While the artificial intelligence (AI) arms race is ongoing, the quantum computing arms race is heating up. Several companies are vying for supremacy in this field, but not every company is a great buy right now.

At the top of my list for investing in quantum computing are Nvidia (NVDA 0.29%), Alphabet (GOOG 0.80%) (GOOGL 0.83%), and IonQ (IONQ +6.75%). I believe a combination of these three quantum computing stock picks is a great way for investors to spread out risk while capturing the upside that this exciting technology offers.

Image source: Getty Images.

1. Nvidia

Nvidia may seem like an odd inclusion in this list, as it's not actively participating in quantum computing. Instead, it focuses on providing the tools that active competitors need to integrate quantum processing units (QPUs) into existing high-performance computing systems. In particular, Nvidia has developed its CUDA-Q software, a derivative of the CUDA software used with its GPUs.

NASDAQ: NVDA

Key Data Points

CUDA is one of the primary reasons Nvidia has dominated the GPU field and has grown to become the largest company in the world. By adapting this foundational software to the quantum world, it cements itself as a critical partner in quantum computing. By integrating existing computing systems with quantum computing ones, it also prevents its current business from being displaced.

Nvidia is an excellent stock pick to bridge the gap between traditional and quantum computing, making it a top stock to buy for its association with quantum computing.

2. Alphabet

Alphabet, the parent company of Google, is a key factor in the increased investor excitement surrounding quantum computing. Back in December, it announced that its Willow chip had completed a task in five minutes with extreme accuracy that would have taken the most advanced supercomputer 10 septillion years (10 to the 25th power) to complete.

While Google openly admits that this is a computing task specifically suited for quantum computing and has no commercial relevance, it showcases that quantum computing technology is rapidly advancing and nearing practical usefulness. Alphabet is one of my top picks in the space because it has vast resources available to invest in quantum computing.

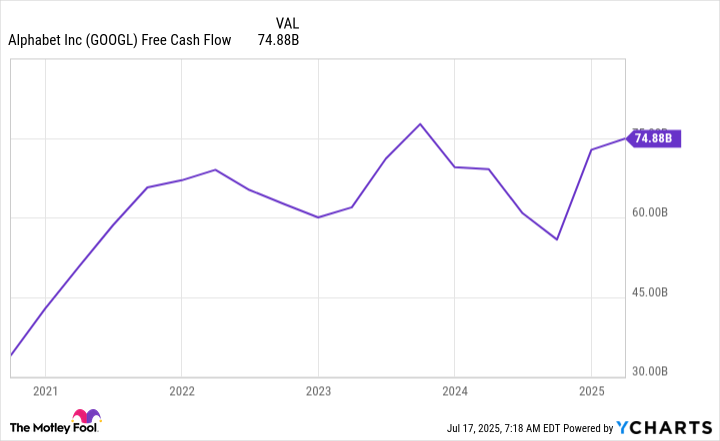

GOOGL Free Cash Flow data by YCharts

Over the past 12 months, Alphabet has produced around $75 billion in free cash flow. That's a massive chunk of change, and while Alphabet has some plans for that cash pile, it could also invest a fraction of that into its quantum computing arm, giving it more resources than many of its smaller competitors.

While this isn't a guarantee of success, I believe it gives Alphabet a significant advantage over the competition, making it a top pick in the quantum realm.

NASDAQ: GOOGL

Key Data Points

3. IonQ

IonQ is one of those smaller pure-play quantum computing stock picks. It doesn't have any other businesses besides quantum computing (unlike Alphabet and Nvidia), so its success or failure is dependent on quantum computing. For IonQ to become relevant in this field, it needs to have a technology that differentiates it from others.

While most competitors in the quantum computing arms race are using a superconducting approach, which requires cooling the particle to near absolute zero -- a very expensive proposition -- IonQ uses the trapped ion technique.

NYSE: IONQ

Key Data Points

This approach has a few advantages, but chief among them is the temperature at which quantum computing is conducted. Trapped ion quantum computing can be performed at room temperature, which significantly reduces the input costs of a quantum computer. This is key, as this fledgling technology attempts to establish commercial relevance, given the significant cost barriers to entry.

Additionally, the trapped ion approach allows every qubit to interact with every other qubit. It's well established that allowing qubits to interact with each other reduces errors in calculations; however, superconducting qubits only allow qubits to interact with their neighbors. The trapped ion approach allows the qubits to interact with every other qubit in the system, potentially leading to increased accuracy.

This is a significant reason why I believe IonQ is the best pure-play quantum computing company, as it's taking a different approach to some of the largest competitors in this arena. While it may not work out for IonQ in the end, it still has a fighting chance, which makes it a great lottery-ticket pick in the quantum computing investment space.