Netflix (NFLX -0.76%) has partnered with another business to implement its plan to launch a lower-priced ad-supported streaming service tier as early as this year. In choosing Microsoft (MSFT -0.20%) to help facilitate and sell advertising, Netflix went with a proven global operator.

Rumors had surfaced that Netflix might pick Alphabet (GOOG 1.61%) (GOOGL 1.59%), but the advertising giant has competing operations with its YouTube service. The new tier can boost Netflix's revenue from its U.S. and Canada segment by $1 to $3 billion annually. This is for a company that generated $29.7 billion in revenue in its most recently completed fiscal year. Let's look at the move and determine whether Netflix's stock is a buy.

An ad-supported version could reverse subscriber losses for Netflix

Netflix is one of the highest-priced streaming services on the market today. Many rivals launched competing services during the pandemic, nearly all at lower prices. That fact, along with slowing demand for in-home entertainment due to the economic reopening, caused Netflix to shed 200,000 subs in its first quarter, which ended on March 31. The loss was just the tip of the iceberg, as the company forecasts a decrease of 2 million subscribers in Q2.

The abrupt reversal of fortune led management to change tack and consider an ad-supported version. For years, executives had resisted calls to launch a lower-priced ad-supported tier. Given its remarkable growth in subscribers, revenue, and profits, the company felt it was making the right decision.

NFLX Revenue (Annual) data by YCharts.

From 2012 to 2021, Netflix's revenue skyrocketed from $3.6 billion to $29.7 billion. Meanwhile, its operating income jumped from $50 million to $6.2 billion, and its subscriber count surged to 222 million as of March 31. With that kind of result, it's understandable why management didn't want to change the status quo.

In hindsight, executives might be equally commended for quickly adjusting course when they did observe trends moving in the opposite direction. After all, Netflix made this move after only the first quarter of reporting subscriber losses.

Investors have yet to receive an update from Netflix on details or the potential impacts of a lower-price ad-supported version, which leaves mostly speculation as to what the outcome will be. Rival Walt Disney (DIS -0.42%) earned $2 billion from advertising on its ad-supported streaming service in the previous 12 months. It can be reasonable to assume Netflix could surpass that figure once its ad-supported version is fully operational because it has more subscribers than Disney's version.

An excellent time to buy Netflix stock

Overall, the lower-priced version should be a positive for Netflix investors. It could attract subscribers on the fence about joining the service and pull customers from competitors. The incremental increase in revenue could be used to fuel new content, further solidifying its competitive advantage in scale.

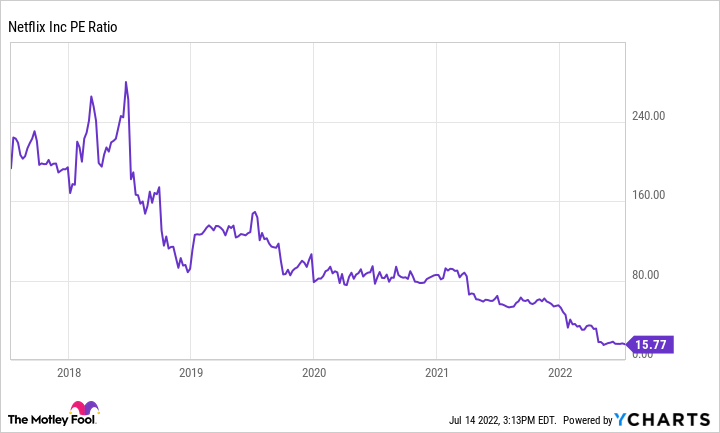

NFLX PE Ratio data by YCharts.

Don't forget the near term is expected to be rough for Netflix, with 2 million sub losses in Q2 and uncertain prospects for the remainder of the year. However, Netflix's stock has arguably more than paid the price for that. Selling at a price-to-earnings ratio of 15.8, it's an excellent time for investors to buy Netflix stock.