Investors in industrial supply company Fastenal (FAST 4.15%) were pleased to see their stock rise 7.5% on the day of the third-quarter earnings release. That's excellent news for Fastenal, and given the company's sales are often seen as a critical bellwether of conditions in the industrial sector, many commentators are taking it as a sign that an inflection point has passed in the industrial economy. I beg to disagree, and here's why.

All about Fastenal

Anyone hoping for an upcoming earnings season characterized by industrial companies lauding an improvement in the economy, based on Fastenal's earnings, might be in for a disappointment. Yes, Fastenal did well in the quarter. Still, I'd argue this was mainly due to the successful expansion of its onsite locations rather than any cyclical pick-up in the economy.

Fastenal signed 93 new onsite locations in the quarter and hit 268 new onsite locations for the year while aiming to reach 350 new locations for the full year. Discussing Fastenal's onsite locations on the earnings call, CEO Daniel Florness said: "Our daily sales in those onsite, excluding transferred business when you open an onsite, is in the low-double-digit rates. Those sales contributed to the 5.7% increase in overall sales in the quarter.

What Fastenal's sales say about the economy

The company sells fasteners, safety products, cutting tools, janitorial supplies, and more. Given that at least 74% of sales go to manufacturers , its monthly sales data is a valuable barometer of manufacturing conditions.

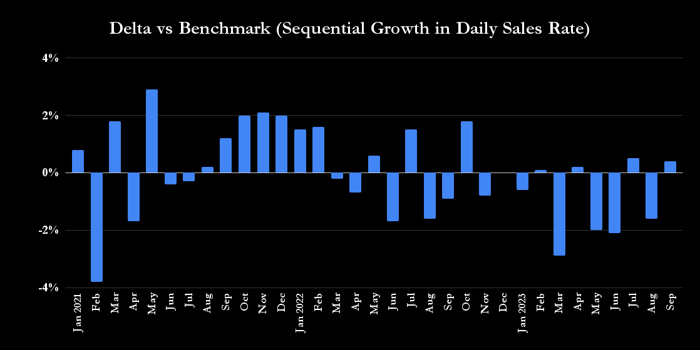

The following chart needs a little explanation, and I'll try to keep it simple. It measures the monthly change in sales (for example, September sales compared to August sales); that's the "delta." Then Fastenal compares that delta to a benchmark (taken as the average over the last five years, excluding the highly distortive year of 2020) to see how sequential sales performance compares to usual performance.

Data source: Fastenal presentations. Chart by author.

The chart shows two positive numbers in the last quarter (September and July), but it's far too early to conclude anything from this.

First, while the September daily rate reported 4% sequential growth in August and 5% growth year over year, both numbers appear to be a low hurdle to clear. Weak sales in August and an easy comparison with September 2022 may make this result look a little better than the reality. This point was partly acknowledged in CFO Holden Lewis's commentary on the earnings call discussing the improvement in September: "It seems to have more to do with easing comparisons in certain parts of our business than a clear signal of firming customer demand or brightening outlooks."

Second, there's no clear pattern in the data (unlike the strength in 2021 as the economy recovered from the lockdowns imposed on the populace), and relying on one data point (September) is never a good idea.

Third, the company's most cyclical products, fasteners, continue to underperform. For example, the fastener daily sales rate was down 2% in the quarter compared to the same period last year. In comparison, safety supplies were up 9.2%, and "remaining products" (contributing 46.5% of total sales) were up 6.8%. As such, the sales that represent Fastenal's strongest exposure to the economy are its weak points.

Image source: Getty Images.

Fourth, when asked which industry verticals were positive/negative on the earnings call, Lewis replied, "Aerospace is doing fairly well," but "everything else remains fairly tepid." Frankly, it's no surprise that aerospace is doing well as the industry continues to recover from the devastation wrought upon it during the pandemic.

What it means to investors

Buying into the sector based on Fastenal's data would be a mistake, as it's far too early to conclude that a corner has been turned just yet.

That said, manufacturing conditions will eventually improve, and recall that the weakness in 2023 has been exacerbated because many industrial companies are destocking following a rush to build inventory during the worst of the supply chain crisis last year. A recovery will come in time, not least after the destocking is over.

As such, it makes sense to be a little patient and look and listen carefully for what management says when companies report earnings in the current season.