Tesla (TSLA 3.76%) is having an incredible year with its stock up 74% so far. However, other electric vehicle (EV) makers like Rivian (RIVN 0.28%) haven't seen nearly the return Tesla has, with its stock returning just 15% since the calendar flipped to 2023.

So is Rivian stock a sleeping giant? Or is Tesla just in a league of its own? Let's find out.

Strong production growth wasn't enough to turn a profit

Rivian is just in its first year of production and is rapidly ramping its production pace. Just look at the progress it made throughout 2022.

| Quarter | Vehicle Production | QOQ Growth |

|---|---|---|

| Q1 | 2,553 | 178% |

| Q2 | 4,401 | 72% |

| Q3 | 7,363 | 67% |

| Q4 | 10,020 | 36% |

Data source: Rivian. QOQ = Quarter over Quarter.

With 24,337 vehicles produced for the entire year, Rivian still fell short of the 25,000 target management set for itself. While we don't know why this shortfall occurred (Rivian reports fourth-quarter earnings on Feb. 28), it wasn't for lack of demand.

As of the third quarter, Rivian has about 114,000 preorders for its R1 platform and an initial order of 100,000 electric delivery vans (EDV) for Amazon.

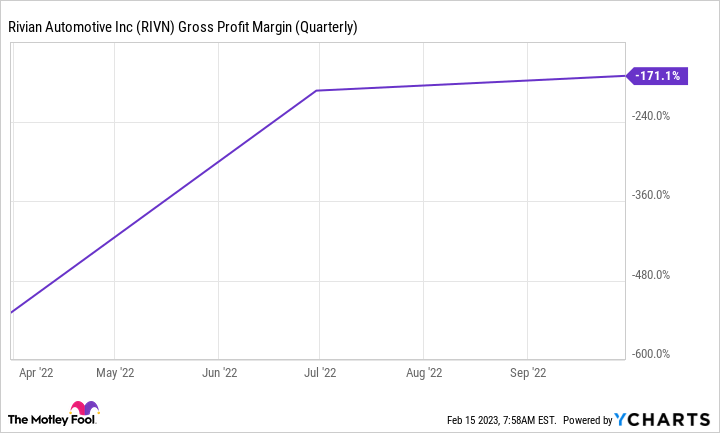

Regardless of why Rivian missed production targets, it will likely post another quarterly loss because it hasn't reached scale. In Q3, Rivian's revenue was $536 million, but the cost of that revenue was $1.45 billion. That's a gross loss margin of 171%, which means Rivian will have to produce many more vehicles to break even.

RIVN Gross Profit Margin (Quarterly) data by YCharts

Combined with $857 million in operating expenses, Rivian's operating loss was $1.77 billion. With $13.2 billion in cash on the balance sheet as of Sept. 30, that means (by very rough estimates) Rivian has about seven quarters left of survival before it would need to raise more money at its current burn rate. Including Q4, Rivian will be in financial trouble by mid-2024 if it doesn't reach full production rates.

Investors will learn more about Rivian's financial state in its Feb. 28 Q4 conference call, but can investors take a position now hoping for good news?

Rivian is fighting for its life in a crowded space

The critical difference between Rivian and Tesla was Tesla's head start in the industry. When Tesla was the only one seriously making EVs, it gained a leg up on the competition. Unfortunately, Rivian doesn't have that luxury, with Ford and General Motors EV trucks also available for purchase, and Stellantis' (RAM 1500 REV) and Tesla's Cybertruck also coming to the market by next year.

Increased competition won't help Rivian; once its initial preorders are delivered, it will face stiff competition among an established crowd. Everyone knows truck owners are relatively loyal, and getting one to switch from gas to EV will be hard enough, let alone getting one to switch from Ford to Rivian.

NASDAQ: RIVN

Key Data Points

Tesla is also among the most profitable automakers (the most profitable if you take out luxury brands), so investors aren't worried about it going bankrupt anytime soon. Rivian isn't anywhere close to that status, so its stock seems purely speculative.

While you can hope for a turnaround, hope alone isn't a sound investment strategy. If you're looking to invest in EV stocks, consider Tesla or one of the traditional automakers. Rivian is acceptable as a small, speculative position, but the company has enough question marks that it's not worth devoting a significant portion of your portfolio to right now.