Stocks have been beaten down pretty badly over the past year as investors weigh the impact that rising interest rates will have on economic growth. While the sell-off has been a challenge, it has also provided investors with opportunities.

One they won't want to miss is that falling stock prices drive up dividend yields. Because of that, many dividend stocks look attractive these days.

Three current favorites of these Fool.com contributors are Blackstone (BX -1.14%), Simon Property Group (SPG -1.05%), and Mid-America Apartment Communities (MAA -0.23%). Here's why they would buy any of those dividend stocks without hesitation these days.

Tremendous growth ahead for Blackstone

Matt DiLallo (Blackstone): Shares of Blackstone have lost more than a quarter of their value since the market peaked in early 2022. That sell-off has come even though the leading alternative-asset manager is doing extremely well.

The company's assets under management (AUM) grew 11% last year to nearly $975 billion. Meanwhile, fee-related earnings expanded by 9% to over $4.4 billion, or $3.65 per share, while total distributable earnings rose 7% to $6.6 billion, or $5.17 per share. Blackstone returned $6.1 billion of that money to shareholders, including paying $4.40 per share in dividends for the year.

The company's investment funds delivered differentiated returns last year. While the public stock and bond markets were crashing, Blackstone's funds produced stunning outperformance.

Because of that, the company became a victim of its own success as some investors requested to cash in on their investment in its popular non-traded real estate investment trust (REIT) to cover losses elsewhere or invest in new opportunities.

Despite that headwind, Blackstone has powerful growth tailwinds that should drive its business for years to come. While its non-traded REIT is currently a concern, that vehicle should become a magnet for investors again in the future, given its continued outperformance. Meanwhile, institutional investors plan to continue allocating capital to private investments, enabling Blackstone to launch new investment funds.

These catalysts should empower Blackstone to continue growing its AUM and earnings at above-average rates. That should allow the company to continue paying sizable dividends.

With the stock currently down sharply on near-term concerns, it looks like an excellent long-term investment, given its growth drivers. Because of that, I wouldn't hesitate to buy more shares at the current price.

The strong labor market supports consumer spending -- and Simon Property Group

Brent Nyitray (Simon Property Group): Simon Property Group is a REIT that focuses on shopping malls and premium outlets. The company also owns an 80% noncontrolling interest in mall operator Taubman Centers and a stake in French retailer Klépierre (KLPEF -1.71%). Simon owns or has an interest in 230 properties, with a combined 184 million square feet.

The Employment Situation Summary from the Bureau of Labor Statistics showed that the U.S. labor market is extremely tight. The unemployment rate is back at levels last seen in the late 1960s, when there was a military draft and the U.S. had little international competition.

US unemployment rate data by YCharts.

The low unemployment rate is remarkable given that the Federal Reserve has been hiking interest rates aggressively for almost a year. A strong labor market, where employees are getting raises, is supportive for consumer spending.

Residential real estate prices have also soared since the beginning of the pandemic, although home price appreciation has stalled out on a month-over-month basis. The economic situation for the consumer is well supported.

Simon earned $11.87 per share in funds from operations (FFO) in 2022. REITs generally use FFO because earnings per share as reported under generally accepted accounting principles tend to understate cash flow due to depreciation and amortization, which is a noncash charge.

Simon is guiding for 2023 FFO per share to come in between $11.70 and $11.95. This puts it on a 2023 FFO per share multiple of 10.6 times, which is attractive. The stock also has a dividend yield of 5.7%, and the $7.20 annual dividend is well covered by FFO per share.

Mid-America Apartment Communities offers reliable payouts at a bargain price

Marc Rapport (Mid-America Apartment Communities): A down market is a great opportunity to find bargains, and the real estate space is a great place to start. Mid-America Apartment Communities is a fine example, with its long record of reliable dividend payouts backed by one of America's largest collections of rental properties.

This REIT has a portfolio of approximately 300 apartment complexes in 16 states and the District of Columbia with a focus on the fast-growing, job-rich metro areas of the Sunbelt, including Atlanta, Dallas, and Tampa and Orlando in Florida.

That growing portfolio of more than 100,000 apartment units generates a reliable stream of income for passive investors that has led to 116 straight quarters of payouts. The two charts below illustrate the long-term and current opportunity that the stock presents to investors interested in passive income with a good chance of share-price appreciation.

First, here is the total return over the past 15 years (since the dawn of the Great Recession) for Mid-America and two good benchmarks: the Vanguard S&P 500 ETF (VOO -0.36%) to represent the greater market and then the Vanguard Real Estate ETF (VNQ 0.01%), a weighted collection of about 160 REITs.

MAA total return level data by YCharts.

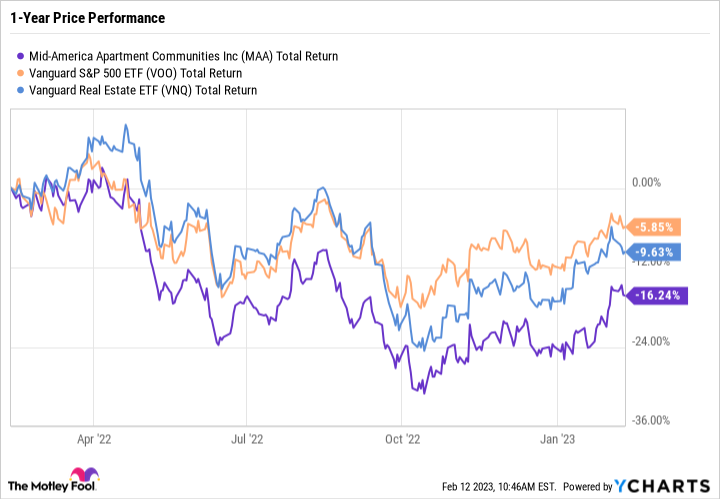

And here is how beaten down that Mid-America stock remains over the past year versus those two exchange-traded funds.

MAA total return level data by YCharts.

Real estate investing is a proven hedge against inflation and other vicissitudes of the market, and REIT investing adds instant liquidity and income without the hassles of managing a property. Mid-America stock sells for about $171 a share and yields about 3.3%. It's a good way to benefit from those advantages now.