Finding growth technology stocks at a reasonable price in today's market is not easy. Despite some major ups and downs during 2020, 2022, and now 2025, technology stocks have generally gone on a tear since the Great Recession of 2008-09, making investors a fortune in the process. Today, a lot of these stocks trade at expensive levels.

Not every stock, though. Two technology giants -- Amazon (AMZN 0.18%) and ASML (ASML -1.42%) -- look reasonably priced in today's market and are primed to grow over the next decade and beyond, propelled by the same tailwind: artificial intelligence (AI). Here's why these two stocks can set up investors for life if you hold for the long haul.

Image source: Getty Images.

Amazon's cloud demand continues

Many know Amazon for its e-commerce marketplace, a segment that is still putting up solid growth and finally flexing its profitability muscles. However, most of Amazon's profit comes from cloud computing. Amazon Web Services (AWS) hit a record $117 billion in annualized revenue in the first quarter, growing 17% year over year, and a record operating margin pushed 40% in the period. Over a 12-month period, this profit margin would equal between $46 billion and $47 billion in operating income for Amazon just from its AWS division.

According to management, AWS is still capacity-constrained when trying to bring on data centers for its AI customers, such as Anthropic. This is great news for the division and shows the long runway for growth cloud computing has when combined with the AI boom in data center spending. If Amazon can keep up this impressive profit margin at AWS, the division could be on its way to generating $100 billion in operating income within the next five to 10 years.

Let's not forget e-commerce, either. Net sales in its North American retail division popped 8% in the quarter (excluding foreign currency translations), with growing profit margins. Amazon may face some headwinds if these tariffs stick around, but it is well equipped to get through to the other side and navigate supply chain upheaval. A lot of its profits come from advertising revenue for product listings, which grew 18% year over year to $13.9 billion in the quarter, with high profit margins.

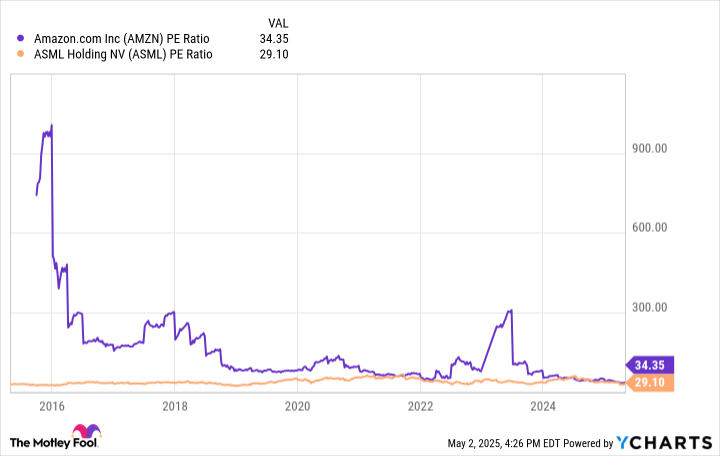

Today, Amazon stock trades at a price-to-earnings ratio (P/E) of 34, which may seem high for some investors looking for value in today's market. However, investors should understand that Amazon's profits are set to grow at a quick pace over the next decade, which will bring down this P/E ratio. Also, Amazon's average P/E ratio over the past 10 years is closer to 55. Now is a great time to buy shares of Amazon stock and keep holding in perpetuity.

Data by YCharts.

Durable advantage in semiconductors

ASML has been a leader in manufacturing high-tech lithography equipment used by semiconductor manufacturers. Other companies around the globe have been unable to replicate the company's advanced systems, even in China, where state-funded research capacity provides a capital advantage. Without these advanced lithography machines, you cannot make cutting-edge computer chips like the ones designed by Nvidia to power the AI revolution.

The company does not grow rapidly, but it does have a durable runway for growth ahead of it as more semiconductor manufacturing capacity is built for advanced chips around the globe. For example, the $165 billion in total spending Taiwan Semiconductor Manufacturing has committed to investing in its United States-based facilities. Some of that spending will be on lithography machines from ASML, which sell for hundreds of millions of dollars each.

Revenue for ASML fell last quarter, but it has produced steady growth in the last decade, with trailing-12-month revenue up 351% over that period. By 2030, it expects to generate 44 billion to 60 billion euros in revenue ($50 billion to $68 billion at current exchange rates). Trailing-12-month revenue was $33 billion.

Like Amazon, ASML does not have a cheap-looking P/E ratio, currently sitting at 29. However, like with Amazon, Its current PE is well below its 10-year average, and ASML has a long runway to keep growing its units sold due to the explosion in demand for AI data centers and computer chips. This should keep ASML's earnings chugging higher through 2030, bringing the stock price along with it.