The drama of earnings season continued on Thursday as investors digested the latest financial reports and what they mean in terms of the ongoing economic recovery.

Investors have been sitting on the edge of their seats waiting to learn if the accelerating adoption of artificial intelligence (AI), which began in earnest last year, will help drive technology stocks to new heights. Solid results and a blockbuster forecast from a company deeply integrated in the AI space helped lift other stocks in the sector.

With that as a backdrop, AI server specialist Super Micro Computer (SMCI -4.47%) rose 1.6%, AI solutions provider C3.ai (AI -2.36%) climbed 3.4%, chipmaker Taiwan Semiconductor Manufacturing (TSM -1.99%) jumped 6.8%, warehouse-automation specialist Symbotic (SYM 0.21%) soared 9.2%, and AI audio-solutions provider SoundHound AI (SOUN -7.36%) surged 14.6% by the time the market closed on Thursday.

A check of all the usual suspects -- regulatory filings, financial reports, and changes to analysts' price targets -- turned up nothing in the way of company-specific news driving any of these AI stocks higher. This suggests that most investors were captivated by how AI affected the quarterly financial results of Arm Holdings (ARM -4.38%).

Image source: Getty Images.

A surprisingly strong performance

The semiconductor specialist reported the results of its fiscal 2024 third quarter (ended Dec 31.), and investors were watching closely to see if the company would benefit from the mad rush to adopt AI -- and they were not disappointed. And while Arm's results were better than expected, it was the company's blockbuster forecast that caught market watchers by surprise.

Arm generated revenue of $824 million, an increase of 14% year over year. While that might not seem spectacular at first glance, it blew past the company's previous guidance in a range of $720 million and $800 million. Its profits also got a lift, with adjusted earnings per share (EPS) of $0.29 rising 32% year over year.

For perspective, analysts' consensus estimates were calling for revenue of $761 million and EPS of $0.25, so Arm sailed past both benchmarks with ease.

However, it was Arm's forecast for the current quarter that caught investors off guard. Management said it expects fourth-quarter revenue in a range of $850 million to $900 million, well ahead of Wall Street's expectations of $778 million. The company is also forecasting a commensurate boost in profitability, guiding for adjusted EPS of $0.30 at the midpoint of its guidance, sailing past analysts' estimates of $0.21.

Further fueling the fervor were comments made by CEO Rene Haas. In an interview with Bloomberg Television, the chief executive said, "AI is not in any way, shape or form a hype cycle," he said. "We believe that AI is the most profound opportunity in our lifetimes, and we're only at the beginning."

In the wake of those strong results and the CEO's bold pronouncement, Arm Holdings shares soared nearly 48%.

AI will touch every industry

It's easy to see why investors got caught up in the frenzy, as Arm's robust results and dazzling forecast made headlines. Furthermore, it's been just a year since generative AI burst on the scene, and many companies are still deciding how best to implement the technology. This suggests that the AI boom could continue for quite some time.

So, what does all this have to do with our quintet of stocks, and how will they benefit from these advances in AI?

- Super Micro Computer makes high-end servers that are energy efficient and highly customizable, helping meet the growing demand for AI.

- C3.ai offers turnkey AI solutions that help enterprises get AI applications up and running quickly.

- Taiwan Semiconductor Manufacturing operates a foundry that produces many of the chips used in AI applications.

- Symbotic developed an AI-fueled, end-to-end warehouse-automation system that optimizes storage and traffic. As retailers look to benefit from AI, Symbotic will likely be high on their list.

- SoundHound AI provides AI-controlled voice and audio solutions to the automotive and restaurant industries. The company's solutions can be adapted to restaurant drive-throughs, self-serve kiosks, and phone orders, among others, which will help these businesses join the AI revolution.

It's important to remember that not all AI-centric companies are created equal. It will be important as time goes on that these companies live up to the promise of AI by delivering the revenue and profits investors expect. Of the five, only Taiwan Semiconductor and Super Micro Computer are currently profitable.

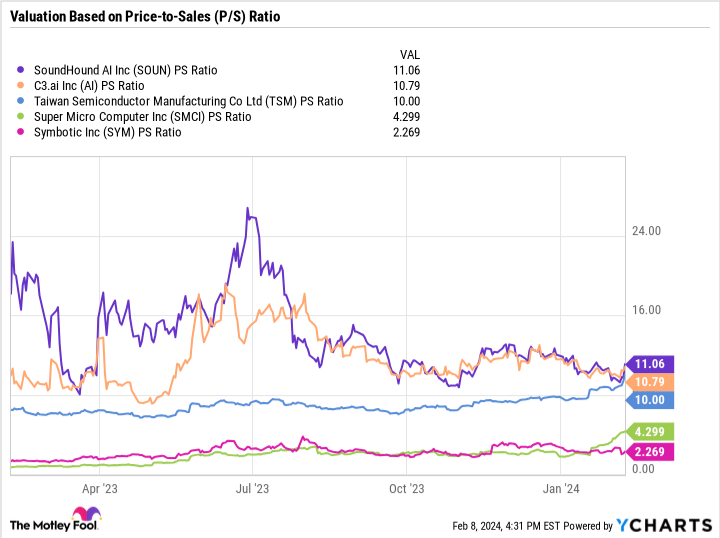

Data by YCharts.

Then, there's the matter of valuation. SoundHound AI and C3.ai are each selling for 11 times sales, while Taiwan Semiconductor, Super Micro Computer, and Symbotic are selling for 10 times, 4 times, and 2 times sales, respectively.

For my money, Taiwan Semiconductor is the least risky of the stocks presented here, and Symbotic is the best value. That said, each of these stocks represents an intriguing opportunity, but investors should size their positions based on their risk tolerance and the degree of volatility they are prepared to withstand.