For much of the last three years, artificial intelligence (AI) headlines have dominated the newswires on Wall Street. But this is far from the only trend that's helped push the stock market's major indexes to new heights.

In addition to the rise of AI, excitement surrounding stock splits in a number of influential businesses has played a meaningful role in lifting the broader market.

Image source: Getty Images.

Stock-split euphoria has gained momentum on Wall Street

A stock split is an event that allows a publicly traded company to adjust its share price and outstanding share count by the same magnitude. However, these adjustments are purely superficial, with no changes made to its market cap or operating performance.

Though stock splits can move a company's share price in either direction (up or down), investors view the two types of splits very differently. Reverse splits, which increase a company's share price and concurrently reduce its share count, are often viewed negatively by investors. The businesses undertaking reverse splits are, traditionally, struggling from an operating perspective and attempting to avoid delisting from a major stock exchange.

On the other hand, investors typically gravitate to businesses enacting forward stock splits. This type of split is designed to make a company's shares more nominally affordable for everyday investors who can't purchase fractional shares with their broker.

Companies completing forward stock splits have a knack for out-innovating and out-executing their competition, which explains why their share price rose to the point where a split became necessary in the first place. Additionally, companies conducting forward splits have historically outperformed Wall Street's major stock indexes in the 12 months following their initial split announcement.

Perhaps it's no surprise that Wall Street's most anticipated stock-split candidate of 2025 is the No. 1 holding for four of the stock market's most prominent and successful billionaire money managers.

Image source: Getty Images.

Billionaires have loaded up on this trillion-dollar stock -- and it's not hard to understand why

To date, only three high-profile stocks, all from outside of the tech sector, have taken the plunge and completed a forward split in 2025. What Wall Street is waiting for is the only member of the "Magnificent Seven," and one of only 11 publicly traded companies to have ever reached the psychologically important $1 trillion valuation mark, to announce its first-ever stock split. I'm talking about social media sensation, Meta Platforms (META 3.28%).

No later than 45 calendar days following the end to a quarter, institutional investors with at least $100 million in assets under management are required to file Form 13F with the Securities and Exchange Commission. This filing provides a concise snapshot that allows investors to see which stocks Wall Street's smartest fund managers are buying, selling, and holding.

With most billionaire money managers having different investment approaches, their top holdings by market value are often unique. But Meta is the exception.

NASDAQ: META

Key Data Points

As of the end of March, Meta Platforms stock was the top holding of four billionaire investors:

- Chase Coleman of Tiger Global Management: 16.18% of invested assets

- Terry Smith of Fundsmith: 10.19% of invested assets

- Philippe Laffont of Coatue Management: 9.55% of invested assets

- Stephen Mandel of Lone Pine Capital: 8.75% of invested assets

While the excitement surrounding Meta certainly involves its AI ambitions, what can't be ignored is the company's cash-cow foundation. Meta is the parent of popular social media destinations Facebook, Instagram, WhatsApp, Threads, and Facebook Messenger. During the month of March, its family of apps attracted an average of 3.43 billion people per day. With no other social platforms coming closing to this figure, businesses have been willing to pay a premium to get their message(s) in front of users on these platforms.

To build on this point, nearly 98% of Meta Platforms' net sales can be traced to advertising. Although recessions are normal and inevitable aspects of the economic cycle, they're usually short-lived. In the nearly eight decades since World War II ended, the average recession has lasted 10 months and the typical economic expansion has endured for roughly five years. The disproportionate nature of economic cycles is a positive for ad-driven businesses like Meta.

As noted, Meta's future is very much dependent on incorporating AI solutions. It's already giving its advertising clients access to generative AI solutions, which can tailor ads to specific users and improve clickthrough rates. Further, AI is expected to play a sizable role in the development of the metaverse -- the 3D virtual world where users can interact with each other and their environment. CEO Mark Zuckerberg is angling his company to be a key on-ramp to the metaverse in the coming years.

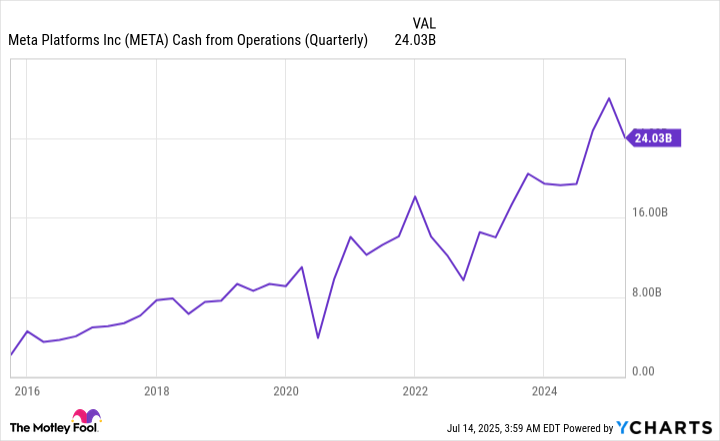

META Cash from Operations (Quarterly) data by YCharts.

Tying things together is this company's pristine balance sheet. Meta closed out March with $70.2 billion in cash, cash equivalents, and marketable securities, and it generated north of $24 billion in net cash from operations in just the first three months of 2025. It's one of a very small handful of companies that has the ability to take risks and aggressively invest in an artificial intelligence-driven future.

The surprising cherry on top for Meta is that is that its valuation still supports plenty of upside. Even with a trailing-three-year gain of 340% (as of July 12), shares of the company are valued at a reasonable multiple of 25 times forward-year earnings.

With Meta Platforms stock firmly back above $700 per share and north of 27% of its outstanding shares held by everyday investors, the catalyst for it to become Wall Street's next stock-split stock is very much in place. While it's highly unlikely this is the primary impetus behind billionaires Chase Coleman, Terry Smith, Philippe Laffont, and Stephen Mandel making Meta their respective No. 1 holding, it would nevertheless be another in a laundry list of catalysts for the company.