Shares of Opendoor Technologies (OPEN -21.01%) have caught fire in the last month. Driven by investors posting online about buying the penny stock, it is now up 325%, with most of the gains coming in the past week.

Investors are piling into Opendoor, driving up the stock price of this small-cap company with high short interest. Some are calling it the next 100-bagger in the making.

However, nothing has fundamentally changed about this real estate platform's business model. Here's my prediction for what comes next for the company after its 325% rapid-fire gain.

Traders are piling in

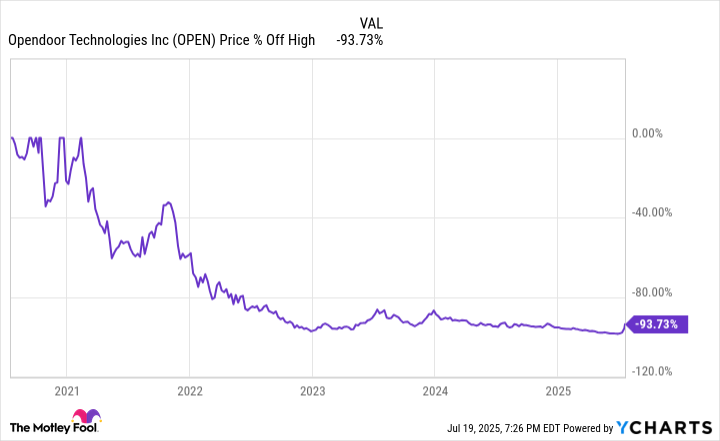

At the beginning of June, Opendoor stock was down 98% from all-time highs set during the pandemic market mania, with the share price below $1. The company even proposed a reverse stock split to get back above $1 and not risk being delisted.

Times were tough for the forgotten iBuying giant. Frozen real estate transactions and higher interest rates killed the company's growth potential, along with its risky business model.

An iBuyer is a real estate platform that directly buys homes from sellers and relists them to buyers, hoping to earn a profit spread. It is house-flipping at a national scale, funded by debt and venture capitalists trying to disrupt the traditional homebuying process.

Since the peak of home prices in 2022, Opendoor has struggled mightily and has been forced to scale down its home purchases. At one point, it had bought 50,000 homes over a 12 month period. That rate has since fallen to below 15,000 a year.

Despite these struggles, online traders have begun loading up on its shares. Since it has a low float and is a small-cap company, the iBuyer's stock soared on this increased activity, which is why it is now up so much so quickly.

Image source: Getty Images.

What's the future business model?

In its last quarterly letter, management highlighted its evolving business model, where it is now working with real estate agents to funnel potential home sellers to let Opendoor make an all-cash offer for them. In a frozen housing market where many people are priced out by high home prices and increased mortgage rates, the company needs all the demand it can get in order to grow its home purchases again, which will drive revenue higher.

This is a big evolution of its business model, but not one that will solve two fundamental problems the company still has. First, there are the low margins it earns between its purchase price and selling price for its housing inventory.

Opendoor has a gross margin of just 8%, a figure that has rarely been above 10%. This makes sense, because even if you are a company, flipping a home is not going to lead you to a 50% gain while sitting on it for a month.

The second issue with its business model is liquidity and debt financing. When it purchases homes, it does not sell them immediately, leaving them on its balance sheet. If it increases its pace of home purchases, it needs funding to do so.

This is why as revenue grew for Opendoor, so did its debt financing. Interest expenses are a huge headwind Combined with low gross margins, this is why the company has never turned a profit.

My prediction for Opendoor stock

It doesn't matter if the stock is out of the gutter because of loud online traders. It doesn't matter that the company now enlists real estate agents to funnel potential purchases to the platform. What matters is a lack of profitability and a flawed home-flipping business model.

It has never generated a profit, requires a ton of debt to grow, and is significantly smaller than it was at its peak during the pandemic. Even in the 2020-2022 period, when home prices soared at the fastest pace in history, the company was still unable to earn positive net income with home-flipping. This should concern any investor considering chasing the stock after its recent 300%-plus run-up.

The long-term trend in its share price has been rational, not the recent rebound in the stock. It's still off 94% from all-time highs, and for good reason. My prediction is that Opendoor's share price returns to its downward trajectory if the company keeps losing money over the next few years. Avoid buying this stock today.