The United States, like all countries, has gone through its share of ups and downs -- from soaring economies to recessions, from times of peace to wars. Most recently, President Donald Trump's plan to impose tariffs on imports has rocked the financial markets, as investors worry about the impact of tariffs on prices -- and eventually on the economy.

But through thick and thin, famous investor Warren Buffett has firmly remained a supporter of his country and U.S. companies. Back in 2008, with the financial crisis raging, the billionaire wrote an op-ed in The New York Times, clearly saying the financial world was "a mess" and the general economy wasn't looking much better.

During those troubled times, Buffett was doing one thing -- and it's something that might surprise you. He was buying U.S. stocks.

"Bad news is an investor's best friend," Buffett wrote. "It lets you buy a slice of America's future at a marked-down price."

Fast-forward to 2025, and Buffett's message and strategy haven't changed. (And why should they? Buffett's method has led Berkshire Hathaway to market-beating returns over 59 years.) At Berkshire Hathaway's annual shareholder meeting recently, the billionaire said he felt lucky to have been born in the U.S. and encouraged investors not to worry that the country hasn't solved every problem it's encountered -- his words suggest that, because the U.S. constantly has changed, evolved, and been resilient, there's reason to be optimistic about the future.

With this Buffett wisdom in mind, here are some top American companies worth investing in right now.

Image source: The Motley Fool.

1. Coca-Cola

What better way to start this list than with a Warren Buffett favorite? Buffett bought shares of Coca-Cola (KO 0.23%), the world's largest nonalcoholic drinks maker, over a seven-year period starting in the late 1980s. And he's held on ever since. Buffett likes this company for its solid moat -- its strong brand and established global presence -- as well as its commitment to dividend growth.

Though Coca-Cola is a household name around the world, the company's flagship market is North America, which brought in almost $19 billion in revenue last year. That's nearly 40% of total revenue.

In an environment of tariff uncertainty, Coca-Cola is a great stock to own because the business relies on local suppliers and bottlers in each of its markets. This reduces the need to import, and therefore cuts the tariff exposure. The company said during an analyst call last month that it expects "minor impacts" and is confident about its ability to manage the tariff situation.

So if you buy Coca-Cola stock, you can benefit from this quality business and passive income over time -- and in the near term, tariff worries won't keep you up at night.

2. Palantir Technologies

Palantir Technologies (PLTR 1.71%) prides itself on its work with the U.S. government. In fact, this Denver-based software company in its earlier days generated most of its revenue and growth thanks to contracts with the government.

Recently, though, its commercial business has exploded higher, and Palantir has worked with international companies and governments too. But the U.S. remains its biggest business, representing 71% of total revenue in the recent quarter.

NASDAQ: PLTR

Key Data Points

So, Palantir depends greatly on the health of American businesses and the spending of the U.S. government. This has worked out well so far, with revenue growth soaring, and the company is so optimistic about the future that it recently raised several forecasts for the full year, including its revenue outlook.

Palantir, using artificial intelligence (AI)-driven platforms, helps customers aggregate and make better use of their data. As companies and governments rush to apply AI to their projects and gain efficiency, Palantir could see bright days ahead. That makes it a great stock for growth investors to buy and hold right now.

3. Vertex Pharmaceuticals

Vertex Pharmaceuticals (VRTX 0.03%) is the global leader in cystic fibrosis (CF) treatment, with blockbuster drug Trikafta helping the company generate $11 billion in product revenue last year. The biotech just launched a new CF drug, Alyftrek, as well as a non-opioid painkiller called Journavx that's expected to create another billion-dollar franchise for the company.

Though Vertex sells its products internationally, it makes most of its revenue -- 60% of total revenue last year -- in the U.S. And the following is very important in a context of import tariff uncertainty: Vertex produces its CF drugs primarily in the U.S., limiting exposure to these extra costs.

But Vertex isn't only a tariff safe haven. It's also a company that has proven its ability to innovate, produce game-changing drugs, and generate growth. Its newest product launches should keep that momentum going and lead to more share price growth over the long run. So when you buy shares of Vertex, you're adding a fantastic growth stock to your portfolio -- and betting on America at the same time.

Image source: Getty Images.

4. Chewy

Your dog, cat, or goldfish may know Chewy (CHWY +0.73%) very well. That's because this e-commerce company sells everything your pet may need, from food and toys to health insurance. And Chewy even recently launched vet clinics, a great move to add a new revenue stream and potentially introduce new customers to its e-commerce offerings.

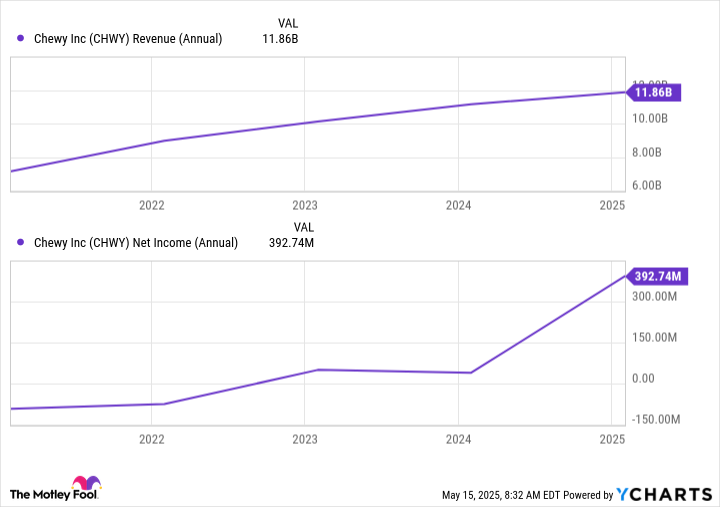

Though Chewy expanded into Canada in recent years, it makes most of its revenue in the U.S. So the company depends on the buying power of the U.S. consumer for growth. This has worked out nicely in recent years, as Chewy has steadily increased revenue and profit.

CHWY Revenue (Annual) data by YCharts

And Chewy has developed a loyal customer base, as we can see through Autoship -- a service that automatically reorders and ships your favorite products to you. Autoship sales now make up 80% of total sales.

What about the issue of tariffs plaguing the market these days? Chewy says it has "very small exposure" to China -- the country most impacted by the U.S. tariff plan -- thanks to its reliance on local sources for many products, making it a great buy for investors seeking safety along with growth for their portfolios right now.

5. American Express

Finally, I'll finish off this list with another stock Buffett holds in the Berkshire Hathaway portfolio. Like Coca-Cola, it's a long-term position and one that offers Buffett security, dividend growth, and exposure to the U.S. economy.

I'm talking about American Express (AXP 0.92%), which issues credit cards around the world -- but the U.S. remains its biggest market. For example, U.S. consumer and business customers made up 67% of American Express's total worldwide network volume in the 2024 full year.

NYSE: AXP

Key Data Points

It may seem counterintuitive to invest in a credit card company now as economic uncertainty remains -- but American Express actually makes a fantastic buy during these times. Since the company has a large base of affluent customers, who are less sensitive to tough economies, it actually holds up well during these environments. In the first quarter of this year, American Express reported an 8% increase in revenue and cited "the power of our premium customer base."

On top of this, millennials and those in Gen-Z make up American Express's fastest-growing U.S. customer group, and this popularity with a young crowd shows potential for more growth down the road.

All this means Buffett favorite American Express may be a surefire way to bet on the strength of the U.S. consumer, today and over time.