Bull markets are times of burgeoning opportunity, and with opportunity comes risk that's easier to sweep under the rug than to account for soberly. Especially after a brutal 2022, investors are apt to return to the good times of bull markets past, and that's why the temptation to make ill-advised moves with your money is going to be strong if 2023 sees stock prices shoot upward once again.

The good news is that with a bit of mental preparation today, you can inoculate yourself against making (at least a few) portfolio-harming mistakes if the bull market returns with vigor. Here are three of the juiciest -- and most dangerous -- missteps that are likely to tempt you.

1. Buying a stock just because its price rose recently

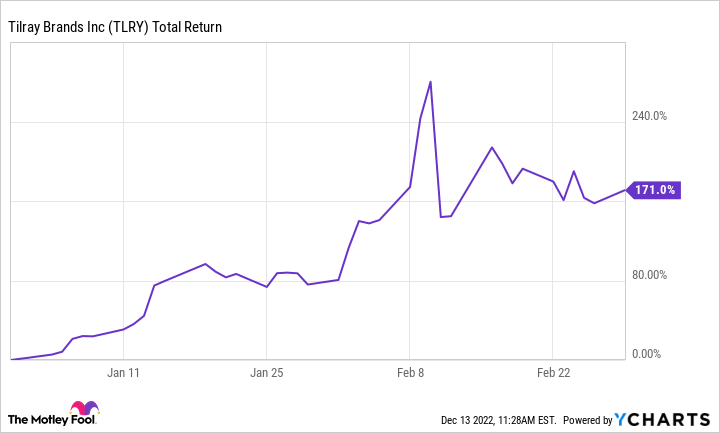

One of the all-time bugbears of investors, young and old, is buying shares of a company on the basis of its short-term price performance rather than its long-term merit, and it's not very surprising why. Look at this chart of Tilray Brands' (TLRY 11.29%) shares in early 2021:

Data by YCharts.

Would you be ready to invest in this cannabis titan after seeing such a sharp run-up over the course of a few months? The old chestnut that past performance doesn't predict future returns seems trite because of how often it's repeated, but it's the truth. Now, examine this second chart:

Data by YCharts.

As you can see, even if you're a believer in Tilray, it's a fool's errand to try to get rich quickly by buying a stock at the apex of its hype cycle. It would be best if you had a fully fleshed-out investing thesis to justify your purchases, preferably one that takes everything from a business' competitive advantages to its stock's valuation into account. And when the market is surging, stepping back to think about the long-term growth potential of a company is key, as bullishness will eventually give way to another pullback where higher-quality businesses won't see their shares decline as much.

2. Selling a stock at a loss to invest in a more exciting business

As the meme traders say, we all have our bags to hold. By that, they mean there are a few lemons in everyone's portfolio that we continue to hold at a loss for fear of admitting defeat and selling, potentially exposing us to even greater losses as the stock trends toward zero.

For many of us, seeing a reminder of our underwater stock picks is a bit frustrating, regardless of the market conditions. And during a bull market, there's often a gnawing temptation to liquidate our bags and reinvest the money in a more attractive place where we could potentially make up for the prior losses. But that possibility is often a mirage.

Locking in your losses by selling your shares means depriving your portfolio of the chance that your investment might recover in the long term. And the bubbling excitement surrounding a trendy business during a bull market typically leads to frothy valuations that are eventually corrected. It's one thing to decide that your investing thesis was incorrect, thereby justifying your sale. However, it's less advisable to ditch your "losers" and throw your money into a recently anointed "winner" without sufficient due diligence.

3. Concentrating your portfolio on hot growth stocks instead of diversifying

Bull markets are not an excuse to stop diversifying your investments to protect yourself against downside risk. Nonetheless, buying shares of companies that would leave you even more exposed to those risks is especially tantalizing when it seems like there's a bull run in a given sector or industry.

For instance, let's say that in early 2021 you saw that cannabis stocks were in vogue, and after an ill-fated investment in Tilray, you also saw that shares of Cresco Labs were rising sharply too, gaining 45.5% in the first three months of the year. If you bought Cresco Labs at that point, you'd now be sitting on a loss of around 71%, and your investment in Tilray would also be deeply underwater.

This isn't a dig at either of those two businesses -- practically everything in the cannabis industry got hit hard in the bear market due to a combination of factors like an oversupply of marijuana, regulatory woes, and the market's sharp turn away from favoring growth stocks. But it shows how doubling down on stocks exposed to the same set of drivers, risks, and headwinds is in itself a major risk for your entire portfolio.

It's fine to invest in growth stocks during a bull market, and it's also fine to invest in multiple businesses in the same sector. Just make sure not to leave diversification by the wayside when you choose, as diversification is one of the best tools to limit your losses when things don't go your way.