Having as many data points as possible when deciphering when something is wrong or how to improve a process is critical. However, collecting these data points for software programs can be difficult. That's where Datadog (DDOG 15.77%) can help with its application performance monitoring (APM) software.

Knowing how data flows is crucial as more software programs are integrated into businesses. This makes Datadog a key software provider as the industry adopts more software solutions. Yet the stock is near its 52-week low, which I think is an excellent opportunity to purchase the stock. Here's why.

Customers are expanding their use significantly

Not only does Datadog offer its APM platform, but it also has log management and cloud security offerings. In fact, 80% of Datadog's customers use at least two of its products. However, only 16% use six or more, so the opportunity to "up-sell" customers is present with Datadog, especially since it has 15 different products under its roof.

For APM, Gartner recognized Datadog as a leader in the space, claiming the highest ability to execute of all companies analyzed. Investing in an industry leader is a crucial investment strategy as second-tier companies often don't fare as well.

The company also receives glowing reviews from its customer base, receiving 4.3 out of five stars from 354 reviews on G2. It's also rapidly expanding its customer count with around 4,700 customers added over the past year -- a 27% increase.

In the third quarter, the company reported revenue of $437 million, up 61% year over year. Revenue growth significantly outpaces customer growth because of Datadog's high net retention rate of greater than 130%, meaning existing customers spent at least $130 this year for every $100 they spent last year.

But customer and revenue growth don't mean a lot without profits.

Expenses are rising

Like many of its tech brethren, Datadog isn't profitable. However, it doesn't have far to go to reach that threshold. In Q3, Datadog lost $26 million -- a loss margin of 6%. This metric is trending in the wrong direction compared with last year's 2% loss margin.

But it might help to investigate where Datadog's expenses are increasing.

| Expense Line Item | YOY Growth |

|---|---|

| Cost of Revenue | 48% |

| Research and Development | 82% |

| Sales and Marketing | 71% |

| General and Administrative | 68% |

Data source: Datadog.

Starting at the top, Datadog's cost of revenue rose more slowly than its revenue, meaning Datadog is exercising some pricing power. This is a huge deal, because it means Datadog isn't cutting prices to drive sales in a more challenging economic environment.

As for operating expenses, it's a little concerning that every segment rose faster than revenue. However, seeing research and development rising the fastest shows that Datadog is investing heavily in developing new products to capture as much market share in its niche as possible. Investors will need to keep an eye on these expenses to ensure they don't spiral out of control, but they aren't raising too many alarm bells right now.

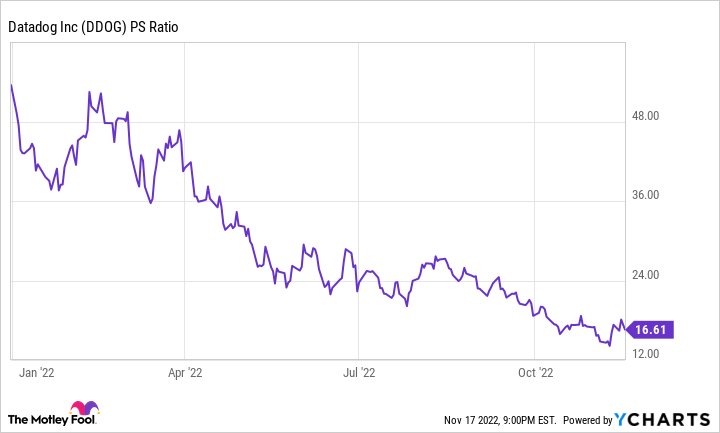

The stock's valuation has also fallen throughout the year. While 16.6 times sales isn't cheap, it's not terribly expensive for a company growing sales at a 60% pace.

DDOG PS Ratio data by YCharts

With Datadog's enormous market opportunity and strong customer relationships, it's likely to post solid revenue growth for years. However, if its expenses continue to rise uncontrollably, I may change my opinion of the business.

As for right now, I think Datadog's stock is a strong buy because if it keeps reporting outstanding quarters in 2023, more investors will take notice, causing the stock price to rise.