While stocks that go hyperbolic in a bull market may garner more attention during their climb phase, companies that are capable of thriving in turbulent markets may be more valuable to investors over the long term.

That second type of resilience is a critical attribute that Nasdaq-listed stocks Axon Enterprise (AXON 0.18%), Medpace (MEDP -2.87%), Casey's General Stores (CASY 1.58%), and XPEL (XPEL -2.06%)have shown so far in a brutal 2022 market.

Up between 110% and 4,500% over the last five years, these four growth stocks have histories of showing strength in any environment, and they look poised to continue beating the Nasdaq during this bear market.

Axon's transformation brings increased recurring revenue

Initially known for its Taser electroshock weapons, Axon Enterprise has reinvented its business model, and now offers a wide array of law enforcement solutions built around its Axon Cloud. It still sells Tasers, but also provides law enforcement agencies with body cameras, fleet cameras, drones, dispatch solutions, digital evidence management, and even virtual reality augmented training.

Its Axon Cloud connects all these products, creating an ecosystem that removes many of the inefficiencies from the paperwork-laden police work processes of the past, making it a cost-effective one-stop-shop for agencies looking to bring their systems into the modern era.

To highlight just how rapid its adoption has been, Axon Cloud sales have grown from $58 million in the entire year of 2017 to $82 million in just 2022's second quarter. Riding that success, the company's share price has taken off.

These cloud sales also carry robust gross margins of 70% and help Axon grow its subscription revenue, which now accounts for 80% of the top line. And these subscription bundles provide it with long-term recurring revenue: One-third of Axon's biggest 100 contracts will last for a decade or longer.

Best yet, these subscriptions have had a net retention rate of 119% for each of the last five quarters, showing that Axon's existing customers are expanding their usage of its products at a strong clip.

While the stock is trading at a somewhat expensive valuation of 10 times sales, Axon's cloud operations, its recurring revenue, and its guidance for 27% sales growth in 2022 all point to the company's resilience in this complex economic period.

Medpace: The power of well-timed share buybacks

Medpace acts as a guide to many smaller biopharma companies on their journeys toward the commercialization of their treatments. Its full-service suite offers solutions for every phase of the clinical trial process. Riding the tailwinds of a biotech industry that's projected to grow at a 14% annualized rate through 2030 (according to Grand View Research), the company reported blowout third-quarter earnings last week, leading to a 30% increase in share price.

While Medpace grew revenue and its total backlog by 30% and 21%, respectively, its 59% increase in earnings per share stole the show. That earnings per share spike was notably enhanced by the fact that management bought back 14% of the company's outstanding shares over the last two quarters while the stock was trading at lower valuations.

Data by YCharts.

Despite Medpace's recent run-up in price, its shares still hold immense potential for investors as its rising return on invested capital (ROIC) highlights the company's streamlining operations and profitability.

Data by YCharts.

Historically, stocks with high and rising ROIC tend to outperform the market, making Medpace an excellent investment even at its now-higher share price.

Casey's: The pizza chain that sells gas

With a loyalty program that boasts more than 5 million members, Iowa-based Casey's General Stores is gradually expanding its cult-like following into regions beyond the Midwest. It has made a habit of scooping up clusters of new stores through small-scale acquisitions, and then bringing a higher ROIC to these gas stations by adding its popular pizza operations and leveraging its supply chain network and private branding.

Thanks to its strategy of slow and steady expansion (which has made it America's fifth-largest pizza chain), the company almost doubled the total returns of the S&P 500 Index over the last five years.

Best yet for investors, Casey's has raised its dividend for 23 consecutive years, at an average rate of more than 14% annually.

Data by YCharts.

Even more impressively, it has kept its payout ratio low, demonstrating its incredible dividend growth potential.

Data by YCharts.

It's now trading at 18 times free cash flow, and its 11% sales growth from inside sales in its fiscal 2023 Q1 looks superb. While its 0.6% dividend yield may not immediately wow income investors, Casey's track record of payout increases and successful acquisitions, as well as its growing loyalty program, make it a perfect buy-and-forget-about investment.

Can XPEL build upon its 47,000% return over the last decade?

Given that XPEL has delivered more than 400-bagger returns in just the last 10 years, it would be reasonable for investors to think that its period of impressive share price growth might be entirely in the past. However, this paint protection film and window tint specialist may just be getting started.

XPEL's products protect cars' finishes against rock chips, bugs, and debris. But the $1.8 billion market capitalization company is also expanding into the home and office window film industry, and developing other non-automotive use cases.

In the second quarter, it grew revenue and net income by 22% and 17%, respectively, despite foreign exchange headwinds and COVID-19 lockdowns in several major cities in China. While its international operations were a headwind for XPEL this quarter, overseas markets offer it immense upside over the long term, as the U.S. and Canada still account for 70% of its sales.

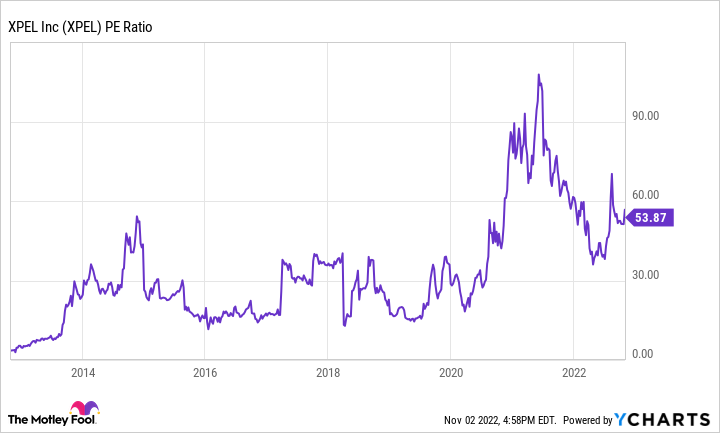

Although its earnings per share have grown by nearly 2,500% over the last decade, XPEL's price-to-earnings ratio of 54 isn't as high as one might expect in the wake of its hyperbolic share price rise.

Data by YCharts.

While the stock is not necessarily cheap, XPEL's international growth runway and product optionality have it poised to build on its successes, making it an interesting candidate for a starter position.