One of the things that attracts me to a stock is a high yield relative to a company's own historical yield trends. In 2015, Nucor's (NUE 0.35%) yield was high for a reason, but I didn't see anything wrong with the company itself that suggested the multidecade history of dividend increases would be at risk.

I've been well rewarded for that decision, and I've no plans to sell the stock. Here's why I bought and still own Nucor.

A different time

Steel is a cyclical industry, prone to material swings as the economy moves between good periods and bad. Back when I bought U.S. steel giant Nucor, the industry was in a downturn. However, there was another headwind, as foreign-produced steel was flowing into the U.S. market at a high pace, putting additional downward pressure on domestic steel prices. It was not a good time for Nucor or any of its peers.

Image source: Getty Images.

But the company was still profitable and maintaining its streak of annual dividend increases. Assuming the dividend doesn't get cut, the company's annual dividend streak should hit 50 consecutive years in 2023. That will make it a Dividend King, a highly elite group of companies. That's extra impressive, given the industry's cyclical nature.

Right now, Nucor's stock is feeling some pressure, down nearly 20% from its recent highs. But I'm still up dramatically from where I bought it. The key factor for me, however, is that management is still doing what it has always done to ensure Nucor is an industry leader. And as long as that is the case, I'm happy to own the stock and ride the industry's swings.

NYSE: NUE

Key Data Points

The basic model

The first thing that is important about Nucor is that it operates a fleet of electric arc mini-mills. This is a more modern, flexible technology than blast furnaces. Without getting too deep into the process, Nucor can more easily adjust production to accommodate industry trends. This generally allows the company to remain profitable throughout the cycle, while companies highly reliant on blast furnaces will often bleed red ink during downturns.

In addition, Nucor is vertically integrated. This ensures it has a steady supply of steel, via its scrap business, at reasonable prices. And it has a "customer" for a portion of its production, as it uses its own steel to make fabricated products, like building components. Generally speaking, the products it makes out of its in-house steel are higher margin as well, helping to improve profitability.

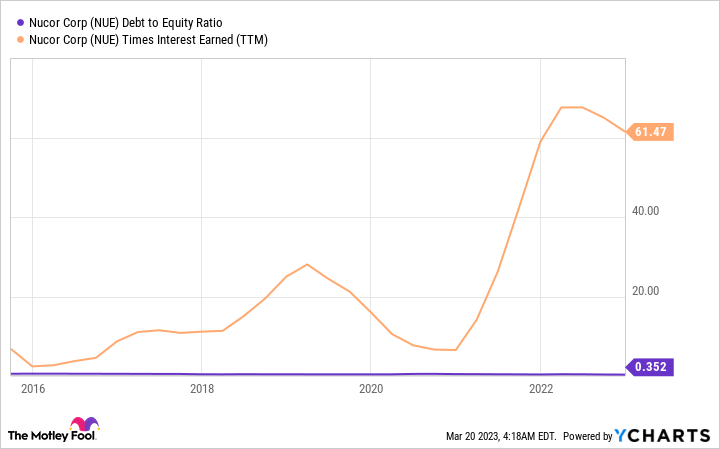

On top of that, Nucor has long focused on having a strong balance sheet. Today, its debt-to-equity ratio is roughly 0.35 times, a reasonable number for any company. And it covers its trailing-12-month interest expenses by over 60 times. Having a strong foundation ensures the company can more easily handle the hard times.

NUE Debt to Equity Ratio data by YCharts

Nucor also has a simple plan for remaining an industry leader: It invests throughout the cycle in growth projects, and specifically likes to put money to work during downturns. This helps to ensure that it comes out of the downturn a stronger company. The company's current plans call for $1.6 billion in spending in 2023 and another $2.3 billion in 2024. The list of projects includes a new mill and upgrades to a number of existing assets.

The last big selling point for Nucor is the way it treats its employees. The core of the issue is the company's use of profit sharing. During good years, its workers get paid extremely well, and during the lean years they get less, giving Nucor a break on salary expenses right when it needs it. However, what's most telling is that Nucor is largely union free because its relationship with its employees is so strong.

Well run, all around

Nucor isn't a perfect company, but no company is perfect. The recent 20% stock price decline, for example, is a huge drawdown that might not be acceptable to all investors, even though it is pretty much par for the course for a steel stock.

I'm OK with the price volatility, knowing full well that Nucor's business is rock solid thanks to a successful playbook that remains as important today as it was when I bought the stock eight years ago. I can't say I think the stock is cheap today (even after the 20% drawdown), even given the record results it has achieved of late. But if you are thinking about a steel company, Nucor should be on your watch list.