Meta Platforms (META +1.52%) has been a mover and a shaker in this artificial intelligence (AI) boom. You may know the company best for its social media apps, from Facebook and Messenger to WhatsApp and Instagram, but Meta also has put a significant focus on AI and aims to become a giant in this industry. The company has poured billions of dollars into AI research and recently launched a new unit, Meta Superintelligence Labs.

The company is set to report quarterly earnings on July 30. That's when investors will likely learn more about this AI growth story and of course get a close look at revenue, profit, and more. But that may not be Meta's biggest news. Instead, Meta might make another announcement that will grab investors' attention. My prediction is this could be the tech giant's next major move.

Image source: Getty Images.

Meta's advertising revenue

Before I dive in, though, a quick summary of Meta's path in recent times. As always, Meta's social media presence has driven revenue growth quarter after quarter, and this is thanks to advertising. Businesses aiming to reach consumers with their products and services flock to Meta because they know people spend a lot of time on its social media apps. In fact, more than 3.4 billion people use a Meta app daily. As a result, advertising makes up the lion's share of Meta's revenue and over time has delivered enormous growth.

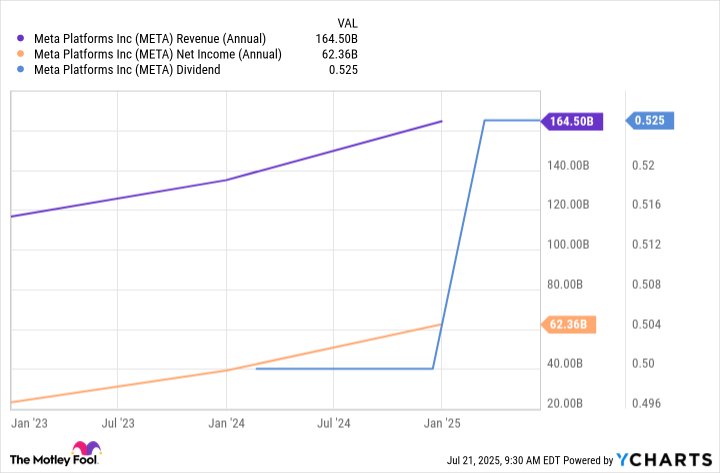

This has helped Meta increase earnings, growing revenue and profit into the billions of dollars, and even pay a dividend.

META Revenue (Annual) data by YCharts.

Now, with an investment in AI, Meta aims to increase its ad revenue potential by using AI to better target audiences for advertisers. AI tools, such as the Meta virtual assistant, will prompt people to spend more time on the apps, and that may encourage advertisers to boost their ad spending too. On top of this, Meta's development of its own large language model (LLM) could lead to other products and services.

All of this is exciting, and we'll probably hear more about it during the July 30 report, but my prediction is Meta's next big move may be the announcement of a stock split. For now, Meta is the only Magnificent Seven company -- these are a group of tech stocks that have led market gains -- that hasn't yet executed such an operation.

Stock splits are a way to lower the price of a soaring stock without changing anything fundamental about the company. So, market value, valuation, and everything else remain the same. A stock split is simply a mechanical move to lower the price of each individual share, and this is done by issuing more shares to current holders.

NASDAQ: META

Key Data Points

Why a stock split could be a good idea

Why do I think Meta may announce such a move? The stock not only has soared in recent times -- by about 280% over three years -- but today it trades for more than $700. This level may make it difficult for some investors to access the shares unless they turn to fractional shares, and not all brokerages offer these. On top of this, certain investors hesitate to invest in a stock as it approaches $1,000 or trades at around that level as it represents a psychological barrier. They may consider the stock expensive even if valuation shows the price to be reasonable. These elements could weigh on Meta stock's growth potential.

By launching a stock split, the company could solve these problems, opening the investment opportunity up to a broader range of investors. At the same time, a stock split often is seen as a sign of confidence, showing that management believes the stock has what it takes to soar again from its new, lower price. Investors love stock splits for these reasons, though it's important to remember that a split itself isn't a reason to buy a stock; it won't act as a catalyst, spurring share gains.

Considering all of this, I see Meta as ripe for a stock split right now -- and that's why I think announcing such an operation might be its next big move.