Nvidia's (NVDA 0.32%) strong Q1 results were overshadowed by the U.S. government's decision to revoke Nvidia's export license for H20 chips that were specifically designed to meet U.S.-imposed restrictions. This resulted in Nvidia missing out on $2.5 billion in sales during the first quarter. As the company had already brought in $4.6 billion in H20 sales in the quarter before the decision, the loss of the H20 business resulted in a large hole in Nvidia's business going forward.

However, Nvidia's fortunes appear to be changing, and they delivered investors exciting news about H20 GPUs returning to the Chinese market.

Image source: Nvidia.

H20 exports are expected to resume shortly

Nvidia filed to resume its export license for H20 graphics processing units (GPUs), and says it has been assured by the U.S. government that the license will be granted. This is a massive win for Nvidia, as it allows a sizable chunk of its revenue stream to return and allows Nvidia to increase its foothold in one of the largest markets in the world.

As mentioned above, H20 sales in Q1 would have been $7.1 billion if the export restrictions weren't in place. That would have accounted for about 15% of Nvidia's total sales, so the return of H20 chip sales will be a welcome boost. Nvidia's Q2 ends in late July, so there won't be any H20 sales this quarter. However, pent-up demand could surface in Q3, potentially causing its growth to reaccelerate.

NASDAQ: NVDA

Key Data Points

Even without second quarter H20 sales, Nvidia still expects an impressive 50% year over year growth rate to $45 billion. The H20 export restriction removed a projected $8 billion in Q2 sales, so if it had had those sales, its revenue growth rate would have been 77%. That's quicker than Q1's rate and about the same growth rate as the company's fiscal 2025 fourth quarter. Maintaining a growth rate at Nvidia's size is incredibly challenging and has never been achieved before. With the return of H20 chips, Nvidia will be positioned to sustain that growth level.

As a result, I think Nvidia can skyrocket off of this news, as it's not valued as highly as it was during this time last year.

Nvidia's valuation is better than you may expect

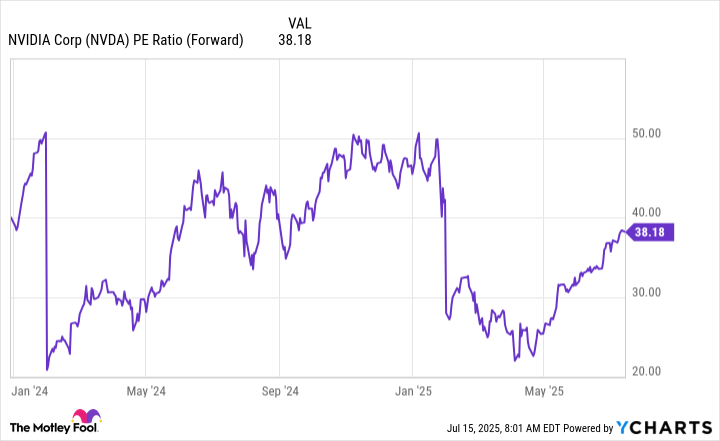

Nvidia's stock isn't cheap by any measure right now, as it trades for 38 times forward earnings.

NVDA PE Ratio (Forward) data by YCharts

This is an expensive valuation, but it isn't much more expensive than some of its big tech peers. Furthermore, it's the only one remotely close to growing as quickly as it is.

Another item to note regarding this valuation is that it only considers earnings for the next year. If Nvidia maintains its jaw-dropping growth rate (as it could do with H20 chips returning), then this valuation doesn't look all that expensive with a five-year mindset.

The return of H20 chips can't be understated for Nvidia's future, and the stock will likely move higher after the news. However, I think the real chance for Nvidia's stock to skyrocket will come when it reports Q2 results in late August. They'll give guidance for its fiscal third quarter at that time, which will likely include H20 GPU sales. This news could cause the stock to jump, making it a smart move to buy the stock now.