Microsoft (MSFT +0.77%) has been a steady yet quiet outperformer this year. While the market is up around 6%, Microsoft shares have risen an outstanding 20%. Most of Microsoft's strength is derived from its artificial intelligence (AI) capabilities.

We'll receive more information regarding the AI arms race on July 30 when Microsoft reports its results for the fourth quarter of its fiscal 2025. These events can bring significant stock price swings.

If you're a firm believer that Microsoft will post guidance-beating results, then picking up shares right now seems like the smart move.

Image source: Getty Images.

Microsoft Azure is a huge driving factor for the stock

Microsoft is far more than the company that makes Word or Excel. It's also the owner of LinkedIn, Xbox, and Activision Blizzard, the game creator. It divides its business into three units: productivity and business processes (the products most people think of when they hear Microsoft), more personal computing (Microsoft-branded hardware and its gaming platforms), and intelligent cloud.

Intelligent Cloud is the primary reason investors are bullish on Microsoft's stock, as it drives significant growth for the company. In its fiscal third quarter (ending March 31), productivity and business processes grew revenue 10% and more personal computing increased sales at a 6% pace. Those two growth rates are common for a mature company like Microsoft, but its Intelligent Cloud is anything but old and boring. It grew revenue at a 21% pace, led by Azure's 33% growth.

NASDAQ: MSFT

Key Data Points

Azure is Microsoft's cloud computing division, which is the primary beneficiary of all of the AI spending that's going on. Microsoft isn't directly competing in the AI arms race with a generative AI model. Its investment and partnership with OpenAI, the maker of ChatGPT, is a key part of Azure's growth, as OpenAI was the first mover in this space and is generally seen as the leader. However, Azure also offers other leading AI models such as Llama from Meta Platforms; China-based DeepSeek, a much cheaper generative AI model; and Grok from xAI, Elon Musk's generative AI company.

This library of generative AI models is a key reason why Microsoft is winning on the cloud computing front, as it aims to be an AI facilitator, rather than just promoting a single model.

The future is also bright for Azure, as the global cloud computing market is expected to expand from a $750 billion base in 2024 to $2.4 trillion by 2030, according to Grand View Research. This growth stems from both AI and non-AI workloads, serving as a massive tailwind that pushes Azure higher, alongside Microsoft's stock.

When Microsoft reports on July 30, I'll be watching management's language regarding Azure, as there is no room for weakness in this critical division.

Microsoft's stock has a premium valuation and looks a tad expensive

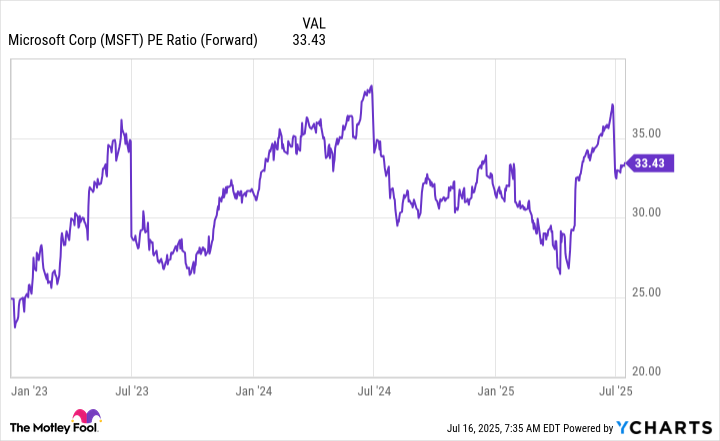

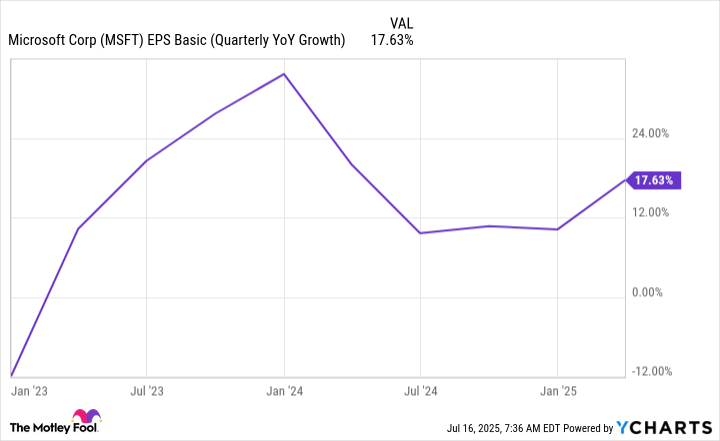

With Microsoft's impressive run and leadership position in the industry, it should come as no surprise that the stock has garnered a premium valuation. At more than 33 times forward earnings, it trades at the top end of its valuation range.

MSFT PE Ratio (Forward) data by YCharts

This premium valuation has some merit, as Microsoft has consistently grown its earnings per share (EPS) at a market-beating pace.

MSFT EPS Basic (Quarterly YoY Growth) data by YCharts

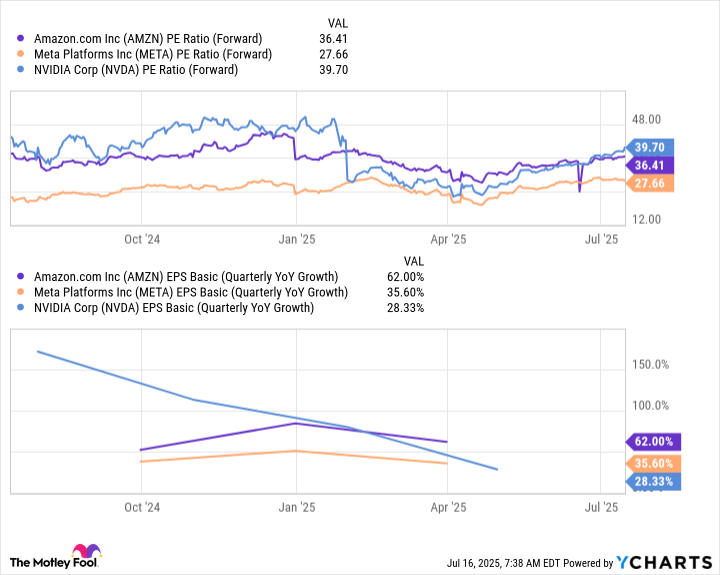

Still, if you look at other companies in Microsoft's valuation range, most are growing their EPS at a much quicker pace.

AMZN PE Ratio (Forward) data by YCharts

As a result, I think investors should be patient with Microsoft's stock. Microsoft has been and will continue to be an excellent AI stock to own, but there's no denying it has gotten expensive. Investors should wait to see what Microsoft has to say on July 30 before rushing to buy the stock today.