The first quarter of 2023 is in the books, and it was a decent one for the major indexes. The Nasdaq Composite, S&P 500, and Dow Jones Industrial Average gained 16.7%, 7%, and 0.4%, respectively.

With the tech-heavy Nasdaq leading the way higher, some investors are wondering: What technology names are worth owning right now?

These three Motley Fool contributors are eyeing Sea Limited (SE -0.17%), SoFi Technologies (SOFI 2.46%), and Adobe (ADBE 0.31%). Here's why.

Image source: Getty Images.

A banking crisis overshadows SoFi's numerous positives

Justin Pope (SoFi Technologies): It's been tough living as a digital bank for SoFi Technologies. The company's been plagued by a student loan freeze for several years, and the recent banking crisis has only shaken investor confidence in smaller lenders. Shares are trading near the low end of their 52-week range, down 77% from their high.

But the bank's on firmer ground than its share price might indicate. First, SoFi is well capitalized -- well above the minimum financial ratios regulators mandate, and its depositor base of 5.2 million members is more diversified than a bank like Silicon Valley Bank. Second, there's a student loan freeze in effect, which has hurt SoFi's loan refinancing business, which was huge before the pandemic.

However, it hasn't stopped SoFi from marching toward profitability. The company posted non-GAAP (adjusted) earnings before interest, taxes, depreciation, and amortization (EBITDA) of $143 million in 2022 and is guiding for $260 million to $280 million for 2023. Importantly, management expects net income under generally accepted accounting principles (GAAP) to turn positive by the end of the year.

Between a banking crisis and a student loan freeze, it's hard to imagine what else could go wrong for SoFi. That's why the stock could rebound when the smoke clears. The student loan freeze seems on course to end later this year, and it looks like the government will do what's needed to ensure confidence in the banking system.

Then, investors might better appreciate SoFi's rapidly growing user base, looming profitability, and strong balance sheet. CEO Anthony Noto reiterated his confidence, buying roughly $1.2 million in stock last month. You can't predict when, but SoFi's stock could spring higher at the first sign of positive news.

The tech conglomerate that may soon seem 'unlimited'

Will Healy (Sea Limited): Admittedly, Sea Limited stock may appear to have moved too far too fast. Since falling to a low of just under $41 per share last November, it has more than doubled.

Still, in other ways, Sea Limited appears far from done. The tech conglomerate, which includes the e-commerce business Shopee and fintech segment Sea Money, has drawn investor interest amid a push to cut costs and turn profitable.

Sea Money has continued to grow at a triple-digit clip, though it only makes up around 10% of the company's revenue. Earlier in the year, Shopee reversed most of its expansion plans outside its core Southeast Asian market. But the strategy seems to have worked as e-commerce revenue of $7.3 billion rose 42% in 2022 compared with the prior year.

Additionally, the factor that could make Sea Limited's stock fully turn around is the reversal of declining revenue in its gaming segment, Garena. Garena's Free Fire was the world's most downloaded mobile game from 2019 to 2021, but its popularity has waned amid a decline in the gaming industry. Consequently, Garena's revenue dropped 9% in 2022 to $3.9 billion.

However, Newzoo forecasts player numbers will grow from 3.2 billion in 2022 to 3.5 billion by 2025. Such growth should help reverse declines in the gaming industry. That could accelerate Sea Limited's revenue growth, which in 2022 surged 25% to $12.4 billion.

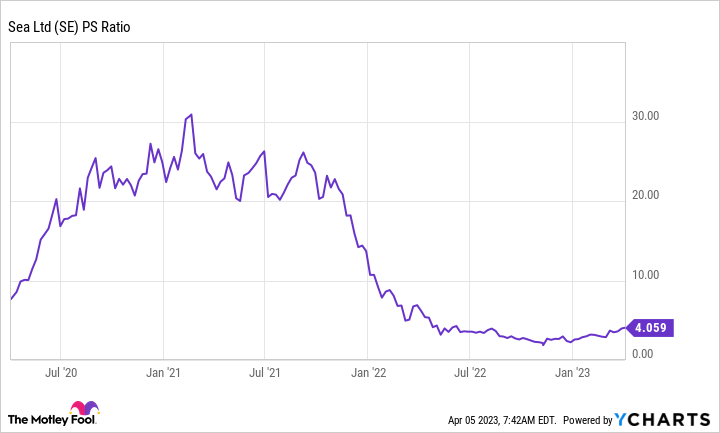

SE PS Ratio data by YCharts

Moreover, despite the recent surge in the stock price, investors should remember that Sea Limited sells at a discount of more than 70% from its all-time high in the fall of 2021. As a result, it trades at a P/S ratio of 4. That is just above all-time lows and well below the record sales multiple of just above 30 in 2021.

Such a valuation could induce investors to brave the waters. And given the entertainment stock's potential when all three segments are in a growth mode, the new bull market in Sea Limited stock may have only just begun.

Adobe's stock is still a bargain

Jake Lerch (Adobe): Shares of software giant Adobe have been on a wild ride over the last year and a half. The stock is still more than 44% off its all-time high of $688.37, even after rallying 35% over the last six months.

Yet, to my eye, Adobe has room to run higher from here -- much higher. Why? Two reasons.

First, Wall Street has been wrong. Many analysts have expected a pullback in demand for Adobe's products that just hasn't materialized. The company has beaten earnings expectations in four straight quarters. Adobe's rockstar lineup of products, including Creative Cloud, Document Cloud, and Experience Cloud, continue to draw in new customers and help retain existing ones.

Second, Adobe's valuation still looks attractive. As you can see above, Adobe's stock price has more or less tracked its trailing-12-month revenue over the last 10 years. However, right now, its stock price is lagging far behind its revenue. This is why the company's price-to-sales ratio stands at 10, below its long-term average of 12.

I expect Adobe will deliver solid sales and earnings results going forward -- thanks to its subscription model and its best-of-breed creative software solutions. And if that happens, Adobe's stock could be off to the races.