The most eye-catching feature of Annaly Capital Management's (NLY 0.47%) stock is its 14%+ dividend yield. There are some strong reasons to consider buying the mortgage real estate investment trust (REIT). And yet there's a caveat here that income investors specifically will want to know before buying this stock like there's no tomorrow. Here are three reasons to like Annaly and one very big reason to avoid it.

What does Annaly Capital Management do?

As noted, Annaly is a mortgage REIT, which is a unique corner of the broader REIT sector. It buys mortgages that have been pooled together into bond-like securities, which is very different from buying physical properties and leasing them out to tenants. The mortgage securities Annaly buys are impacted by things like interest rates, housing market dynamics, and mortgage repayment rates. It would be hard for most investors to track this business.

Image source: Getty Images.

Annaly has done a commendable job of creating value for investors over time. Notably, the total return of the stock has kept pace with the total return of the S&P 500 index (^GSPC +0.16%) over the long term. And the stock's performance has been notably different from that of the S&P 500 index, suggesting that Annaly would provide attractive diversification benefits to a portfolio. Those two facts combined are reason one that investors might like to buy this stock, perhaps with abandon.

Reason two is that Annaly just increased its dividend at the start of 2025. There's a saying among dividend investors that the safest dividend is the one that has just been increased. At the very least, that dividend hike suggests that Annaly's business seems to be doing well right now.

NYSE: NLY

Key Data Points

The third reason to jump on Annaly's stock is interest rates. It seems increasingly likely that interest rates are going to be cut before they are increased again. The main asset Annaly owns is its portfolio of mortgage bonds. When interest rates fall, the value of bonds tends to rise. So an interest rate cut would likely create value here.

The dividend yield is the reason to stay away from Annaly

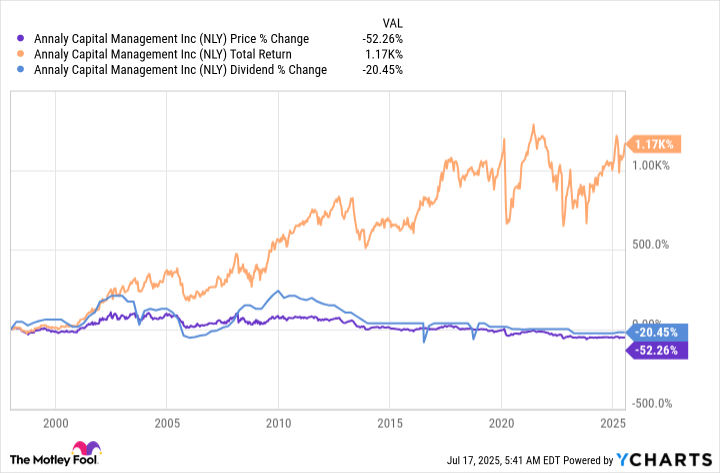

Notice that the huge size of Annaly's dividend yield isn't in the list above. At 14%+ you would think it would be, especially given the recent dividend hike. But there's some history here to examine. Notice in the chart below that the dividend has been extremely volatile over time, including a long period in which it was steadily reduced. And yet there's that strong total return performance.

The key is that to achieve that strong total return, investors would need to reinvest their dividends. Investors trying to live off of the dividends they generate from their portfolios would have been sorely disappointed with an investment in Annaly Capital. Given that dividend volatility is pretty normal for a mortgage REIT, this dynamic isn't likely to change.

Annaly Capital will probably be a bad investment for most dividend investors, who are likely looking for dividends that grow steadily over time. This is a stock that investors focused on asset allocation will appreciate, providing exposure to a unique asset class that performs differently from the broader equity space. The lofty dividend yield, in the end, isn't really the most important feature here.

Make sure you understand what you are buying with Annaly

The big problem is that some income investors reach for yield without taking Annaly's business model into consideration. And then there's a mismatch between what an investor wants and what an investor gets. Annaly isn't a bad company, but it probably won't be a great dividend stock for income investors. However, if you are an asset allocator, this total return stock could be an interesting buy right now.