Chipmaking giant Taiwan Semiconductor Manufacturing (TSM +0.22%) -- also known as TSMC -- doesn't get the attention that other big tech companies tend to get, but it's an under-the-radar dynamo that powers much of the world's technology. Companies come to TSMC with chip designs; TSMC brings those designs to life.

In the past five years, TSMC's stock is up around 252%, more than 2.5 times the S&P 500 index's gains in that span (as of July 14). Nobody knows how the stock will perform over the next five years, but I predict it will continue soaring. The reason? Its critical role in the artificial intelligence (AI) pipeline.

NYSE: TSM

Key Data Points

TSMC's semiconductors power data centers, which together make training and deploying AI possible. Its ability is leagues ahead of competitors', making it the go-to for AI chip manufacturing, and the demand has begun showing in its financials.

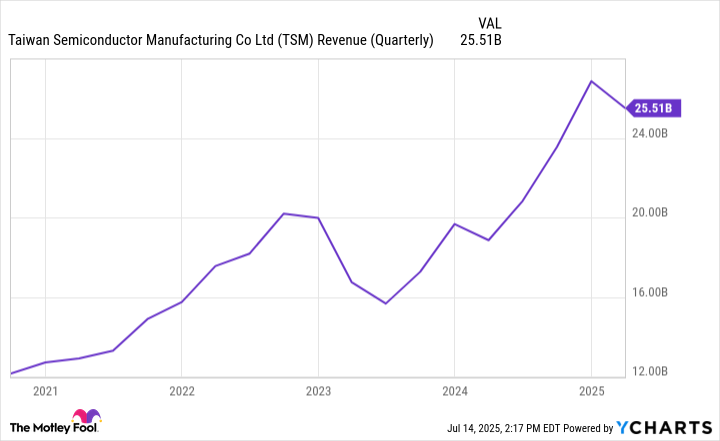

Management at the Taiwan-based company expects its AI accelerator revenue to double this year and produce a compound annual growth rate (CAGR) in the mid-40% range until 2029 (starting from 2024). This would be a huge boost to TSMC's revenue, which has been impressive already, more than doubling in the past five years.

TSM Revenue (Quarterly) data by YCharts

With major AI players like Nvidia and Advanced Micro Devices relying so heavily on TSMC, the chipmaker is uniquely positioned to benefit from the industry's natural growth. More AI adoption requires more AI training; more AI training requires more data centers; more data centers require more chips; and more chips require TSMC's manufacturing ability.

No competitor can come reasonably close to TSMC's dominance in the next five years. That should reflect in its overall stock growth in that span.