other EV manufacturers is disconcerting for some investors.

While Volkswagen aims to be the global EV leader, replacing Tesla by 2025, there are several young EV companies that may also pose stiff competition to Tesla. Then there are industrywide challenges that are affecting Tesla as it ramps up production at its factories in Berlin and Austin.

There are concerns relating to Tesla's growth in its EV segment, and things are far hazier when it comes to its secondary projects. The steeper correction of Tesla stock and its peers than the broader market reflects some of these concerns.

There's a lot to look forward to with Tesla

Clearly, there are some valid concerns relating to Tesla and its growth. And that's why the stock has fallen. Some of those concerns may prove to be valid. However, I'm going to give the company the benefit of the doubt for the moment because I think that Tesla has lots of growth ahead.

The company can grow not only in terms of vehicle sales, but also in full self-driving features, robotaxis, battery technology, and other potential areas, all paving the way for sustained or higher margins. Tesla has maneuvered through challenges successfully in the past and can continue to do so in the future.

No one can tell if markets will slide further from here and for how long. But Tesla stock is trading close to its 52-week low, offering an attractive entry point for long-term investors.