The artificial intelligence (AI) analytics company Palantir Technologies (PLTR +0.36%) enjoyed quite the run in the market, surging this year partly due to the AI trade. Palantir's stock is up nearly 285% this year.

Given the run and the valuation, some analysts are starting to push back, with the average Wall Street analyst price target implying roughly 48% downside, according to TipRanks. However, some analysts still think the stock can march higher.

One point of contention between analysts could be earnings projections in 2025. They seem torn, with some projecting minimal upside while others think they could double.

Why earnings projections are important

Earnings can get lost in a frothy market categorized by high valuations. However, earnings are crucial to a stock's price because they show a company's profits or losses.

Analysts frequently rely on the price-to-earnings (P/E) ratio to value a stock, which looks at a company's market capitalization compared to its earnings. Another way to look at it is by comparing a company's stock price to its earnings per share (EPS). For example, if a company has a $20 stock price and earned $2 in earnings per share over the last 12 months, it has a P/E of 10.

Analysts use the P/E ratio to determine if stocks are undervalued or overvalued, and each sector normally has different P/E levels that determine this. But the P/E is not everything, and there are many other ways to value a stock.

Long-term investors looking five to 10 years down the road don't have to rely on the P/E as much because it will change frequently. A longer runway allows investors to focus less on near-term profits, especially if they believe fundamentals and the long-term outlook are intact.

However, institutional money managers who invest on 12- to 18-month time horizons are laser-focused on earnings. You shouldn't invest like professional money managers, but you should still pay attention to this group because institutional inflows and outflows can move a stock materially.

Investors can also glean a lot of information by looking at earnings projections. For instance, if the range of earnings projections varies greatly, analysts are likely less certain, and there could be more room for error and valuation adjustments. Meanwhile, a tighter range of earnings projections usually means there is a clearer consensus on a company's near-term outlook.

Wall Street analysts are torn on Palantir

Palantir's consensus diluted EPS estimate in 2025 is $0.31, which implies a 48% increase from the consensus estimate in 2024 of $0.21, according to Visible Alpha. (Fourth-quarter earnings of 2024 won't come out until January.) The low estimate for 2025 is $0.25, implying 19% upside.

That wouldn't be bad for most companies, but when you trade as high as Palantir, I would consider that earnings growth to be minimal. The high estimate is $0.42, implying a doubling from 2024. The consensus consists of nine brokers' estimates.

While I'm not certain who holds the low estimate, Argus Research downgraded the stock earlier this month, one of the only downgrades in the last two months, and after Palantir reported strong third-quarter earnings. The Argus analyst Joseph Bonner attributed part of his downgrade to a valuation call because the stock tripled and now trades at a huge valuation.

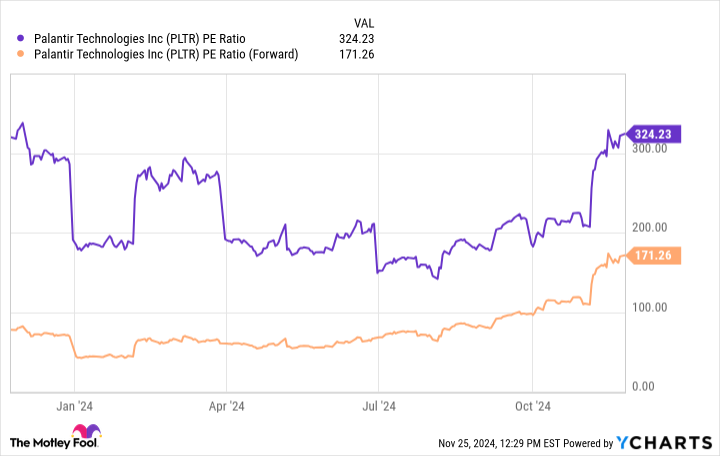

PLTR PE Ratio data by YCharts; PE = price to earnings.

Palantir would have to grow earnings very fast to maintain this valuation, he said during an interview with the Schwab Network. Bonner's other concerns focus on Palantir's potential market. The company's platform harnesses AI and machine learning to analyze real-world data and gain insights and trends that help businesses solve problems.

The platform makes it easy for people without training in AI and machine learning to use and even visualize the data. Palantir does a lot of business with the government and wants to expand further in commercial sectors. However, Bonner questions how big this potential market is and how much competition the company could face.

Meanwhile, Wedbush analyst Dan Ives recently issued a report reiterating his outperform rating and hiking his price target from $57 to $75. Ives believes software companies are about to join the "AI party," and he sees burgeoning uses for Palantir and further adoption of generative AI in 2025, which he views as a catalyst.

I tend to take a more Bonner-like approach and avoid stocks trading at massive valuations like this. Ives' price target only implies about 15% upside from current levels. I am not an expert on generative AI and its future, so there may be a case for holding the stock for long-term investors, but I wouldn't be surprised to see a pullback at some point.