AMC Entertainment Holdings (AMC 1.95%) stock has been a thriller over the last year and a half. The star of the show has been meme traders, but the company's fundamentals look dire, and management has been shareholder-unfriendly. Here are three reasons why investors should avoid the stock.

Where are all the movies?

Now that movie theaters have fully reopened after being shuttered during COVID lockdowns, pent-up demand from movie-goers during the mid-May through Labor Day summer box office season should've been a blockbuster for theater stocks. Unfortunately, silver screen releases were scarce. Wide releases (shown on 2,000 or more screens) amounted to only 22 movies this summer, well short of the 42 in the summer 2019 campaign. Since the lockdowns, theater operators like AMC have been losing money.

Image source: Getty Images.

There were some successes, however. Top Gun: Maverick grossed $701 million at the domestic box office, making it the fifth-highest domestic grossing film of all time. The flick raked in an astounding $1.4 billion globally. After that, Jurassic World: Dominion grossed $375 domestically and almost $1 billion worldwide. Overall, the North American box office grossed $3.43 billion this summer, which is 21% lower than in 2019.

The movie slate for the remainder of the year also looks pretty bleak. It only contains four potential blockbusters: Warner Bros. Discovery's (WBD 1.69%) Black Adam, Marvel's Black Panther, Walt Disney Amination's Strange World, and 20th Century's Avatar: The Way of the Water. One explanation for the scarcity is that movie production, which can take years, was slowed during the pandemic. Now movies in production have moved back their release dates while production is finished.

AMC's massive shareholder dilution may get worse

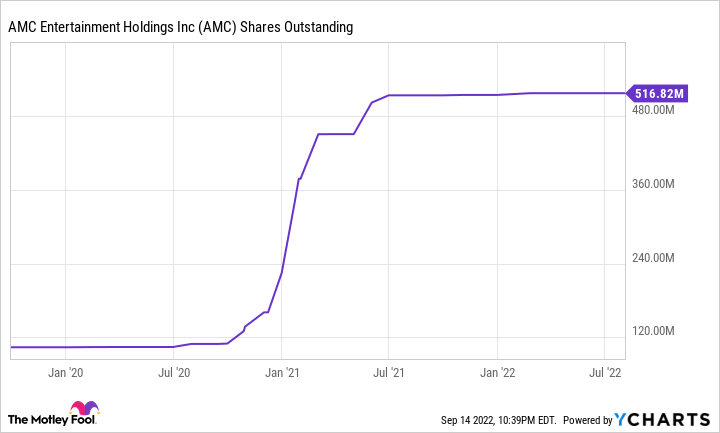

Until movies return to theater en masse (if they do), AMC may continue to hemorrhage cash. Even before the pandemic, the company reported earnings of negative $149 million. AMC lost $4.6 billion in 2020, $1.27 billion in 2021, and another $458 million through the first half of 2022. To finance the losses, the company issued new shares three times in 2021 after the stock price experienced meme-fueled run-ups. AMC raised about $1.5 billion from the new shares, which massively diluted shareholders. The company quintupled its share count from 104 million at the end of 2019 to 517 million currently.

AMC Shares Outstanding data by YCharts

If AMC is going to raise additional capital by issuing more shares, it will need shareholder approval, which is not likely at all. But with the company facing further losses due to a skimpy movie slate for the rest of the year, AMC recently found a loophole that could raise more dilutive capital without a go-ahead from shareholders. In August, the company authorized itself to issue up to one billion shares of AMC Preferred Equity (or APE, in an ode to its meme stock fan base) which holders can convert into one share of common stock in the future.

The company gave about half of those shares away to existing shareholders in the form of a special dividend for which it did not receive consideration. The other half can be issued to raise money for the company to pay debt or fund losses. If all the APE shares are converted, the company's share count would almost triple from here, theoretically cutting each share's value by two-thirds. Considering the scant movie slate for the rest of the year and the company's current lack of profits, the issuance may be inevitable.

The state of movie theaters could be in jeopardy

Succumbing to a crushing debt load, the world's second-largest movie theater operator, Cineworld, filed for Chapter 11 bankruptcy protection last week. The company will seek to restructure its debt, but will continue to operate its theaters during its bankruptcy. The bigger issue may be Cineworld's attempt to lighten its lease payments with its theater landlords as part of the proceedings. The risk here is that landlords refuse or find a better return on their properties by converting them to, say, apartment or retail buildings. They could even sell properties to real estate developers.

Suppose Cineworld's debt restructuring or landlord disputes force it to shut down many of its theaters. In that case, it will reduce potential box office takes, and movie producers may find it more profitable to send movies directly to streaming. The whole process may take years to play out, but movie producers like Disney (DIS -0.42%), Paramount (PARA -2.43%), and Warner Bros. Discovery are already looking to attract streaming subscribers. Putting movies onto their streaming platforms would certainly aid them in the streaming war.

There are better options out there

The company faces three genuine risks, including a dire outlook for movie releases, value-destroying shareholder dilution, and fallout from the Cineworld bankruptcy. I don't see any fundamental reason to own shares. Of course, the stock could move higher in the short-term for several reasons, including another meme-inspired run-up. But I would not suggest long-term investors go down that path. A number of high-quality stocks have been beaten down this year that could be buy-and-hold bargains. Avoid the risk embedded in AMC stock and look elsewhere.