Nvidia (NVDA 0.32%) has already reached a couple of huge milestones this year. It became the world's biggest company and reached a market value that no other company has ever attained: $4 trillion. To do this, the tech powerhouse had to surpass tech giants Apple and Microsoft, which had long reigned as the top two by market value

The rise in market cap (share price multiplied by number of shares) happened thanks to Nvidia's dominance in what may be today's highest-potential investment area: artificial intelligence (AI). Nvidia designs the world's most sought-after AI chips -- called graphics processing units (GPUs) -- and these and other products have helped the company's earnings skyrocket. Investors have appreciated this and piled into the shares, and as a result, Nvidia's market value also has roared higher.

But $4 trillion isn't the limit for Nvidia, and investors already are wondering when this supercharged company will reach $5 trillion in market value. Can it happen this year?

Image source: Getty Images.

Nvidia's path to $4 trillion

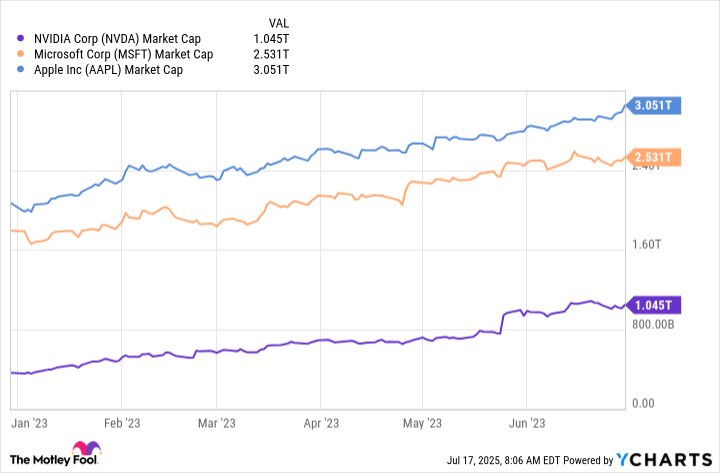

Before diving in, let's trace Nvidia's path to $4 trillion. Nvidia has seen its market capitalization surge in a short period of time, advancing from less than $1 trillion back in June 2023. Around that time, Apple and Microsoft outpaced Nvidia by far, as you can see in the chart below.

NVDA Market Cap data by YCharts

But as the AI boom accelerated, so did Nvidia's revenue and investor interest in the stock, and that's helped Nvidia jump ahead of these tech giants. They, too, are present in the AI space, but Nvidia plays the key role and has benefited the most from this technology so far. For example, in the latest fiscal year, Nvidia's revenue climbed in the triple digits to more than $130 billion as customers rushed to get in on its chips and related products and services.

There's reason to be optimistic this momentum will last because Nvidia has built an empire of AI offerings to cater to all of its customers' wishes, and with its deep knowledge of the field, Nvidia is able to envision and design the best products and services of tomorrow. On top of this, Nvidia has made a concrete promise to update its GPUs on an annual basis, adding to efficiency every time. This is key because the faster a user can train an AI model, for example, the lower the cost of the effort over the long run.

NASDAQ: NVDA

Key Data Points

The road to $5 trillion

All of this tells us Nvidia's past, present, and future are bright. But what does this mean for market value in the months to come? Now, let's consider the road to $5 trillion. Today, Nvidia stock trades for about $171 and has a market cap of roughly $4.2 trillion. A jump from $4.2 trillion to $5 trillion would be about 20%. I think a 20% jump in the stock price (and thus the market cap) would be very easy for Nvidia to accomplish over a period of a few months.

Such a move would increase Nvidia's trailing 12-month price-to-earnings ratio from about 55 today to 66. That's considering a trailing-12-month earnings-per-share of $3.10. Valuation would be higher than it is right now, but not ridiculous for a high-quality growth stock.

All of this means that from a technical standpoint, Nvidia clearly could reach $5 trillion in 2025, and it could do so without pushing valuation to extreme levels.

So, should investors count on Nvidia reaching this milestone this year? It's impossible to predict what a stock or the market will do over a period of a few months. Unexpected situations may arise, and they could impact a stock's performance. A perfect example is President Donald Trump's announcement this spring of his import tariff plan, a move that temporarily hurt stocks. It's important to keep that in mind when investing, and focus on the long term.

But, from the information we know now, I can say the following. It's very possible that Nvidia, thanks to its outsize growth and solid prospects, may not only continue as the world's biggest company in 2025, but the AI behemoth also could reach the next milestone of $5 trillion in market value in the next 5.5 months.