Foot Locker (FL -0.08%) has been a mall staple for decades. And like many mall-based retailers, the company has faced its share of challenges over the last few years: the growth of online shopping, the COVID-19 pandemic, and labor shortages, to name just a few.

However, the company has a new CEO, Mary Dillon, who is pledging to turn the company around. Can she do it? Let's take a closer look.

Image source: Getty Images.

Foot Locker will benefit from surging sneaker sales

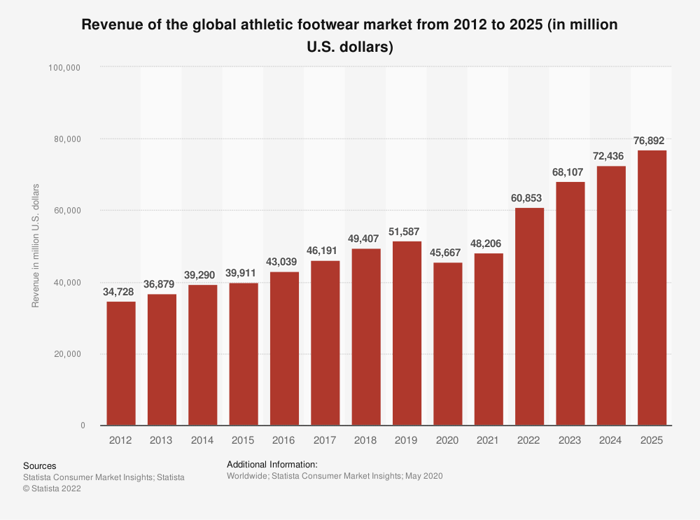

Foot Locker's core business is selling athletic footwear. And thankfully for the company, sneakers are a big business. After dipping during the pandemic years, athletic footwear sales have bounced back and should grow to nearly $77 billion by 2025.

Sneakers offer comfort and style. And for true enthusiasts, they're more than just something to put on your feet -- they're a status symbol. Sneakers have a cult following. Sneakerheads are often willing to pay big bucks for the latest releases from their favorite brands.

Foot Locker is a favorite destination for sneakerheads, as it frequently hosts launch parties for widely anticipated shoe releases. And with over 1,700 U.S. stores, Foot Locker is well positioned to benefit from the overall growth of the sneaker market.

Foot Locker's stock is historically cheap

Foot Locker has been a publicly traded company for more than 30 years. And during that time, it has had its ups and downs. However, right now it looks like a good time to accumulate Foot Locker shares. Here's a 10-year chart showing the company's price-to-earnings (P/E) multiple, along with its high, low, and average.

FL PE Ratio data by YCharts

As you can see, Foot Locker is coming off a 10-year low P/E of 3, which it hit back in July. Since then, the stock has recovered but remains well below its 10-year average P/E of 13.3.

Analysts expect Foot Locker to earn $4.48 in 2023. Applying the long-term average of 13.3 implies that Foot Locker should trade just shy of $60. Instead, it's currently at around $38. Earnings are never a given, but the company has beaten earnings estimates in its last four quarters. A few more solid quarters might encourage more investors to jump on board, pushing the stock price back toward its long-term P/E ratio.

Is it time to buy Foot Locker?

I'm a believer in Dillon. She delivered tremendous shareholder returns during her near-decade as CEO of Ulta Beauty.

In her first conference call with analysts, she noted that the sneaker industry relies on "passionate enthusiasts," much like the beauty category. I think Dillon is poised to diversify the company's vendors, grow sales to women and kids, and supercharge the company's online store. And that's why I think the company is a buy heading into 2023.