You may have heard the phrase, "If it sounds too good to be true, it probably is." That thinking applies to dividend yields too. Often, once payouts hit 4% or higher, investors question if they're sustainable. When a stock reaches this range, investors would be wise to evaluate the payout in case a potential cut or falling stock price spells trouble on the horizon.

High-yield stocks can be safe, but investors need to do a bit of looking under the hood before coming to that conclusion.

Which sectors have high-yield stocks?

High-yield stocks can come from any sector, but you're more likely to find them in a few industries: utilities, telecoms, and real estate investment trusts (REITs). Stocks in these three sectors have highly predictable cash flows. Consumers pay their utility and phone bills monthly, and REIT tenants have to pay or face eviction. Management can use these consistent income streams to pay out higher dividends than other companies.

When you see a company in these sectors with a high dividend yield, it shouldn't immediately set off alarm bells. And many stocks with high dividend yields outside of these sectors may also be good investments. Regardless, the tools used to examine whether a dividend yield is safe are the same.

So let's look at a key way to analyze dividend payouts.

Payout ratio

The most important metric for examining whether a dividend is sustainable is the payout ratio -- what percentage of earnings a company pays out to shareholders. For utilities and telecoms, investors can use free cash flow or earnings as the baseline. Investors should use funds from operations (FFO) for REITs.

After you find this number, divide the total cash paid out in dividends over the past year by your chosen earnings metric for the same time period.

Anything over 100% is a bad sign as it means a company is paying out more in dividends than it is generating in earnings. That's not a sustainable practice, and a company will need to either cut its dividend or increase its profitability. A stock with weak earnings and a high payout ratio may see more share price volatility, causing the dividend yield to rise to eye-popping levels and set off alarm bells.

If the dividend payout ratio is less than 100%, however, investors can check to see if it aligns with the company's long-term averages.

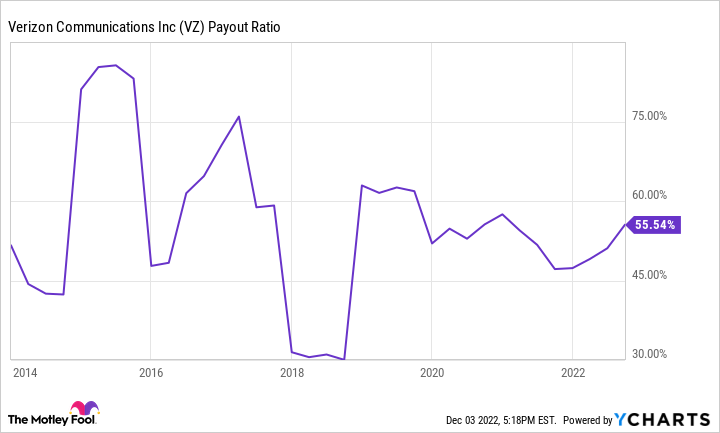

Take telecom giant Verizon, for example. Even though the stock currently offers a 6.8% dividend yield, its payout ratio falls well within its normal range over the past decade.

Data by YCharts.

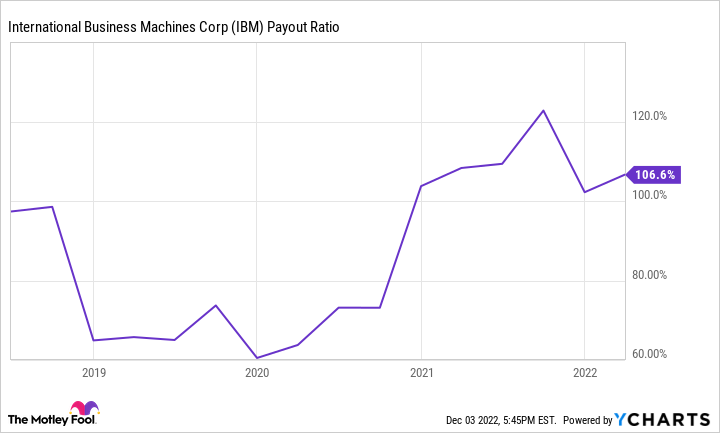

Now, for another example, let's look at IBM.

Data by YCharts.

IBM has been paying out more than it brings in since 2021, which is a cause for concern as its cash levels decline.

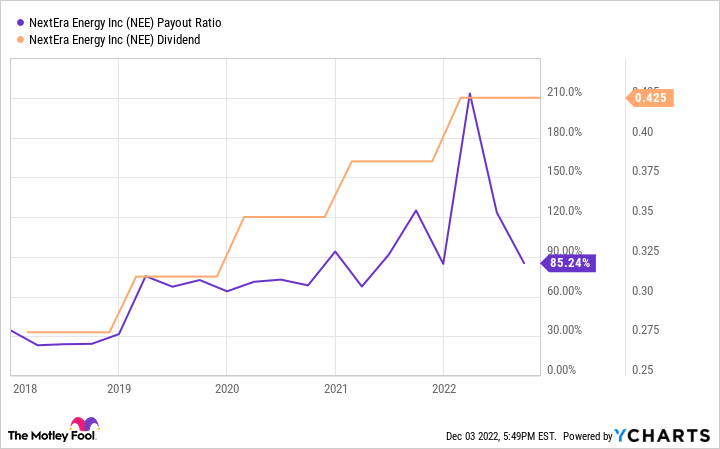

However, spiking above a 100% payout ratio isn't the end of the world. Just look at the largest utility company by market cap in the U.S., NextEra Energy.

Data by YCharts.

Despite a drastic spike, NextEra maintained its dividend and is returning to more historical payout-ratio levels.

Even high-yielding stocks can be safe, but investors have to carefully evaluate whether a company can sustain its payout -- not all dividend stocks are created equal.