Stock splits are big news these days. That's because some of the most popular companies have announced or completed them this year. For example, Amazon split its stock in June. And Tesla shareholders are set to vote on a potential split during their meeting in August.

In this year for top-name splits, it's natural to wonder what other companies may be next. One I've thought about from time to time is Regeneron (REGN -0.09%). The biotech is one of the highest-priced stocks in its industry. Could it be next to launch a split? Let's take a closer look.

A coronavirus treatment

First, a little bit about Regeneron's business. The company made headlines during the earlier stages of the coronavirus pandemic as it won authorization for a monoclonal antibody treatment. In fact, that treatment -- REGEN-COV -- generated more than $6 billion in revenue last year.

The bad news now is REGEN-COV didn't hold up against the omicron variant. As a result, the U.S. Food and Drug Administration (FDA) halted use of the treatment. Regeneron is working on new antibody candidates that may be effective against omicron and other variants. It's started a clinical trial. But, in the near term, Regeneron can't count on its coronavirus program for revenue.

The good news is it doesn't have to. Regeneron sells blockbuster eye drug Eylea, shares in profits from blockbuster eczema drug Dupixent with partner Sanofi, and generates sales from five other products. Excluding REGEN-COV, revenue in the first quarter climbed 25%.

And Regeneron has about 40 candidates in the pipeline -- 12 of these are in phase 3 trials. If even a couple make it to commercialization, we'll be looking at more revenue growth ahead.

Now, let's talk about the idea of a stock split. Companies usually do this when their shares have climbed quite a bit. The idea is they issue more stock to current investors in order to lower the price of each individual share. That makes the shares more accessible to a wider group of investors. Stock splits usually are a sign that business is doing well.

More than $600 a share

Regeneron stock has indeed climbed to a high level. Over the past decade, it's increased about 400% to more than $600 a share. It's the highest-priced biotech stock. But it isn't the most expensive in relation to earnings. It trades at 14 times forward earnings estimates. That's the same as fellow big biotech's Biogen and Amgen.

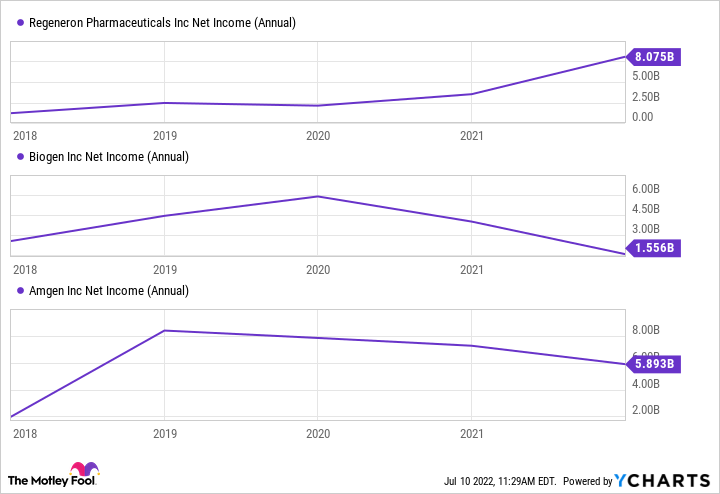

But while profit has been on the decline at Biogen and Amgen, it's been on the rise at Regeneron. Amgen and Biogen have both suffered from biosimilar and generic competition in recent years.

REGN Net Income (Annual) data by YCharts

So, even at this high per-share price, Regeneron is actually reasonably priced. Also, Regeneron has never split its stock in its 31 years as a publicly traded company. Does this mean we should forget about a potential stock split? Not necessarily.

Amazon split its stock more than 20 years ago -- and then only launched another such operation this year. So, a split can happen at any time -- after many years or even as a first-time event for a company. And, yes, Regeneron isn't expensive at these levels. But the company still may see a split as a way of making it easier for more investors to come on board. Investors can get in on a high-priced stock by buying fractional shares. But some brokerages don't offer them.

All of this means I'll keep Regeneron on my stock split watch list. But even if the company doesn't go for such an operation, it still may please investors with its revenue and profit growth and future prospects.