Microsoft (MSFT -0.33%) is one of the biggest names in artificial intelligence (AI). It's not because Microsoft has a leading AI model; it doesn't. Instead, it's leaning more into the facilitator role rather than one actively competing in the AI arms race. While it has deep partnerships with OpenAI because of their investment in the company, that relationship has become increasingly strained.

With Microsoft's role as an AI facilitator, does that make it the top AI stock to buy right now? Or are there better options out there?

Image source: Getty Images.

Microsoft's best unit is its cloud division

Microsoft divides its business into three primary units: Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. Productivity and Business Processes are the platforms you think of when you examine Microsoft from a traditional sense. It includes platforms like Microsoft 365, LinkedIn, and Microsoft Dynamics. It's not an exciting division, although it tends to deliver steady, low-double-digit revenue growth each quarter.

More Personal Computing focuses on hardware, like Xbox and Microsoft-branded laptops and tablets. This can be an up-and-down division based on consumer demand. However, it's about half the size of the other two divisions, and its effect on Microsoft's overall investment picture is muted.

The last division, Intelligent Cloud, is the primary reason most investors are excited about Microsoft. This includes all of its cloud services, namely Azure, and is a massive source of growth for Microsoft. In Q3 FY 2025 (ending March 31), Intelligent Cloud's revenue increased 21% year over year, powered by Azure's growth of 33%.

Microsoft Azure has emerged as a top option in the cloud computing world, with its size and growth outpacing third-place Google Cloud from Alphabet, and it is starting to catch up to Amazon Web Services (AWS), which is growing much slower. Microsoft's partnership with OpenAI, which many view its product, ChatGPT, as the top large language model (LLM) available today, allowed it to capture a large chunk of new AI workloads. Furthermore, it offers other leading AIs, such as Llama from Meta Platforms and Grok from xAI.

Azure has become a place where creators can develop their AI solutions, but does all that lead up to a top AI stock to buy now?

Microsoft's stock falls a bit short in comparison to its big-tech peers

In Q3 FY 2025 (ending March 31), Microsoft's revenue rose 13%, and diluted earnings per share increased 18%. Those are strong results considering Microsoft's size, and translate into a stock that likely has a premium over the broader market, as measured by the S&P 500.

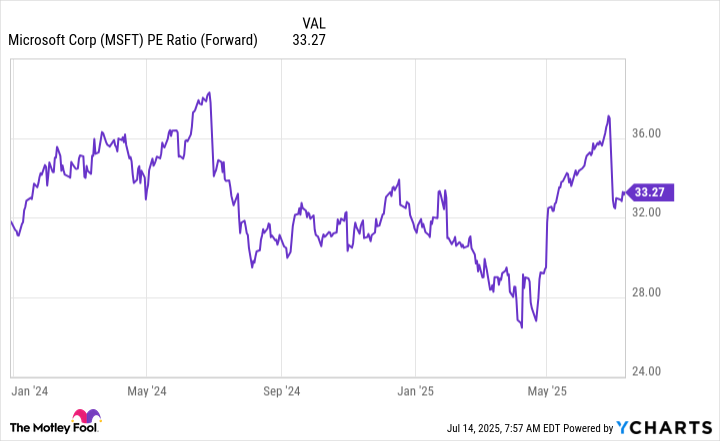

This is true, as Microsoft's stock trades for 33 times forward earnings.

MSFT PE Ratio (Forward) data by YCharts

Compared to the market's 23.7 times forward earnings, that is a fairly hefty premium to pay, but is it too much?

Several of Microsoft's peers, including Amazon, Nvidia, and Meta Platforms, also trade in this price range, making it sensible to compare this cohort when determining if Microsoft can be considered a top AI stock to buy.

| Company | Forward P/E | YOY Revenue Growth | YOY Diluted EPS Growth |

|---|---|---|---|

| Microsoft | 33.3 | 13.3% | 17.8% |

| Nvidia | 38.4 | 69.2% | 26.7% |

| Amazon | 36.2 | 8.6% | 62.2% |

| Meta Platforms | 28.0 | 15.9% | 36.5% |

Data source: YCharts. Note: All growth metrics are from each company's latest quarterly results.

From this outlook, Microsoft is on the low end of diluted EPS growth by some margin, despite being extremely close in valuation. As a result, I think Microsoft stock may be a bit expensive compared to its peers and likely isn't the top AI stock to buy now.

However, it's certainly a very good one and will likely be a long-term winner in the AI realm. Microsoft is a solid AI pick, but there may be other top AI stocks to scoop up right now.