Procter & Gamble (PG -0.23%) will update investors on its fiscal 2022 fourth-quarter earnings before the markets open on July 29. The consumer packaged goods giant has increased its dividend per share from $2.14 to $3.24 in the last decade and is battling to keep costs under control as inflation soars worldwide.

The company has repeatedly raised the estimate of how much inflation adversely impacts profitability. Investors hope those increases have ended when it releases earnings on July 29.

Procter & Gamble is successfully dealing with inflation

In its third-quarter conference call that followed its earnings release, Proctor & Gamble said that rising commodity prices will be an after-tax $2.5 billion headwind for the fiscal year 2022. To put that figure into context, P&G reported revenue of $76 billion in the 2021 fiscal year. Fortunately, the company generated a healthy 23.6% operating profit margin in 2021, so it had wiggle room to absorb higher costs and remain highly profitable.

Still, the company is not sitting still and letting inflation eat into profits. P&G has implemented several rounds of price increases on its portfolio of products. Additionally, it is enacting productivity improvements. In its most recent quarter, which ended on March 31, P&G increased revenue by 7% from the same quarter in the prior year.

PG Revenue (Quarterly YoY Growth) data by YCharts

"We delivered another quarter with strong sales growth and made sequential earnings growth progress despite significant and increasing cost headwinds," said Jon Moeller, president and CEO. "These results enable us to raise our top-line growth outlook for the fiscal year and to maintain our EPS guidance range."

The sales increase was fueled primarily by a 5% increase in prices. That said, consumers are paying higher prices on everything from groceries to gas, spreading their incomes more thinly. To compensate, consumers may begin switching to more affordable generic brands and away from expensive alternatives from P&G. Therefore, management must tread carefully over the next several quarters to avoid pushing consumers to the edge with price increases. That might mean absorbing higher costs, potentially lowering P&G's excellent profit margins.

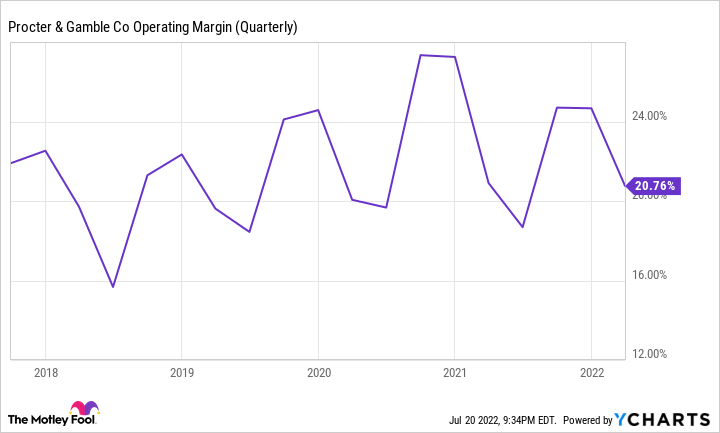

Fortunately, that has not been the case so far. In its most recent quarter, operating profit margin decreased by only 10 basis points as the company found 170 basis points of productivity improvements.

PG Operating Margin (Quarterly) data by YCharts

What this could mean for Proctor & Gamble investors

Analysts on Wall Street expect Proctor & Gamble to report revenue of $19.43 billion in Q4. If the company meets these projections, it will mean an increase of 2.6% from the same period the year before. It would also be a sequential decrease over the 7% revenue growth in the third quarter fiscal quarter.

Perhaps what management has to say about the inflation outlook for its next fiscal year is just as crucial as its fourth-quarter results. If management sounds optimistic, noting that increases have stabilized, it could relieve investors concerned about the impact on profit margins.