Ultimately it is not the stock market nor even the companies themselves that determine an investor's fate. It is the investor.

-- Peter Lynch, "One Up on Wall Street"

Investing is about making decisions. There are thousands of stocks and related products to choose from, and successful investing relies on making the right choices and sticking to a game plan.

That's why I'm fond of exchange-traded funds (ETFs). They offer the ability to easily invest in a basket of stocks, helping to diversify one's portfolio. What's more, many do all this at a low cost.

Let's look at one ETF that I believe is a no-brainer buy right now.

What is the Invesco QQQ Trust?

The Invesco QQQ Trust (QQQ 0.42%) is an ETF that tracks the Nasdaq 100, an index made up of the largest non-financial stocks listed on the Nasdaq exchange.

The ETF and underlying index are both heavily weighted to the technology sector, and the fund's top holdings include Microsoft, Nvidia, Apple, Amazon, and Meta Platforms.

How has the Invesco QQQ Trust performed?

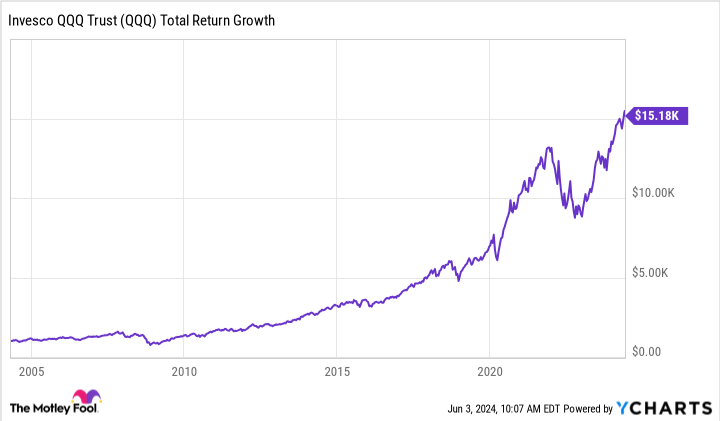

Let's cut to the chase: This fund has been an outstanding investment. Over the last 20 years, the ETF has registered a total return of over 1,400%, equating to annual growth of 14.5%. An initial investment of $1,000 in 2004 would have grown to almost $15,200 today.

Data by YCharts.

Compare that to the S&P 500, which has generated a 10.2% annual total return over the same period. The Dow Jones Industrial Average also failed to keep up with a 9.2% annual return, and the Russell 2000 index lagged even further behind with an 8.1% return.

Data by YCharts.

Over a long-term period like 20 years, those differences in annual returns add up to significant differences in the value of your investment.

Is the Invesco QQQ Trust a buy now?

The growth of technology and how it has changed the lives of billions of people is the story of our lifetime, and that narrative isn't going to change anytime soon.

As a result, technology companies will remain some of market's biggest winners for decades to come, but not all companies companies will thrive -- or even survive. That's one of the core advantages of investing in an index fund. The Invesco QQQ Trust holds 101 stocks, and this diversification allows winners to balance out any losers, helping the overall ETF grow over time.

In short, the Invesco QQQ Trust is a solid choice that is worthy of consideration for any investor who wants exposure to growth stocks in their portfolio.