During the last few months of 2024, quantum computing started to emerge as new area of interest for artificial intelligence (AI) investors. However, unlike with other pockets of the AI realm, rising interest in quantum computing did very little to influence the share prices of mainstream technology stocks such as those in the "Magnificent Seven."

Instead, the quantum computing movement gave rise to a number of previously unknown businesses. One company that burst onto the scene late last year is IonQ (IONQ +3.96%). With a partner ecosystem that includes Microsoft Azure, Amazon Web Services, Google Cloud Platform, Nvidia, and the Department of Defense (DOD), IonQ looks like a multibagger investment opportunity powering the next big trend in the AI landscape.

Like many new stocks in an already hot industry, IonQ has experienced some short-lived share price appreciation. Now, with shares down by roughly 18% from all-time highs, is IonQ positioned for a rebound during the second half of 2025?

NYSE: IONQ

Key Data Points

Why is IonQ stock selling off?

Perhaps the most influential laggard on the stock market this year has been new tariff policies under the Trump administration. While these import taxes have been placed on numerous regions around the world, Wall Street seems to be keyed in on how tariffs will impact trade relations with one particular country: China.

Like many companies, IonQ relies heavily on Chinese suppliers for some of its products. Ongoing negotiations with trade partners as a result of new tariffs has led to disrupted supply chains for businesses across most major industries, especially the technology sector.

However, IonQ is still a small company -- holding just $588 million in cash and short-term investments on the balance sheet at the end of the first quarter.

Considering that the company is not yet profitable, its burn rate will continue to erode liquidity over time. Now, with ongoing uncertainty around supply chain disruptions, IonQ faces a twofold challenge: navigating the impacts of tariffs on its business and doing so in a cost-efficient way.

Tariffs are just one side of IonQ's challenges, though. From an industry-specific standpoint, big tech has expressed interest in exploring quantum computing. Cloud hyperscalers Microsoft, Alphabet, and Amazon have each built quantum computing chips, while Nvidia is developing an extension to its CUDA software system that focuses specifically on quantum applications.

Rising competition from AI's biggest players could be viewed as a major threat to IonQ's future prospects by growth investors.

Image source: Getty Images.

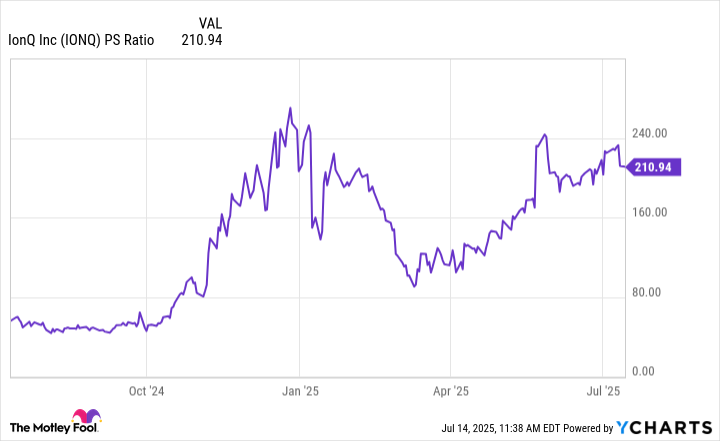

IonQ's valuation is hard to justify

Even with the uncertainties around tariffs and an intensifying competitive landscape, sometimes large-scale sell-offs are overblown and price in all of the perceived bad news.

IONQ Market Cap data by YCharts

Yet despite an 18% decline from its highs, IonQ stock still looks overbought. Per the trends illustrated above, IonQ's market capitalization has experienced a prolonged period of expansion -- suggesting that the share price may have gotten ahead of itself.

It's hard to justify a $10 billion valuation for an unprofitable company generating less than $50 million in annual sales.

Is IonQ stock a good buy right now?

IonQ's price-to-sales (P/S) multiple of 211 is far higher than what investors witnessed during stock market bubbles during the peak days of the COVID-19 pandemic and even the dot-com boom during the late 1990s.

IONQ PS Ratio data by YCharts

With these dynamics in play, smart investors know they need to be careful when it comes to investing in IonQ. While the company's recently depressed share price action might give the appearance of an opportunity to buy the dip, underlying valuation trends suggest the stock remains historically pricey.

In my eyes, IonQ's popularity so far has mostly been supported by bullish narratives around the macro opportunity of quantum computing rather than anything specifically related to the company or its operations.

To me, IonQ lacks tangible catalysts that could lead to a second-half rebound in the stock. Moreover, as investors witnessed during other periods of inflation valuations, I think it's highly likely that IonQ stock could continue plummeting from its current levels and a prolonged period of valuation resetting could be on the horizon.

For these reasons, I see IonQ as a speculative stock to own and would pass on it at its current valuation.