Dividend stocks can be a smart way to generate steady income, especially in uncertain markets. However, not all dividend payers are created equal. A recent study from Ned Davis Research and Hartford Funds found that companies able to grow their dividends over time have historically delivered higher total returns with less volatility than those that merely held steady or slashed their payouts.

With that in mind, let's take a closer look at three stocks to avoid due to their shaky dividend outlooks.

1. AbbVie

AbbVie (ABBV 1.30%) is a pharmaceutical company with a $300 billion market capitalization known for manufacturing popular drugs Skyrizi and Botox. The stock, down 16% year to date, pays a quarterly dividend of $1.64 per share, representing an annual yield of 3.5%.

While AbbVie's management has paid and raised its dividend for 11 consecutive years, it currently has a payout ratio -- the percentage of earnings paid out as dividends -- of 266%. Generally, if a payout ratio stays above 75% for a significant period, it is in danger of being slashed or paused.

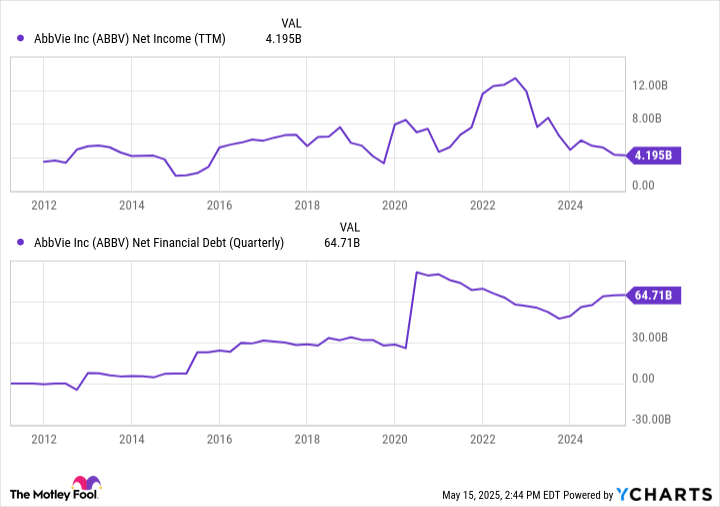

One reason why AbbVie's payout ratio has skyrocketed is that one of its drugs, Humira, a drug to treat rheumatoid arthritis, faces steeper competition. As a result, its sales have been on a nose dive, down 51% to $1.1 billion in fiscal Q1 2025 compared to fiscal Q1 2024. With the loss in sales, AbbVie's net income has plummeted, generating $4.2 billion over the trailing 12 months, or approximately 69% from its highs a few years ago.

Combined with those financials, its net debt has climbed 24% over the past two years to $64.7 billion, and the future of its dividend is in doubt.

ABBV Net Income (TTM) data by YCharts.

On the bright side, AbbVie's next-generation immunology drugs Skyrizi and Rinvoq are growing tremendously. In fiscal Q1 2025 alone, they brought in a combined $5.1 billion -- a 65% increase from the prior year. For the full fiscal year, management expects Skyrizi to generate $16.5 billion and Rinvoq $8.2 billion, marking year-over-year growth of 41% and 37%, respectively.

Still, it's unclear whether this momentum will offset Humira's decline and reignite overall earnings growth.

2. Medtronic

Medtronic (MDT 0.36%) is a medical device company known for cardiac devices, surgical robotics, insulin pumps, and surgical tools. Like many healthcare companies, its stock soared during the COVID-19 pandemic and hasn't recovered since, down 37% from its 2021 highs.

The company is a historical dividend-paying stock, having paid and raised its dividend for an astounding 47 consecutive years. Today, the company pays a quarterly dividend of $0.70 per share, equating to an annual yield of 3.3%. Historically, Medtronic has announced its dividend hikes during its Q4 earnings release, which is slated for May 21. Whereas the increase used to be a certainty, now there are some question marks as it faces increased competition, ongoing supply chain struggles, and patient lawsuits related to spinal cord stimulation technologies.

Medtronic has a high payout ratio of 84.7% on the heels of declining net income in its most recently reported quarter. Specifically, the company reported a net income of $1.29 billion in fiscal Q3 2024, representing a 2% year-over-year decline.

Zooming out, the company's net income hasn't grown significantly in a decade despite revenue reaching all-time highs. This is partly due to Medtronic's acquisitive nature, which has completed over 60 acquisitions, with management focusing on "tuck-in acquisitions," designed to help grow and improve margins.

MDT Net Income (Quarterly) data by YCharts.

Additionally, the company currently holds $18.6 billion in net debt, with servicing costs totaling $757 million over the past 12 months. On the positive side, management has reduced debt by 8% from recent highs and repurchased 3.7% of shares outstanding since 2024 -- moves that help support the sustainability of its dividend. However, whether the company can grow its dividend over the long term remains uncertain.

Image source: Getty Images.

3. Pfizer

Pfizer (NYSE: PFE) is one of the most well-known pharmaceutical companies on the market due to its 176-year history and, more recently, for its involvement in the manufacturing and distribution of a COVID-19 vaccine. The latter reason is also why the company is at a crossroads today and why the future of its dividend is in doubt.

Currently, Pfizer offers a quarterly dividend of $0.43 per share, equating to an outsized annual yield of 7.6% as its stock has fallen 63% from its pandemic highs. While that yield is certainly attractive for dividend investors, its payout ratio of 121.5% casts doubt on whether management can raise it for the 17th straight year. Notably, Pfizer has paid 346 consecutive quarterly dividends, but it did cut its dividend in 2009 to help fund the acquisition of the pharmaceutical company Wyeth for $68 billion.

More recently, Pfizer reported an 8% decline in revenue for Q1 2025, delivering only $13.7 billion compared to $14.9 billion in Q1 2024. Pfizer's COVID-19 product, Paxlovid, led the decline, falling from $2 billion to $491 million, or a decrease of 76%.

In the long term, management will likely continue spending heavily on research and development; it has averaged more than $10 billion over the past few years as it looks to find its next breakthrough drug. In the meantime, management has suspended its share repurchases as it continues to pay down its $44 billion in net debt. The good news is that management has deleveraged the company by 31% in less than a year.

PFE Net Financial Debt (Quarterly) data by YCharts.

Are these high-yield dividend stocks worth buying?

These three stocks have much in common beyond the pharmaceutical industry in which they operate. For dividend-seeking investors, while their yields are attractive, it's important to recognize their associated risks. Considering that and the unfavorable history of stocks that cut or paused their dividends, investors should avoid them for now.