When the market has a correction, investors often throw out the baby with the bathwater. Basically, even great companies can quickly find themselves being sold indiscriminately despite strong businesses and a long history of success. That's why you should keep a list of stocks you'd like to buy in case of a big market sell off.

Three companies you might want to have on that list are Procter & Gamble (PG -0.35%), Realty Income (O 1.03%), and Nucor (NUE -1.02%). Here's why.

1. Procter & Gamble drives growth

Procter & Gamble (P&G) is a consumer staples giant with a $360 billion market capitalization. Its iconic brands, which include Bounty and Tide among others, generally sit at the premium end of the market. And it has the scale and distribution strength needed to be a key partner to retailers.

It's also been very kind to its shareholders, with a dividend increase every year for more than six decades. That makes it a highly elite Dividend King.

One piece of this company's story that often gets overlooked, however, is its commitment to research and development. Consumers love the words "new" and "improved." Retailers love those words, too. New and improved products draw people into stores to spend money -- which is why P&G spends so much time and effort ensuring that the higher costs customers pay for its products are backed by tangible benefits.

Those benefits often lead to category expansion, and sometimes even entirely new categories (the Swiffer, for example). Retailers appreciate that type of growth because it makes the pie bigger, boosting their results, as opposed to a stagnant category where brands battle for share (which does little for the retailer's top line).

PG Dividend Yield data by YCharts

If P&G goes on sale, you should definitely consider buying it. A yield above 3% would be historically attractive.

2. Realty Income could get even cheaper

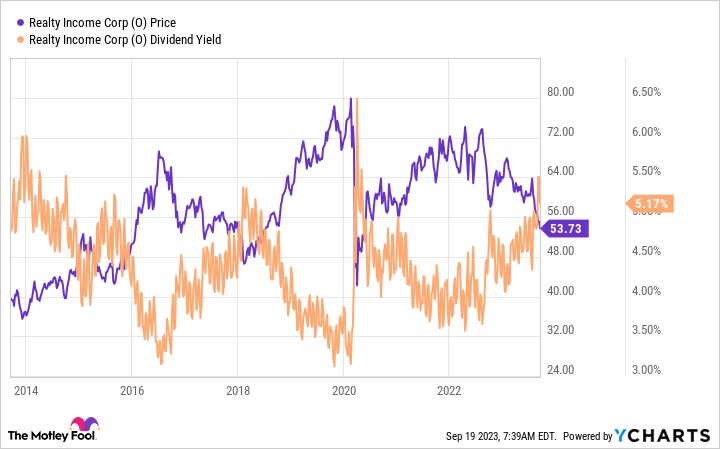

Rising interest rates have put downward pressure on income stocks like real estate investment trust (REIT) Realty Income as safer income options, such as CDs, have become more competitive. With its shares down around a third from their 2020 peak, and the yield up near 10-year highs, this giant net-lease REIT already looks fairly attractive. (A net lease requires the tenant to pay most property-level operating costs.)

But Realty Income has the size and scale to access capital markets at advantaged prices. It has the ability to make larger deals than net lease peers. And it has been expanding its reach into new property types (casinos) and regions (Europe), so that it has more levers to pull for growth.

It is a standout in the net-lease niche, with a 29-year history of annual dividend increases. If investors push the stock even lower, which has happened in the past, it would go from a solid addition to perhaps a great one.

Realty Income is a slow and steady performer, with an annualized dividend growth rate of 4.4% over the past 29 years. So a high yield will play an important role in your total return. On that note, a yield above 6% would be historically attractive.

3. Nucor's industry is volatile but its dividend is reliable

The last name here is Nucor, one of the largest steelmakers in North America and also a Dividend King. Interestingly, steel is a highly cyclical industry, prone to dramatic peaks and valleys. It's not the type of industry where investors would normally expect to find a consistent dividend payer. But Nucor's business model has proven incredibly resilient. There's a lot going on.

It focuses on being the industry leader in the steel products it makes, with mills that are close to customers. It uses leading-edge technology, notably highly flexible electric arc mini-mills that can be ramped up and down along with demand. It works hard to have strong employee relations (specifically using profit-sharing so employees do well when the company does well), so they will be loyal and helpful regardless of the market environment.

It is always looking to invest in its own business, particularly during weak patches so it can come out the other side a stronger company. And it is financially conservative, ensuring that it can muddle through even the worst industry downturns. Altogether, this steelmaker is built to last.

The stock has been a market favorite in recent years, pushing the yield toward the low end of its historical range. If the yield were to rise into the mid-2% area in a broad market correction, it would be a buy signal.

Be prepared and you'll be ready to buck the trend

The problem with market corrections is that they can be very frightening. It is hard to buy when everyone else is selling. Therefore, make a list of stocks you'd like to own if only they were cheaper, before you have to face the fear brought on by a swiftly falling market.

Take some time to make that list now and consider putting P&G, Realty Income, and Nucor on it.