Shares of Alphabet (GOOG 1.12%) are down 26% over the last 12 months and are more than 31% off their all-time high. At first glance, that might make investors' mouths water. However, a lower stock price doesn't always indicate a bargain.

To find out whether Alphabet stock is a screaming buy or a lemon in disguise, investors need to dig into the numbers and see what's truly going on. So let's lift the hood on Alphabet and see what we find.

Image source: Getty Images.

Is Alphabet cheap right now?

One way to evaluate a stock's valuation is to look at its current price-to-earnings ratio (P/E ratio) and compare that to its long-term average. Here's a chart of Alphabet's 10-year P/E ratio, with its average included:

GOOG PE Ratio data by YCharts

As you can see, Alphabet's current P/E ratio of 22.8 is significantly below its 10-year average of 30.1. This suggests that the stock is affordable -- at least relative to its historic valuation. Bear in mind the long-term average P/E ratio for the S&P 500 is around 16. So while Alphabet shares are cheaper than they've historically been, they're still valued higher than the average stock in the S&P 500.

Why are Alphabet shares cheap?

There are two main reasons why Alphabet shares are trading below their long-term average.

- Significant macroeconomic concerns: Alphabet is massive. For context, consider this: Alphabet generated $282.8 billion in revenue in 2022. If it were a country, Alphabet would rank at No. 48 based on gross domestic product (GDP) -- slightly ahead of Pakistan. Enormous size can be an advantage, but it cuts both ways. Alphabet's business will take a hit if the American or world economy heads into a recession.

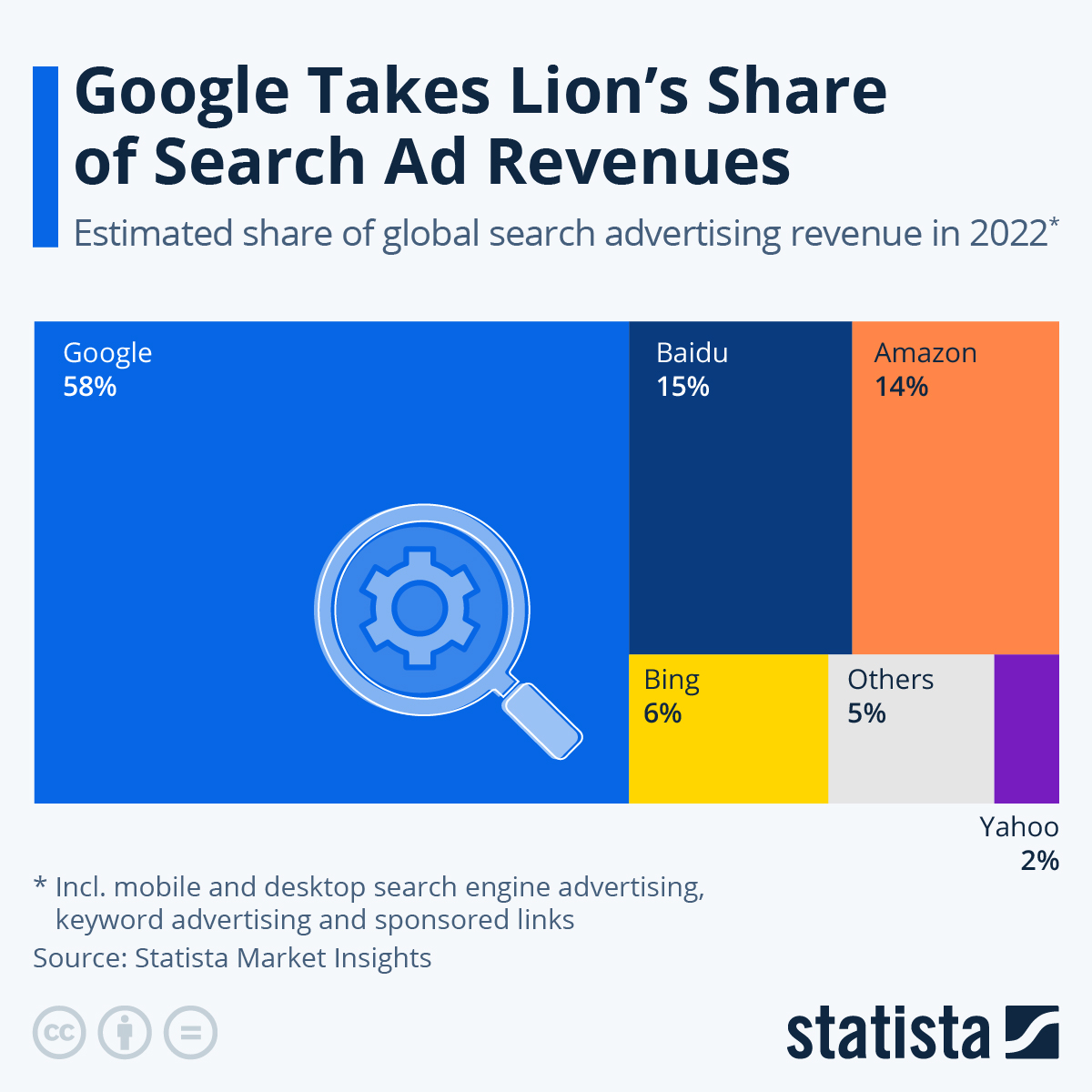

- Market-share slippage: Alphabet is the major player when it comes to online search ad revenue. According to Statista Digital Markets Insights, the company earned 58% of the global total of online search revenue in 2022. That dwarfs the percentage generated by Amazon's ad business (14%) or that of Microsoft's Bing (6%). Nevertheless, there are growing concerns that Alphabet's current dominance will come under threat. Microsoft has already integrated OpenAI's ChatGPT into its Bing search engine, which could eat into Google Search's dominant share of the search market.

Is Alphabet a buy now?

The numbers don't lie: Alphabet shares are trading below their long-term average P/E. To put it another way: Alphabet is still on sale.

However, the reason might give investors pause. A looming recession and serious competitive pressures are weighing on Alphabet's share price.

The company is set to report first-quarter earnings results in the final week of April. Those results should reveal how well it is navigating new threats to its search engine dominance. At any rate, investors would be wise to wait on the sidelines for now.