Uber Technologies (UBER 2.02%) and Carvana (CVNA +4.93%) aren't just two different companies. They're seemingly polar opposites. Ride-hailing giant Uber is thriving largely because owning and driving a car is an increasingly expensive hassle. Used car dealer Carvana, conversely, makes it easy and affordable to own your own automobile.

One could reasonably argue there's solid -- even growing -- demand for both businesses. But it's difficult to deny the contrasted underpinnings of what make these two companies tick. Investors could understandably be confused.

The good news is, one of these names is a clearly better bet than the other -- now and for the foreseeable future.

Comparing and contrasting Uber and Carvana

You almost certainly know the companies. Uber Technologies isn't just a major personal mobility name, after all. It largely brought the domestic ride-hailing industry into existence, and now controls three-fourths of the U.S. market, according to data from Bloomberg. It's developing an international presence as well, even if it's not quite as dominant overseas.

As for its fiscals, the $175 billion company's drivers provided over 11 billion rides last year, up 18% year over year, turning that into nearly $44 billion in revenue and almost $3 billion worth of operating net income. Nearly half of its revenue, however, came from deliveries and freight services rather than passenger trips.

Carvana isn't quite as big, although its growth is just as impressive. The used car dealer reported $13.7 billion worth of revenue for 2024, up 27% year over year, generating a record-breaking $404 million in net income. Most of that profit came from sales of used vehicles to retail consumers, although wholesaling accounts for the bulk of its total unit transactions.

A rebound from a inflation-crimped slide in demand after the peak of the COVID-19 pandemic helped drive these top and bottom lines higher. Last year's forward progress, however, also extends a choppy trend that's been in place for some time thanks to Carvana's clever marketing, and brilliant use of technology to establish scale.

And yet, these two seemingly growing companies' stocks aren't exactly performing in tandem. Carvana shares are up by more than 200% for the past year, and testing their peak reached in 2021. Uber shares haven't made any real net progress since March of last year, upended multiple times by earnings reports marred by one modest shortfall or another.

NYSE: UBER

Key Data Points

The market has largely lost its bigger-picture perspective on both companies, however.

Under the microscope... and macroscope

Take Uber Technologies' recent quarterly results as an example. Yes, since early 2024 either sales or earnings or guidance haven't always lived up to expectations. The company's never failed to make actual forward progress at any point during this stretch, however. Again, last year's revenue improved 18%, and is expected to repeat the feat this year. Although its sales growth rate is slowing, that's a purely mathematical matter. On an absolute basis, it's chugging along as well as it ever has. It's apt to continue doing so well into the foreseeable future, too.

Data source: StockAnalysis.com. Chart by author.

Uber is plugged into a serious secular trend. That is, although plenty of people still own and drive cars, there's a growing segment of the domestic and foreign population that doesn't want to do either anymore. A recent survey performed by Deloitte indicates that only 11% of people living in the United States over the age of 55 would consider giving up their vehicle, whereas 44% of people living in the U.S. under the age of 35 would consider doing so. And the disinterest is greater the younger the crowd. Thirty years ago roughly two-thirds of eligible teenagers held a driver's license. Today that figure's about one-third.

The advent of a viable alternative like Uber is a key reason for this paradigm shift that's likely to remain in motion for years, as younger non-drivers grow up and pass along these new norms to their children. To this end, Straits Research believes the global ride-hailing market is set to grow at an average annual pace of more than 11% through 2033.

Uber is well positioned to win more than its fair share of this growth.

The food delivery industry is also set to grow at an annualized pace of 17%, by the way, according to an outlook from Precedence Research. This is another big growth opportunity for Uber, which already enjoys a strong presence within the market.

But is Carvana just too promising to pass up?

The bullish arguments hold water, to be sure. Chief among them is the sheer cost of a new car. Data from Kelley Blue Book indicates that as of April the average new automobile in the United States was being sold for a hefty $48,699. That puts the monthly payment well over $700, and subsequently, out of reach for most would-be buyers.

Used cars are considerably more affordable though. Kelley Blue Book reports April's used car sales rolled in at an average price of $25,547 apiece, roughly halving the monthly payment as well.

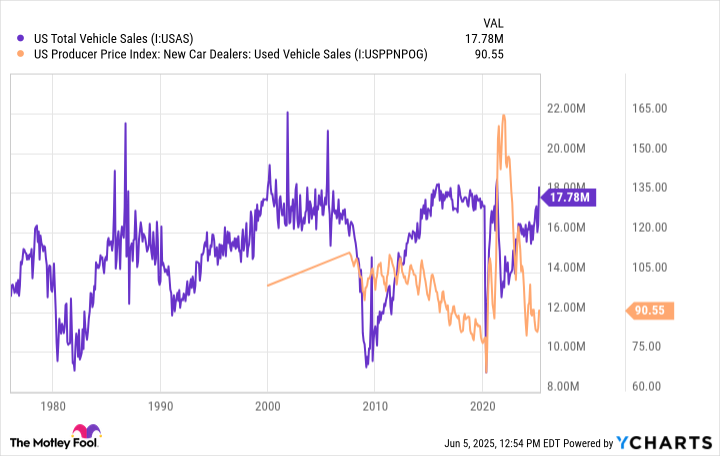

There's an important footnote to add to this dynamic, however. That is, the car business is incredibly cyclical. Once the current wave of updates and replacements has run its course, don't be surprised to start seeing Carvana underperform.

US Total Vehicle Sales data by YCharts

Making matters even more challenging is the lack of new cars manufactured and sold in the U.S. between 2020 and 2022. As Edmunds points out, a three-year-old car (plus or minus a year) is Carvana's sweet spot, so to speak, where affordability and value intersect. Available inventory of these vehicles now stands at more than a decade low though, making it difficult for Carvana to offer what most consumers want.

Intellectual honesty leads you to the superior pick

Never say never, of course. It's possible Carvana will continue to consolidate the country's highly fragmented and largely inefficient used car business, achieving growth through greater scale. There's certainly plenty of room for it. As it stands right now, Carvana estimates it only accounts for about 1% of the used car business.

It's also possible Uber will run into an unexpected headwind sooner rather than later, even if it's not clear what that headwind might be.

Be realistic though. Increasingly crowded urban and metropolitan streets and parking lots paired with car prices that aren't apt to abate anytime soon works in Uber Technologies' favor. Meanwhile, Carvana's recent sales strength doesn't reflect a new long-lived norm as much as it reflects the fact that the average vehicle being driven on U.S. roads is now 12.6 years, according to S&P Global Mobility, an age at which replacing it makes more sense than repairing it. The resulting demand for quality used cars isn't apt to last forever though.

Now throw in the fact that Carvana's shares are currently trading 14% above analysts' consensus price while Uber's stock is 16% below analysts' (most of whom rate Uber as a strong buy at this time) average price target of $97.39, and there's little doubt that the ride-hailing powerhouse is a better stock to buy right now than the used car dealership chain's.